The year 2020 will long be remembered for the COVID-19 pandemic and extraordinary levels of both geopolitical uncertainty and volatility in markets. As 2021 began, we thought the presidential election and market turmoil were mostly behind us. The events on January 6 in Washington, DC and the Democratic win of two Senate seats in Georgia caused the Firm to re-examine our views. Despite the events of January 6, Western Asset’s market views remain largely in place. We expect rates to remain lower for longer. From a political perspective, the wins in Georgia evenly divide the Senate, leaving the Democrats in control of the Chamber. However, we do not expect substantial progressive programs to be enacted. This will be limited by more moderate Democrats and the fact that they get one reconciliation bill per year. There are limitations on what this bill can include. We expect Democrats to use the 2021 Reconciliation bill for an additional round of stimulus, likely in late March. As a result, we doubt there will be any major changes to domestic fiscal policy that would drive inflation.

From a markets perspective, we do not expect elevated levels of volatility because the vaccines provide a light at the end of the pandemic tunnel and the Fed has explicitly stated that it will be accommodative for the foreseeable future. With that said, we remain cautious because the sources of volatility are hard to predict. The additional stimulus we expect, combined with monetary policy that is already exceptionally loose (i.e., limited effect from using additional tools available), leaves the economy in a place of having to move forward under its own impetus. While we are fairly certain to see some additional growth—and possibly even some temporary inflation—as we continue to recover from the pandemic-induced slowdown, the likelihood of a slower growth and inflation environment ahead appears most likely to us. Growth was beginning to slow pre-pandemic with no sign of meeting the Fed’s 2% annual inflation target over a sustained time period. The future scenario we envision is one in which the Fed is likely on hold, with rates pinned near the zero lower bound for several years.

As this “lower-for-longer” period persists, insurers are faced with the problem of continual book-yield decay and what is generally described as the difficult choice between accepting lower yields (thus lower profitability) and reaching for yield but taking on additional risk. Neither option appears particularly attractive at this point in time, making the efficient use of capital a key consideration. The specifics of the problem and potential solutions vary depending on the exact nature of the liabilities in question. Consider the following:

- Health care liabilities are shorter-term, more total-return oriented and the insurer has the ability to reset premium rates annually.

- Life liabilities are longer-term with more time to realize returns, but do not have the ability to reset premiums.

- P&C liabilities can lean in either direction depending upon the type of insurance policy.

