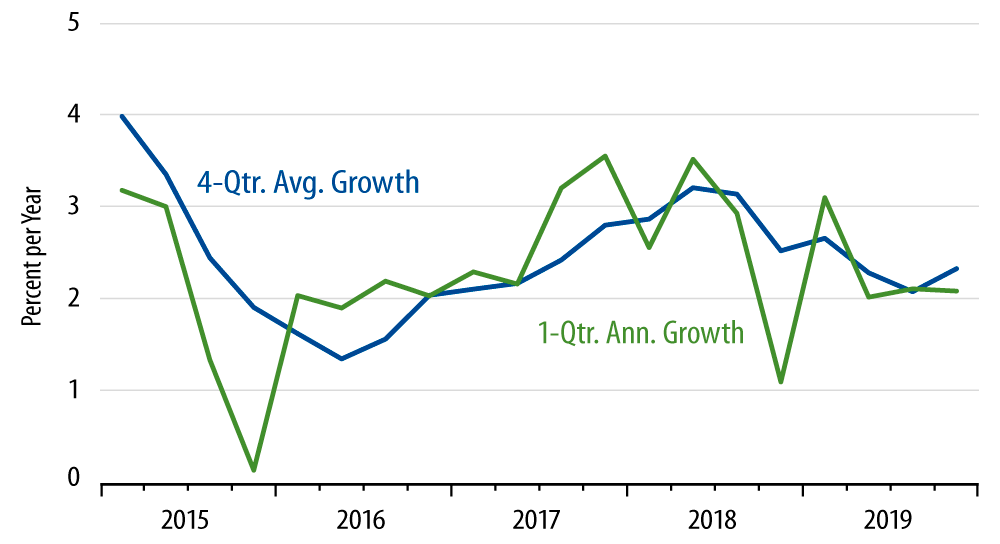

The 2.1% 4Q19 rate is not spectacular, but it did come in above some of the recent Wall Street forecasts, and the 2.3% average for all of 2019 is only a slight deceleration from the 2.5% of 2018 and the 2.8% of 2017. Keep in mind that the slowing economy in 2019 looked to be substantial enough to move the Fed from four planned hikes to three actual cuts. Against that backdrop, the reported 0.2% deceleration in growth is quite mild and certainly not suggestive of a budding recession.

The early press reports we have seen this morning attributed the decent 4Q19 performance in large part to a sharp improvement in the foreign trade balance, driven by a plunge in imports. This is somewhat misleading. As we have remarked with respect to the retail sales data, the slower growth in retail sales in 4Q19 appears to us to be linked to the plunge in imports, especially in those coming from China. So, while by itself the trade balance was a big "add" to 4Q19 growth, in reality it was just the "yin" to the weak goods consumption "yang."

There was further offset to the trade balance coming from a mild decline in non-auto inventory investment. Goods have to come from somewhere. If imports decline, boosting GDP by itself, either consumer spending on those goods must decline or the goods must come out of declining inventories, both of which work to offset the boost from imports.

This is exactly what happened within 4Q19 GDP data. A drop in imports does not, by itself, mean a boost in domestic production, and in 4Q19, the sharply lower imports and related improvements in the trade balance were about fully offset by slower growth in goods consumption and an inventory drain.

Meanwhile, the GM strike also affected the GDP data. According to today’s data from the Bureau of Economic Analysis, the strike-related 4Q19 decline in vehicle production reduced 4Q19 GDP growth by a whopping 0.9%. Then again, a pre-strike boost in vehicle production in 3Q19 increased 3Q19 GDP by about that same amount. On net, then, the vehicle sector was a wash to GDP growth in the second half, but its effects on individual quarters’ growth were quite disparate.

With volatile components like this, it is good to look at an average of growth across a few quarters, and we think the 2.3% reported growth for all of 2019 provides a good description of the state of the economy: slightly slower than in 2017-18, but better than what we saw in 2015-16 and nowhere close to alarmingly slow.