The Census Bureau announced today that the US merchandise trade deficit declined in September to -$846.6 billion per year, from -$876.3 billion per year in August. On an inflation-adjusted basis, the trade deficit narrowed from -$1,029.2 billion per year in August to -$991.6 billion per year in September. (That the inflation-adjusted basis is larger than the nominal basis is due to the fact that both import and export prices have been declining.)

Now, -$876 billion nominal or -$992 billion real (2012 dollars) is still a huge imbalance. However, the trade deficit had been rising in virtually every prior year of the expansion. It has not risen further this year, despite incidence of the trade war.

According to estimates from the Bureau of Economic Analysis contained within the GDP release, foreign trade exerted drags on GDP growth of -0.7% in 2015, -0.4% in 2016, -0.2% in 2017, and -0.4% in 2018. In contrast, for 2019 so far (through the first three quarters), the drag on GDP growth has been zero—nada.

Now, there are conceptual problems with using trade balance movements as a measure of the benefits of foreign trade for an economy, but we are not doing that here. We are talking about whether tariffs and counter-tariffs can be seen to have exerted a clear, contractionary effect on US economic growth, and the foreign trade data simply fail to provide any evidence of that. If anything, trade has boosted 2019 growth.

Another line of complaint concerning the tariffs is that they are inhibiting business investment. Perhaps, but the fact is that domestic business investment started decelerating in the middle of 2018, well before the trade wars began. We bemoan the trade war as much as anyone, but we disagree with the contention that it is pushing the US economy into recession. The record simply does not support that.

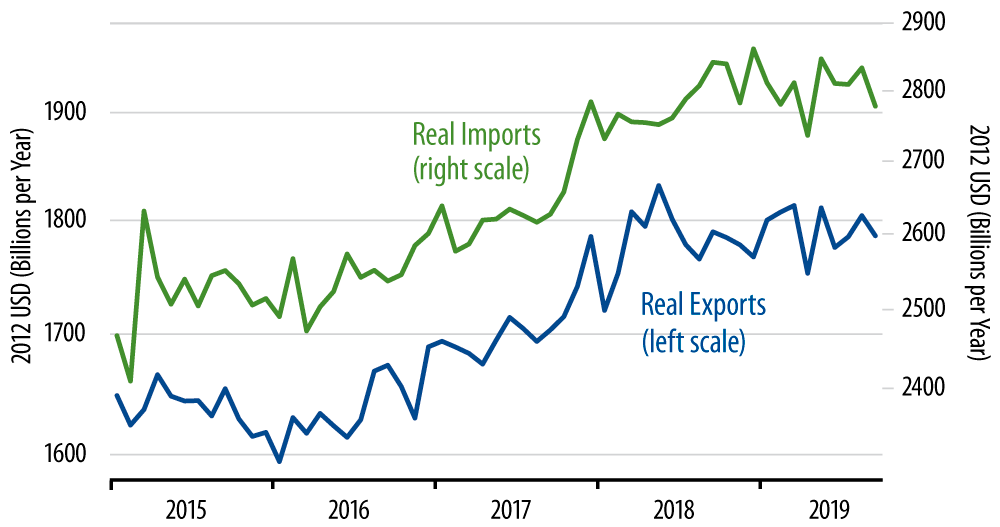

The accompanying chart shows levels of real exports and imports. Exports have been essentially flat since late-2017. While this is slower growth than in 2017, it is better performance than was seen in 2015 and early-2016, when no trade war was in place. Meanwhile, imports have slowed down just as much as exports, and their performance also compares favorably to what we experienced in 2015 and early-2016.

Again, if trade wars are inhibiting trade flows this year, they are not doing so in a way that puts any direct drag on the US economy. Things could change, but for now, they aren’t doing so.