The tax-exempt municipal bond market is one of the largest debt sectors in the US, with a credit history of low defaults, compelling diversification benefits and excellent risk-adjusted returns. Tax exemption is a potentially lucrative feature for tax-paying US investors. But for those who can’t benefit from tax exemption (including many non-US investors), lower nominal yields on tax-exempt municipals can diminish their appeal. The relatively recent growth of the taxable municipal market is a meaningful progression toward providing investors with an attractive opportunity in the already established municipal bond asset class.

The increasing consciousness around the globe about responsible and sustainable investing will likely strengthen the demand for taxable municipals even further. The inherent social responsibility in the broad majority of municipal bonds represents an investment opportunity for buyers with an inclination to consider environmental, social and governance (ESG) impact, and at the same time earn potentially strong returns. State and local governments have a fundamental role in developing and maintaining physical and social infrastructure; as a result, municipal debt generally contributes to noticeable positive impact for the communities.

The Growing Taxable Muni Market

Taxable municipal debt is used to fund the same kinds of essential public projects as those funded by corporate and sovereign bonds, while offering domestic and non-US investors comparable potential total return and yields. The credit backing for taxable municipals can be in the form of a general obligation, or by a legally contractual devoted revenue stream, which is the same as in the tax-exempt market. Viewed from a ratings perspective, taxable municipals offer considerable value compared with other credit sectors. Moreover, they can provide a unique, robust source of fixed-income credit diversification.

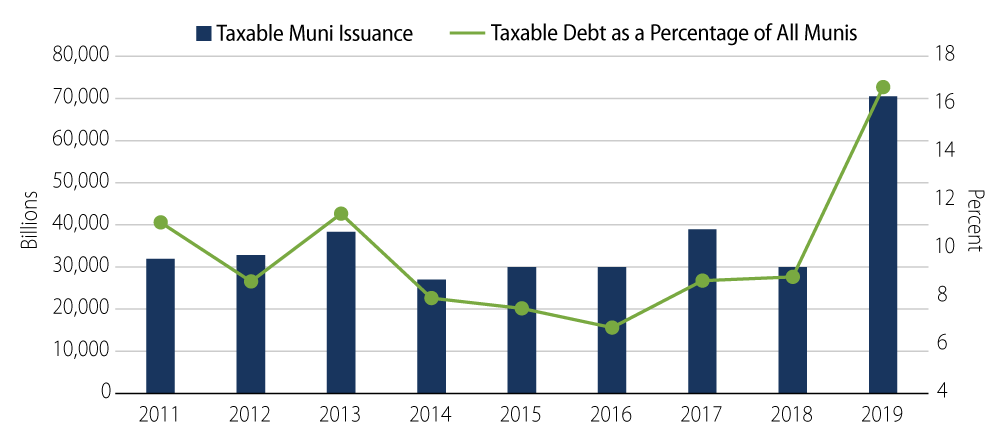

The issuance of taxable municipal securities leapt to record levels in 2019. This was largely driven by rising interest from an expanding pool of investors, the current historically low rates and the 2017 tax-cut law eliminating the advanced refunding option using new tax-exempt issues.

In the current US environment of unusually low rates and low muni-to-Treasury ratios, especially in the shorter end of the yield curve, even some investors of traditional tax-exempt munis who are subject to high state taxes are benefiting from crossover trades into the taxable arena. Taxable munis may also be appealing to investors from outside the US who have been largely unfamiliar with the world of public finance. The favorable capital relief treatment available to eligible taxable municipals that meet the required criteria under Solvency II has improved the attractiveness of their muni bonds and bolstered the investor base in Europe. Asian insurers are utilizing taxable municipals to immunize their liabilities, given the relatively long duration feature of their bond issues.

With this broadening investor base and added supply, there has been an associated enhancement in liquidity. Also, relative to the tax-exempt market, few mutual funds and ETFs are dedicated to taxable munis, thereby minimizing fund flow risks. Some issuers find the taxable approach so effective that they have gone all-in with it as a strategy. For example, the cities of Dallas and Fort Worth, Texas, recently refinanced $1.2 billion of airport debt entirely by using a taxable deal directly marketed to international investors.

Western Asset’s Expertise in Taxable Munis and ESG

Western Asset has incorporated taxable municipals into investment strategies for over 10 years. Even though municipals historically have had high credit quality, it is still critical that credit for taxable muni debt be regularly analyzed and monitored. Like other spread sectors, taxable municipals move with general levels of risk aversion, investor sentiment and economic fundamentals. On average, each of Western Asset’s Municipal Investment and Research Team members has over 25 years of experience, which is a competitive differentiator in muni credit surveillance and relative value analysis.

Local municipalities are supposed to operate in the interest of the public good (e.g., education, transportation), but that is not always easy. Public finance projects are inherently limited by the tax bases that fund them. Assessing the appropriateness of an issue for ESG inclusion is a complex and comprehensive process, and is a growing priority for asset managers.

To deal with the breadth and diversity of the types of issuers in the municipal market, Western Asset’s ESG analysis involves conducting thorough fundamental research and pushing for deeper disclosures. Looking beyond reported financial data to understand the level of adherence of local municipal bond issuers to the ESG standards has allowed us to obtain better perspective and a more informed outlook. Western Asset’s experienced and sophisticated Municipal Investment and Research Team has developed an internal valuation metric for various subsectors, which incorporates the United Nations Sustainability Development Goals to define the minimum threshold a bond must meet to be eligible for a particular ESG strategy.

We believe it’s imperative to research and learn how specific projects and government policies affect life for common residents. Some examples of potential ESG investments that offer direct support to residents are multi-family housing projects that provide safe and affordable living options, power authorities that provide inexpensive wholesale power to businesses promoting economic growth and organizations that provide mental health care services. Another example is the recent debt issued by a New York City authority to fund a climate change resilience project that will build a grid of barriers in neighborhoods susceptible to flooding to prevent damage due to storm surge. ESG strategies can also be a good fit for separately managed accounts (SMAs), as customized accounts allow for better screening of individual investments and focus on specific impacts.

Challenges in Muni ESG Investing

One of the main challenges to systemic ESG integration in the municipal landscape is the non-uniformity of available data, lack of standardized definitions and missing centralized scoring framework. Regulators are scrutinizing ESG funds to determine whether the socially responsible investing claims are real. To guide the investors and help them discern the thematic strategies, impact goals need to be clearly defined, measurable and subject to validation.

Invest and Impact: Muni ESG Strategies Are Here to Stay

More and more investors with a passion for responsible investing are recognizing that the taxable US municipal bond market is an asset class yielding close to what corporate bonds yield, often with significantly less credit risk. It’s also an asset class where positive environmental and social impact can be realized. In today's world where unpredictability and change seem to be the only constants, an increasing number of investors are taking a long-term view and choosing to put their money with the issuers that generate returns, act responsibly and benefit society. Taxable muni ESG investing is here to stay!