A Grinchy November Jobs Report

Private-sector payrolls rose by 221,000 in November, though that gain was meaningfully shaded by a -59,000 revision to the October jobs level. Hours worked declined by 0.2 hours, but average hourly wages rose by 0.6%. Within the household survey, unemployment held steady at 3.7% only because the labor force contracted by 186,000 workers, offsetting a comparable decline in household-survey employment.

All in all, a pretty mixed bag of a report, but it was a distinct disappointment to financial markets, which were looking for enough slowing in job growth and wages to reassure themselves of a downshifting Fed. The markets’ response is understandable, but we think there are nuggets in the report consistent with our contention that the economy is slowing and that inflation will soon be brought under better control. The key is keeping in mind how utterly distorted Covid has made the economy.

So many service sectors are still struggling to regain something approaching normalcy after prolonged Covid restrictions. Economic output has nearly returned to pre-Covid norms, but even in those industries enjoying full recovery, staffing remains depressed, and for the service sectors that were hit hardest by Covid restrictions, the situation is still acute.

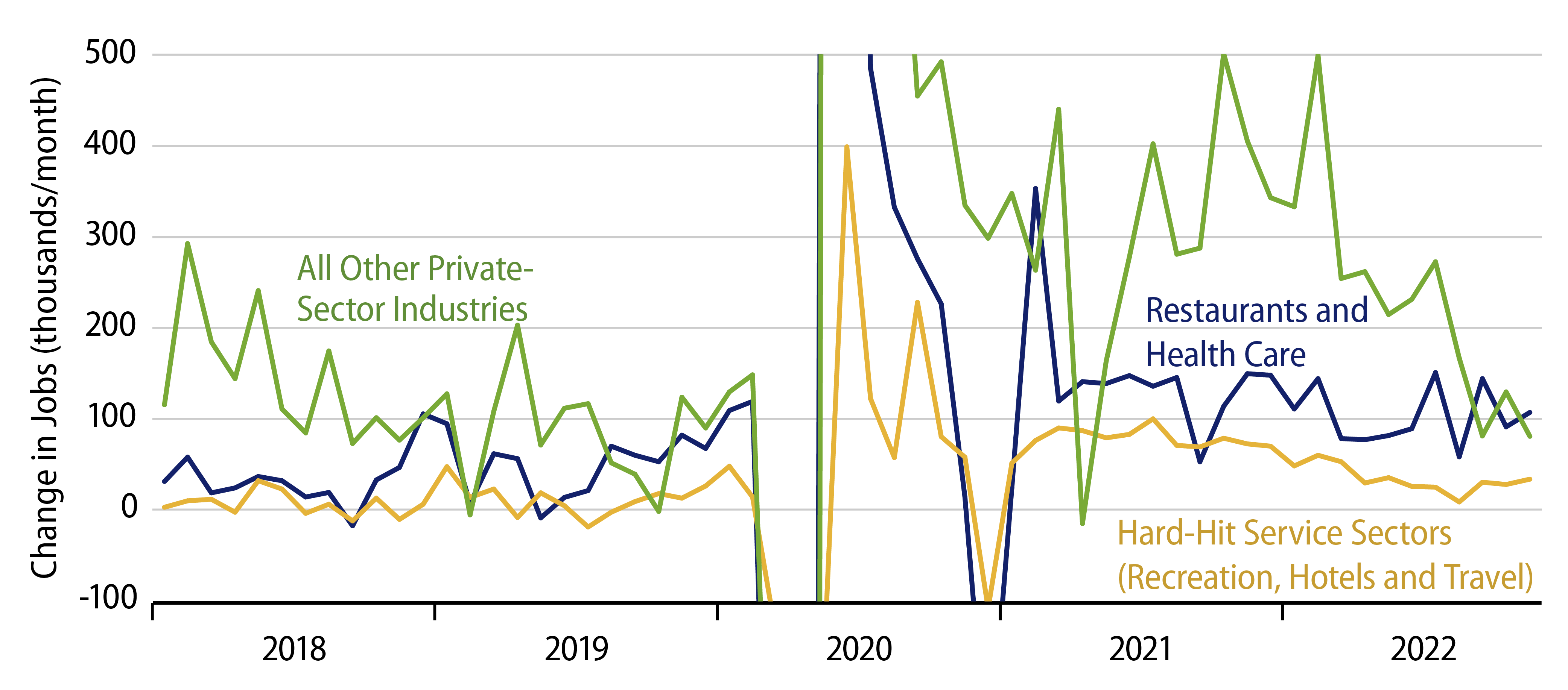

We have talked in these posts about the five service sectors we call the epicenter of Covid effects: health care, restaurants, recreation, travel and lodging. All these sectors remain substantially understaffed relative to pre-Covid trends. These sectors accounted for the bulk of job growth in November and likely all the overage versus market expectations.

These sectors are depicted in the blue and yellow lines in the accompanying chart. For both groupings, job growth has held steady over the past six months and popped a bit in November, even while job growth in the rest of the economy has steadily decelerated throughout 2022 and slowed further in November. For the economy outside the Covid “epicenter,” job growth has fallen all the way back to pre-Covid norms, and, as stated at the outset, workweeks continue to be trimmed back.

If you were an employer with thin staffing facing a possible softening in demand, what would you do? Shed workers that you might have a hard time replacing later or hunker down and economize where you can? The latter course seems more reasonable, and it is a credible description of what we are seeing in the data.

Firms are not (yet?) frantically cutting workers, but they are downshifting the pace of staff additions—or keeping it stable in sectors where understaffing is especially acute. And with more normal levels of staffing, they are able to cut back on workweeks, relieving some of the stress on their long-standing employees.

Admittedly, this stylized account does not explain the November gains in average hourly wages. These were focused in a handful of industries seeing especially large gains. Also, these gains come after a full year of slowing growth in average hourly wages. The markets and the Fed might not like this print, but it doesn’t change the trend of decelerating wages in 2022.