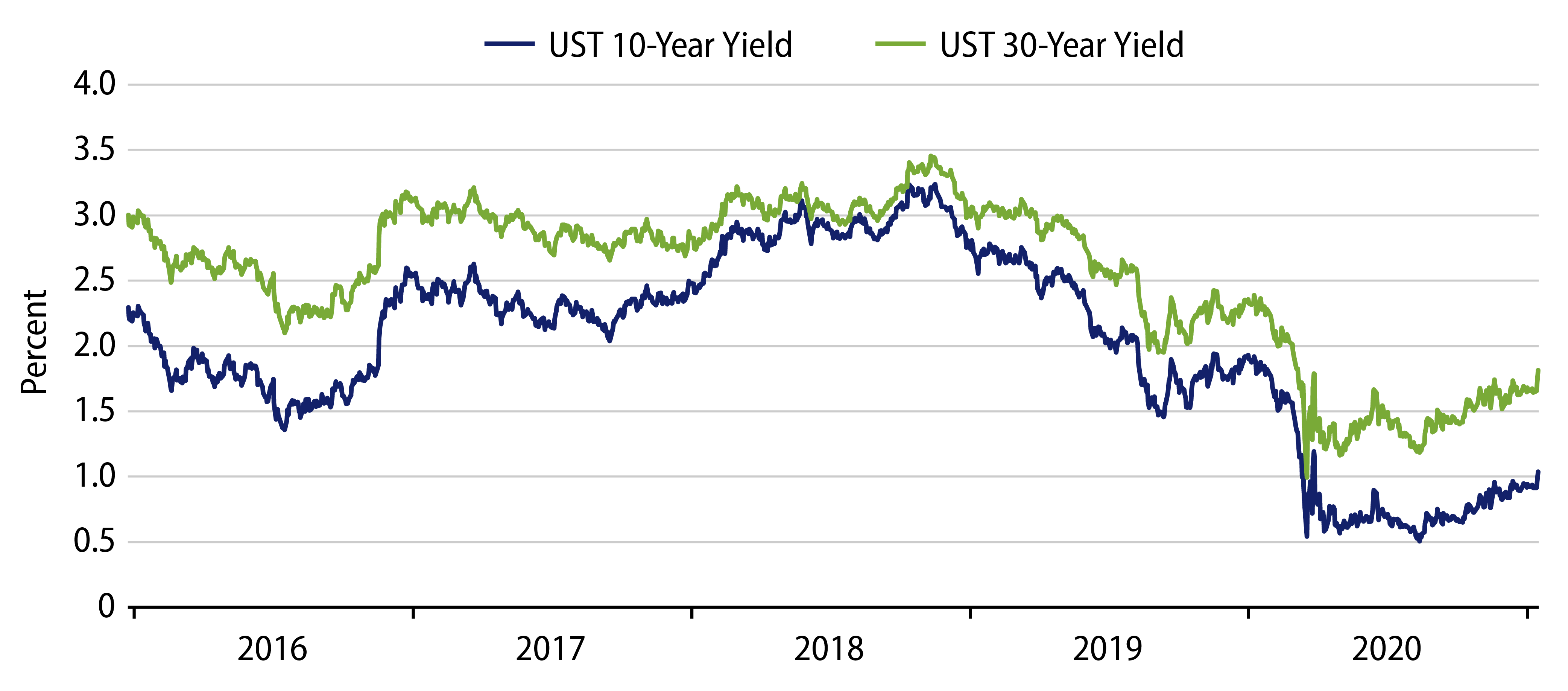

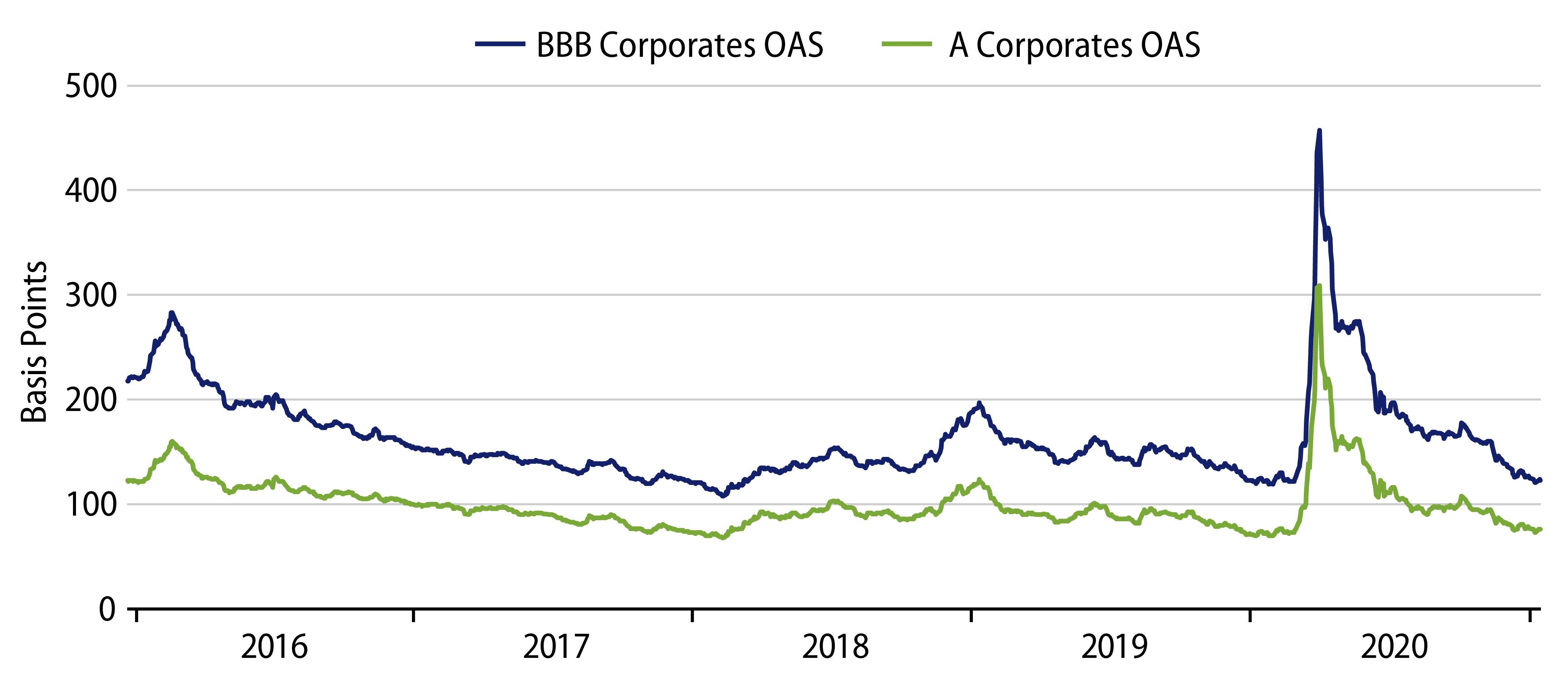

Yields and spreads are both problematic for insurers in this lower-for-longer economic environment. Treasury yields today are materially lower than they were in 2019 and corporate bond spreads have largely retraced the widening they experienced during the pandemic, representing a significantly lower reinvestment yield.

