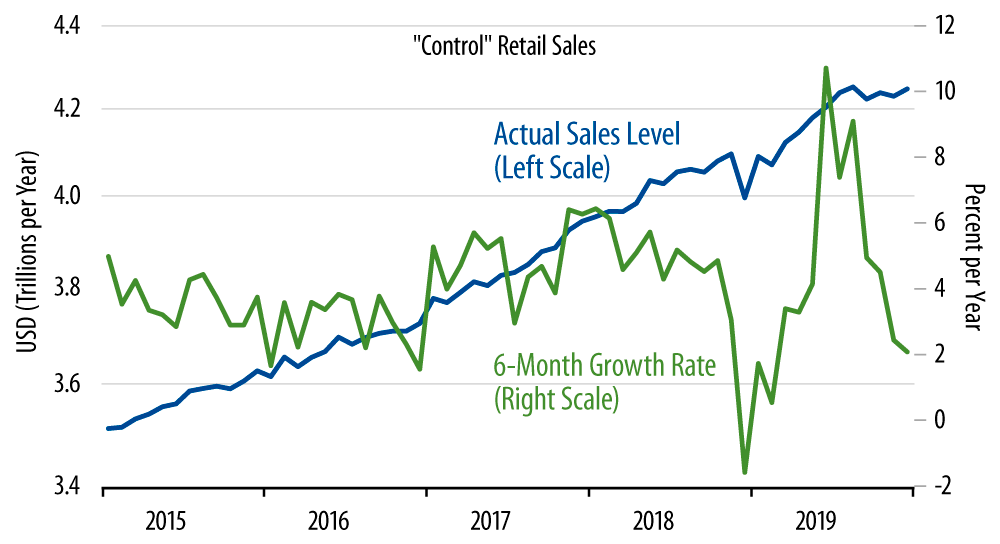

As you can see in the accompanying chart, retail sales growth has sputtered over the last few months, after growing strongly in the middle months of 2019 and also having sputtered in late-2018 and early-2019. Rather than reflecting consumer weakness, we are inclined to think that the soft recent sales growth reflects a paucity of goods, as tariffs have sharply restricted imports from China.

As you may have heard, the US trade balance improved sharply in November. A similar improvement occurred in October. What you probably didn’t hear was that ALL the improvement was due to a decline in imports, NOT to an increase in exports. Where did imports decline? Almost all the drop in imports in October and November occurred for imports of consumer goods.

Furthermore, when one examines bilateral trade data, one finds an equally sharp drop in recent months in imports from ... wait for it ... China. In fact, similar drops in total imports, in imports of consumer goods, and in imports from China occurred a year ago, over exactly the same months during which US retail sales were soggy.

In sum, the evidence leads us to conclude that reduced supplies of apparel, electronics and other goods from China held down the retail sales data over the recent Christmas season. Notice, it doesn’t take a lot of decline there to make a noticeable dent in the aggregate numbers. Control sales have increased a total of 0.2% over the last two months. A cumulative increase of 0.6% to 0.8% would have been satisfactory growth. Could total sales have been reduced by 0.4% to 0.6% during the Christmas season due to reduced availability of goods specifically from China? Of course they could.

Meanwhile, notice that headline sales, including items like gasoline and cars that are less dependent on Chinese supply, increased at better rates. We can add on that household incomes continue to grow nicely and that consumer spending on services has grown in recent months at about the same pace as that of mid-year.

So, again, it is plausible to assert that the recent retail sales softness reflects the sharp recent declines reported in imports from China and NOT any fundamental softening in consumer demand. We would expect retail sales to perk up in the months to come, now that a trade deal with China has been consummated.

There is a lot not to like about the recent trade wars. However, the evidence indicates pretty clearly that the tariffs have significantly affected China’s ability to earn US dollars via trade, which is a good explanation for their willingness to reduce trade tensions.