Relative to expectations, the biggest surprise came from the motor vehicles sector. Vehicle GDP was reported growing at a staggering 32.6% annualized rate. Most monthly data indicators had shown some 3Q19 growth in the vehicles sector. Apparently, automakers had elevated production early in the quarter in anticipation of a labor strike. (Nearly half of the reported gain in vehicle GDP came from inventories.)

Still, the monthly data indicators had suggested much less buoyant growth for vehicles output. Thus, the Federal Reserve’s (Fed) measure of industrial production (IP) in the motor vehicle sector showed a 6.2% annualized rate of increase in 3Q19. While a good gain, this was nothing like what was reported for the sector within GDP.

In terms of its effect on total GDP, if vehicles had shown the same output growth within the GDP data as they did within the IP data, total GDP growth would have been only 1.2%, right in line with expectations. So, it is fair to say that the surprise within vehicles GDP accounted for essentially all the surprise in total GDP. It is not unusual for the GDP data to be giving different signals from what the monthly data are suggesting. Actually, that has been going on all this year. Still, the magnitude of surprise within this one sector in 3Q19 is jolting.

Elsewhere within the data, consumer spending showed another nice gain, with total real consumption up at a 2.9% annualized rate and with the same growth rate for consumption excluding motor vehicles. (Again, the "heavy lifting" for vehicle sector GDP came from inventories.) Goods consumption was a bit below expectations, with services consumption an equal bit above.

Much has been made in the financial press and in the markets of a supposedly sudden weakening in the factory sector in August and September. Yet, total real goods GDP was reported growing at a strong 4.6% rate, and even excluding vehicles, the goods sector GDP grew at a 2.0%. In other words, for the factory sector as for Mark Twain, reports of demise have been greatly exaggerated.

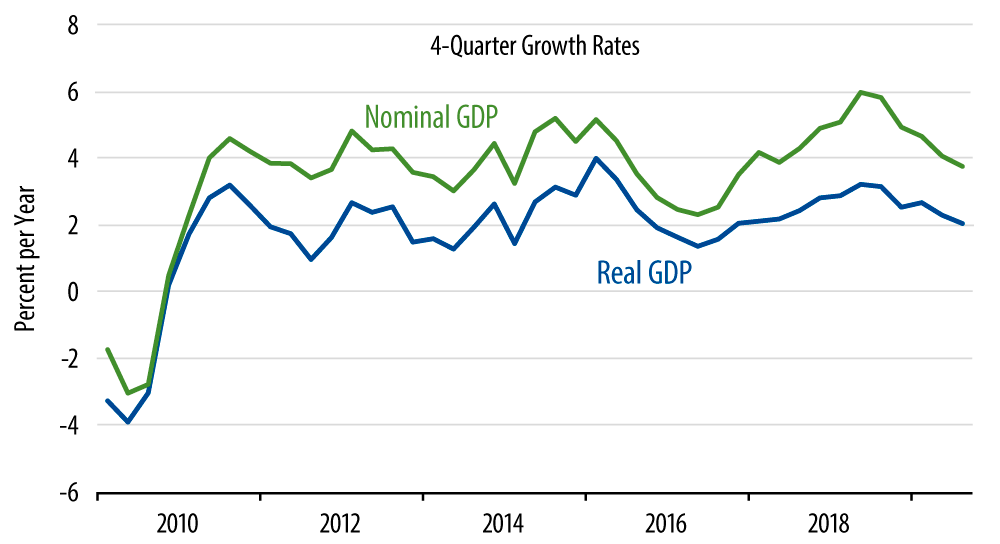

The accompanying chart shows four-quarter average growth rates for real and nominal GDP across the expansion, and it summarizes the situation well. Real growth has cooled from the upturn of 2017-18, but appears to be settling at a pace much like that seen through most of the expansion. Nominal GDP growth is firmly anchored at 4% or less. Regardless of what the unemployment rate does, we simply are NOT going to get an acceleration in inflation when total spending is growing so moderately and so steadily.

So, while much of the financial press is telling a Chicken Little story (the sky is falling), the actual data are more Goldilocks (not too hot, not too cold).