Similar to corporate bonds, agency MBS yields have also decayed markedly in line with Treasuries. So, while spreads have moved back most of the way to where they were before Covid upended markets (with the stated goal from the Fed to get levels back all the way to where they had been), there is no expectation that Treasury yields will go back up, leaving the all-in yield substantially lower. Given this environment, where can insurance companies look to stave off a dramatic decline in their book yield income over the coming months and years?

We believe there are a few corners of the market that provide opportunities to add to yield without increasing outright risk or utilizing additional risk-based capital (RBC). These sectors help alleviate some of the book yield decay that will inevitably creep into portfolios. While some insurers can benefit from increased use of active management in their portfolios, others are reliant on incoming premium flows as well as principal and interest payments to achieve meaningful reallocations.

The next section provides a summary of our insights about today’s market environment to help insurers maintain a moderate level of income in this low-rate environment.

Investment Opportunities

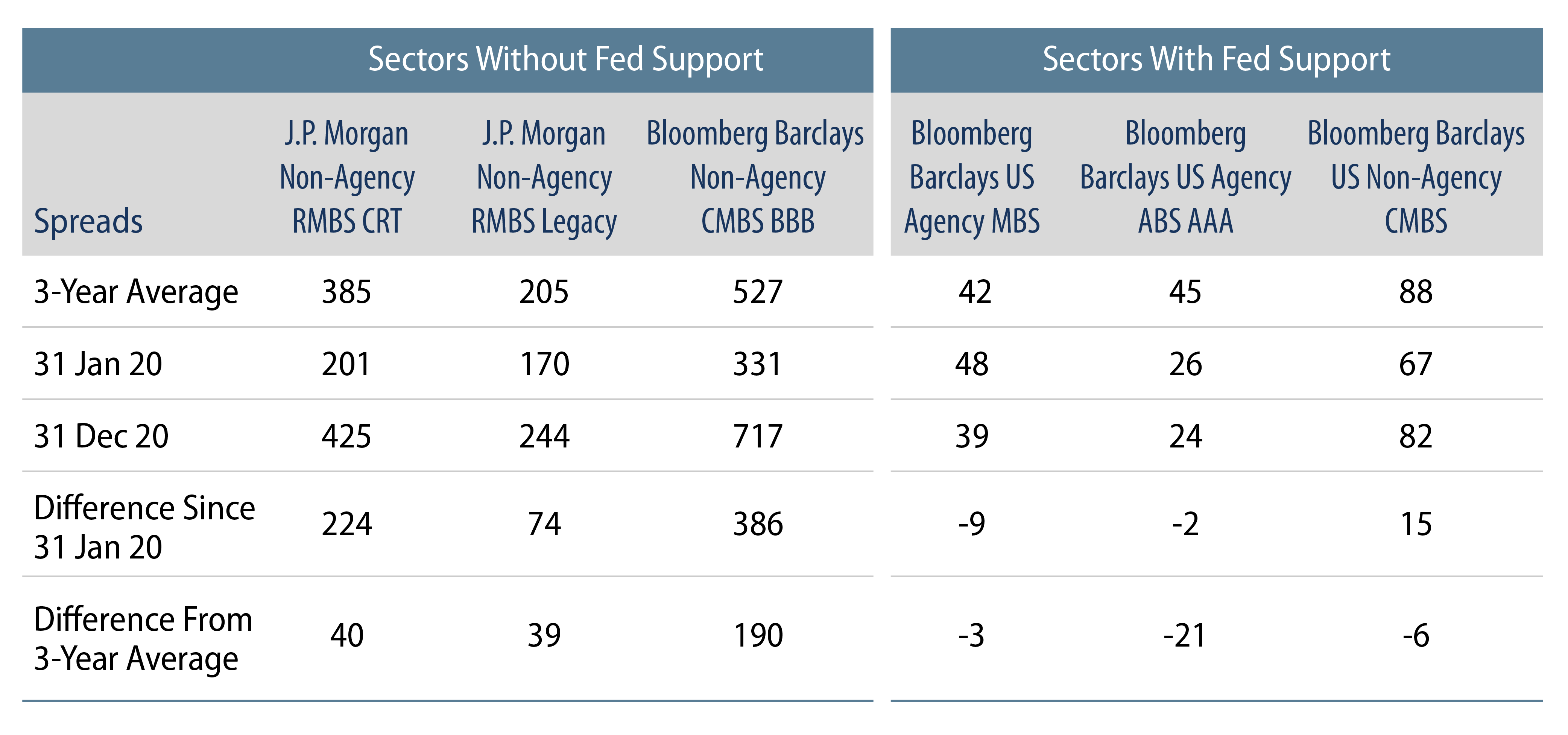

Mortgage and Consumer Credit

Fears related to COVID-19 caused widespread selling of non-agency MBS/ABS and resulted in a severe dislocation between fundamentals and valuations. While spreads remain at wide levels, we believe consumer and US housing fundamentals are strong. From a technical standpoint, mortgage credit (both residential and commercial) has lagged corporate credit in the post-Covid recovery as there has not been explicit policy support from the Fed for much of the structured credit asset class. Within mortgage and consumer credit markets, only AAA rated conduit commercial MBS (CMBS) and new-issue AAA rated ABS have been supported by the Fed, which has resulted in a more marked compression of spreads in these subsectors. The lack of Fed policy support is a key driver of the underperformance in mortgage and consumer credit relative to other credit sectors. Additionally, uncertainty over the economic outlook, particularly concerns surrounding the duration and severity of the Covid crisis, has weighed on the market. Exhibit 3 highlights the current spreads of sectors that received support versus mortgage credit sectors that did not, which we believe provides investors with opportunities for increased yields in those sectors.

Emerging Markets

Emerging markets (EM) represent another opportunity to increase the overall yield of a portfolio while diversifying risk and maintaining credit quality. Like-rated EM corporate bonds trade approximately 80 bps cheap to US corporate bonds. In addition, these EM corporates tend to have slightly better net leverage figures, creating an opportunity to improve both overall credit quality and increase yield. In addition, we would expect that as global growth normalizes, EM securities should benefit more than US corporate debt, for a better total return as well.

Private Placement Investment-Grade Corporates

Yet another option is greater utilization of private placement credit in portfolio construction. Traditionally, the US private placement market has been dominated by and has catered to the large life insurance companies. More recently, the trend has been fueled by a broadening of the investor base and opportunities to invest along the yield curve to match differing liability profiles. This has led to increasing opportunities in a diversified set of names and structures for insurance investors of all types.

