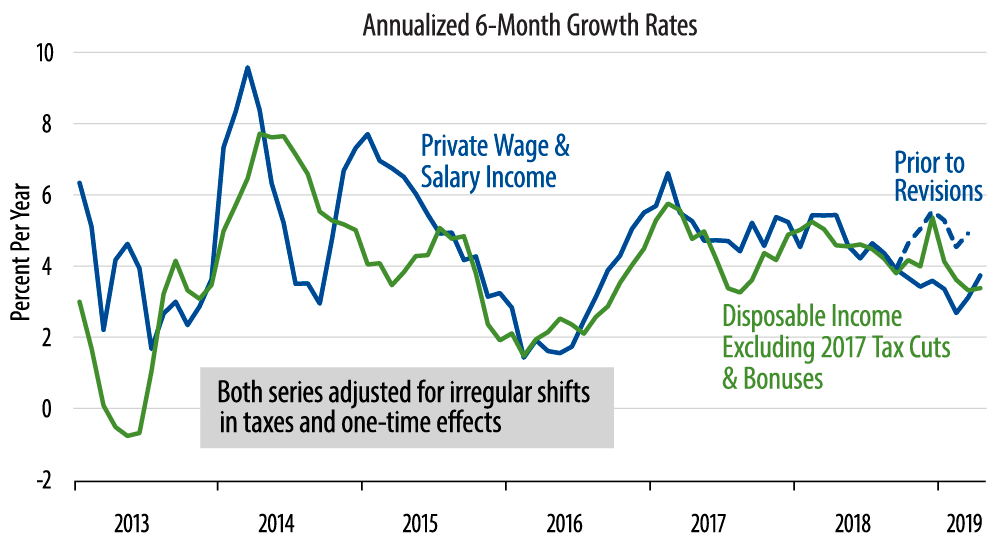

Earlier this month, when covering the April retail sales news, we commented that retail sales growth—and related growth in consumer spending on merchandise—has been showing a meaningful slowing in growth since mid-2018, but we didn’t have any real explanation for this slowing. Today’s income data provide such an explanation. In other words, income growth now looks to have been proceeding more slowly lately than previous data had suggested, and that slower income growth is a compelling explanation of the slower consumption growth seen recently.

Today’s revisions are a somewhat different animal from the monthly revisions that we routinely discuss for various indicators. Essentially all US economic data are based initially on surveys from responding firms. The "month-to-month" revisions to such series then reflect information from late-responding survey participants. Eventually, those series are "benchmark-revised" to incorporate more universal information gleaned from various tax returns, which everyone is required to complete.

Almost all indicators are benchmark-revised once a year to reflect tax return information from about a year-and-a-half earlier. The personal income data—specifically the wage-and-salary income data—are the exception to this rule. They are effectively benchmark-revised each quarter to reflect information from payroll tax returns filed four to six months earlier. Thus, the income data we had a month ago were based on payroll tax returns through September 2018 and survey data for subsequent months. Today’s news folds in payroll tax return data for the months October through December 2018, with survey data then holding for January through April 2019.

We belabor these points because today’s news wiped away most of the wage income growth previously reported for 4Q18. Previous data showed private wage income growing at a 5.4% rate in 4Q18. The revised data mark this rate down to just 1.6%. Now, it is true that wage income growth for the first four months of 2019 is currently estimated at a 4.4% rate. However, those estimates are based on the same survey data for January-April that proved to be so overstated for October-December. In other words, if that 4Q18 income slowing represents some substantive move in the economy that is still in place, the 2019 data income growth data could be revised down just as much (come August) as the 4Q18 data were revised down today.

In any case, again, the data in hand indicate a noticeable slowing in income growth since spring 2018. Consumer spending on goods shows a slowing over the same time span, and growth in consumer spending on services has also looked a bit soggier in recent months. None of these threaten recession, but they are, again, suggestive of slower growth than the Federal Reserve would like to see.