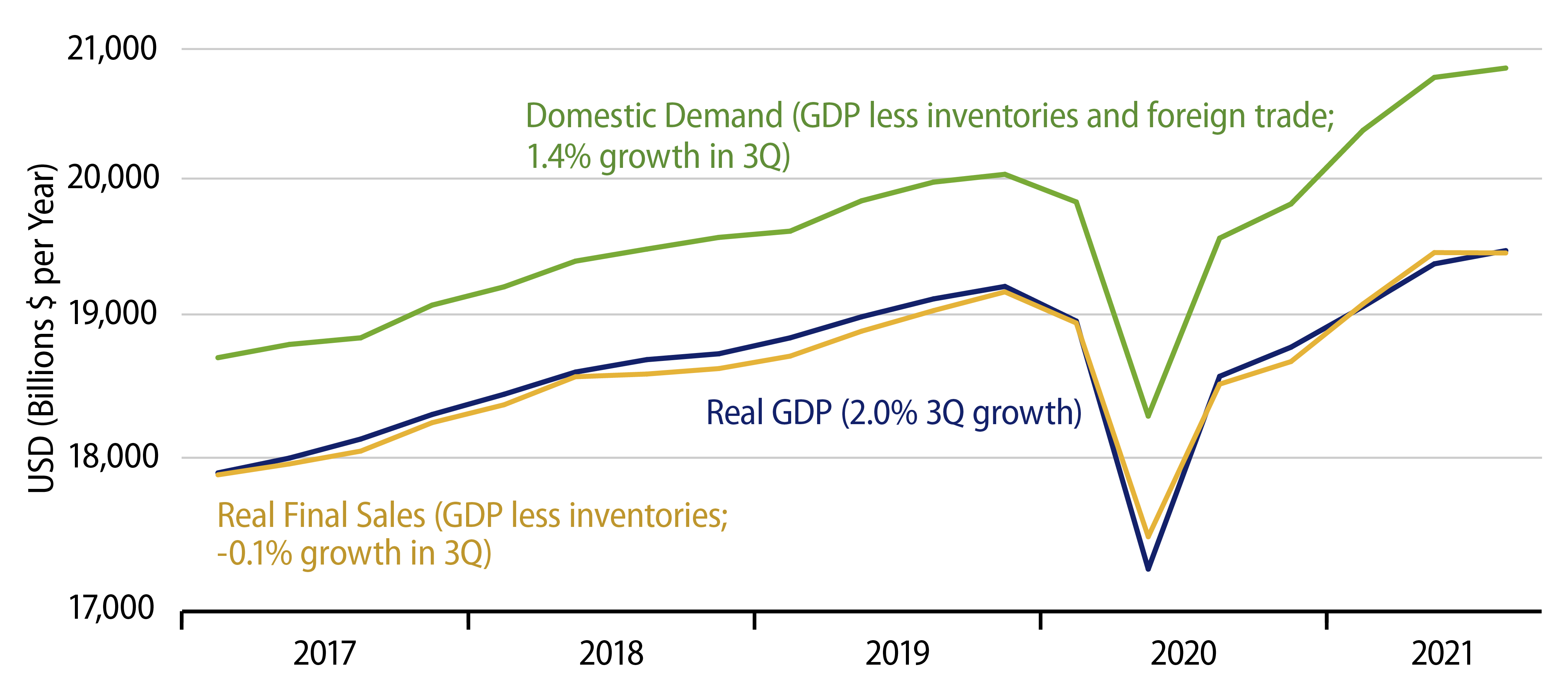

Real GDP growth in 3Q was estimated today to have been 2.0%, compared to 6.6% in 2Q. This estimate was higher than some recent forecasts that had been as low as zero. However, it was way below the forecasts that were being floated around the markets at the start of the quarter, with common projected growth rates around 8%.

Those previously looking for 8% 3Q growth will blame the delta variant outbreak and gridlocked seaports for the growth shortfall. However, the actual reasons for the slowing are much simpler. Neither consumer spending nor housing construction came in anywhere near the Street’s initial estimates of growth, and the shortfalls there actually began last March or earlier, long before the delta variant or port congestion had entered the market lexicon.

As we have remarked continually in these posts, after explosive growth in the first three months of 2021, when consumers were catching up on expenditures not undertaken during the 2020 shutdown, consumer spending on goods has moved sideways to down ever since. Street analysts were looking for government and Fed stimuli to drive further rapid growth. Instead, consumers largely banked the government largesse and pulled back slightly on their rates of merchandise purchases. And while consumer spending on services continued to make up some of the ground lost during the shutdown, the rebound there in 3Q also fell short of expectations.

Much the same was true for housing construction. While it has held at elevated levels relative to pre-Covid experience, the highwater marks for homebuilding were seen in late-2020 and it has been on a slight downtrend ever since. Once again, all these shortfalls were in place well before the emergence of the delta variant this August or the port congestion slightly later.

The apparent surge in inventory investment that worked to boost 3Q growth was something of a mirage. About half of it occurred in motor vehicle inventories. You might be wondering how vehicle inventories could have risen so strongly in 3Q when a chip shortage was critically restricting vehicle output. Well, they didn’t really. The reported vehicle inventory “surge” was instead a statistical technicality.

After the chip shortage had already restricted vehicle inventories in 2Q, they did not decline as much as usual—before seasonal adjustment—during the model-year changeover in 3Q. So, the government’s seasonal adjustment process turned smaller-than-usual declines into a substantial “improvement” in vehicle inventories. Even so, sales of vehicles plunged, leaving vehicle output down sharply in the quarter. Even apart from the auto sector issues, GDP of other goods still rose only tepidly after much stronger growth in the first half, reflecting, again, zero-to-negative growth in goods consumption since March.

Looking ahead, there are other issues that will bedevil 4Q growth. While below expectations, consumer services did still grow strongly in 3Q, but the delta variant and related restrictions on consumer activity are likely to restrain activity there in 4Q. Meanwhile, though goods consumption and homebuilding are not likely to repeat the substantial declines shown in 3Q, we do not expect them to rebound meaningfully in 4Q.

On net, we think a 4Q growth rate similar to that of 3Q is as good as things will get in the current quarter. Until remaining Covid restrictions are lifted, the economy is likely to underperform relative to the expectations of Wall Street and the Fed.