The private placement market allows insurers to trade a degree of liquidity for added yield—in other words, a liquidity premium. If that were the only trade-off, the opportunity—while still beneficial—would not be as compelling. There are additional benefits, however, to making these investments. Insurers can diversify their corporate risk with access to companies that don’t issue in the public markets. Private placements typically offer covenant protection that is not found in like-rated public issues. These securities also typically have greater price stability, creating less mark-to-market impact, as trading tends to be more limited.

Private Mortgage Debt

Both residential and commercial whole loans can offer attractive yields with low capital charges. Western Asset has been active in non-Qualified Mortgages (QM) as well as commercial bridge and transitional loans since 2014. The investment team’s direct relationships with originators of various collateral types enable Western Asset to source attractive investments while managing overall credit risk. Our Firm’s size and sophistication allow us to drive transactions and influence terms and structures. Due to a number of factors, including the relative illiquidity of these whole loans, the valuations of such assets have lagged other credit sectors in the rebound since March. The largest dislocated opportunities are in residential and commercial mortgage credit. The team believes the attractive yields, strong total return potential and diversification benefits can provide value to insurers.

CLOs

Last, we also continue to find value in the CLO market, which we believe offers a compelling return on capital relative to other asset classes. While CLO spreads have narrowed, they are still not all the way back to their tights. CLO structures have been vastly improved since the last major crisis, and we believe they can withstand severe shocks without suffering impairment. A rated tranches, for example, are unscathed—even under a scenario that assumes two times the defaults experienced during the Great Depression. In addition, since CLOs are floating-rate instruments, the coupon income investors receive today is likely to be at the lowest level one will earn over the life of the investment, with upside potential should markets return to growth and normality.

In Summary

With spreads generally having retraced much of the pandemic-induced widening and risk-free rates still pinned at zero, we do not expect that the yield situation will get worse in the coming years (at least to any significant degree). However, it is likely that we could be in this range for a sustained period of time. Depending on the pace of book-yield decay, we think that insurers should consider these possibilities to prudently adjust the risk profile of portfolios in a way that increases future investment yields. Counterintuitively, there are some cases in which total-return-oriented strategies might be appropriate for longer-dated liabilities, although this is a topic for a later discussion.

Western Asset’s insurance and solutions teams can provide capital efficient approaches, market due diligence, analysis and insights to help insurers reach well-informed decisions on their investment strategies in today’s lower-for-long environment.