2015年01月30日時点

On balance, the economic data had come in much stronger than we expected over the past two months, especially consumer spending and homebuilding. There were some slight counterpoints recently, with December retail sales and capital goods orders soft, and now a more substantial miss with today’s preliminary release for fourth-quarter GDP.

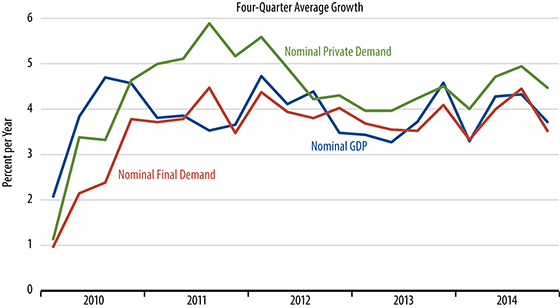

Today’s news put 4Q14 at “only” 2.6% (much weaker than the 3% to 4% growth rates some pundits have been forecasting), and nominal growth at only 2.5%. For 2014 as a whole, these growth rates were 2.5% and 3.7%, respectively. The accompanying chart shows growth rates over four-quarters for various measures of nominal US activity. The consensus drumbeat is that the economy is improving substantially, and even this writer has made some concessions toward this story. Yet, in contrast to this line of thought, the chart shows no improvement whatsoever in nominal GDP and nominal final demand, and only slight improvement in nominal private demand. Even this last aggregate is growing more slowly now than was the case in 2011 and 2012 (hardly robust growth years).

One bottom line here is that despite all the Federal Reserve and Wall Street protestations about the supposed dangers of disinflation, it is falling inflation that—largely alone—has lifted real US growth of late. Indeed, the 4Q14 nominal GDP growth would have been associated with horrendous real growth had the GDP deflator not declined slightly. Yes, this last statement presupposes cause and effect, but the fact remains that overall nominal spending is growing less than spectacularly, and the downtrend in inflation over the last three years has been a net positive for the economy, if anything.

Within the GDP details, consumer spending was up strongly, both for goods and services, though there are some flukey elements to the services gains, namely weather-driven increases in utilities spending and Obamacare-driven increases in estimated medical care spending. 4Q14 GDP was also propelled by a sharp gain in non-vehicle inventories. On the other side of the ledger, 4Q14 growth was held back by substantial softness in vehicles output, defense purchases, foreign trade, and capital spending. The vehicle weakness also looks flukey, as it is at odds with other car-sector data. The defense weakness is merely an offset of overstated 3Q14 gains there. The softness in capital spending is more of a concern.

On balance, the economy has seen recent improvements in consumer spending and housing, partially offset by softer capital spending. The recent homebuilding spike should boost 1Q15 growth. However, exports are likely to soften in 2015, given global conditions, and, again, we are suspicious of the 4Q14 gains in services consumption.