Some months ago, Labor had previewed that it would be revising its payroll data down through 2019 by a total of 500,000, or about 40,000 per month for 2018. That is, these revisions include new, more complete information for the months from March 2018 through March 2019—this period referred to as the benchmark period for this year. For months after March 2019, no new information as yet has been compiled, and these months’ data is mostly based on the same establishment surveys that drive the initial payroll readings. (More complete information comes from payroll tax returns, which all payroll establishments are required to submit, as opposed to the establishment survey which covers only about 30% of nonfarm payroll workers.)

Previous data had suggested a noticeable slowing in job growth from 2018 to 2019. However, with the previewed downward revisions to 2018 and with subsequent indications that 2019 was turning out better than the establishment survey data suggested, our guess was that once this morning’s revisions were in place, 2019 job growth would stack up to be little different from that of 2018.

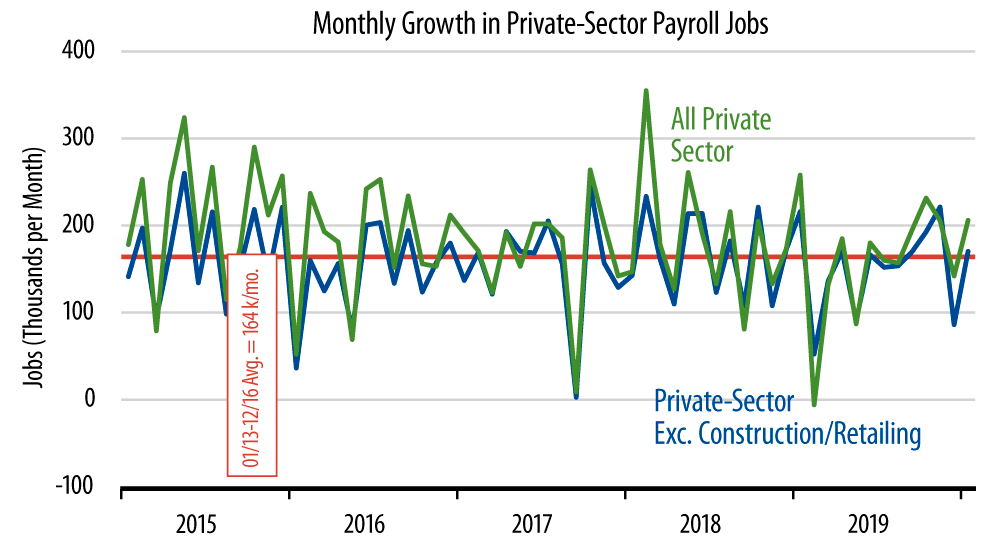

Looking at the revised data in the accompanying chart, we think that is the case. Over the benchmark period, total private-sector jobs were revised down by -512,000, while our preferred measure saw a downward revision of -345,000. Over the subsequent nine months through December, growth in total payroll jobs was revised UP by +90,000, while that in our preferred measure was revised up by +83,000.

For all of 2019, total private-sector payroll job growth averaged 149,000 per month, compared to 189,000 per month over 2018. For our preferred measure, 2019 job growth averaged 150,000 per month, compared to 166,000 per month in 2018. On net, then, we saw some slowing in job growth last year, but not much, and certainly none that is visible comparing month-to-month changes in the accompanying chart.

So, 2019 looks better relative to 2018 than it did a month ago, and 2020 is off to a good start with the January gains reported today. As you can see from the differences between total private-sector payrolls and our preferred measure, there was a lot of volatility and a lot of revisions to the data for construction and retailing. That is the main reason we abstract from these sectors.

In other sectors, manufacturing jobs declined slightly, all of that occurring in motor vehicles, which is still reeling from the GM strike. Net of vehicles, factory jobs rose in January, and non-vehicle factory jobs showed a gain of 50,000 over 2019, a reading that belies the fears about a recently shrinking factory sector.