Private-sector employment rose by a healthy 308,000 jobs in August, though that gain was slightly tarnished by a -52,000 revision to the July level. Job gains were widely distributed across most major sectors, paced by a 68,000 gain at professional and business services and a 62,000 gain in health services.

In earlier posts, we have highlighted the recent declines in homebuilding. Despite declining real construction spending, jobs there rose by 16,000 in August, with the bulk of these gains occurring in residential construction. Within manufacturing, employment rose by 22,000, with factory production jobs up 18,000. Yet factory workweeks declined enough to leave total hours worked in manufacturing unchanged, while factory production hours worked declined by 0.4%.

The contrasts in the construction and manufacturing sectors are redolent of the economy in general. Recovery in construction and manufacturing has been largely complete for over a year, and real output there has been about flat for as long, accounting for most of the accompanying slowing in GDP growth. Yet, employment in both sectors has continued to rise relatively rapidly. Employers in these sectors seem to be bringing staffing back up to pre-Covid levels, relieving pressures on a workforce that previously was producing more output with less inputs.

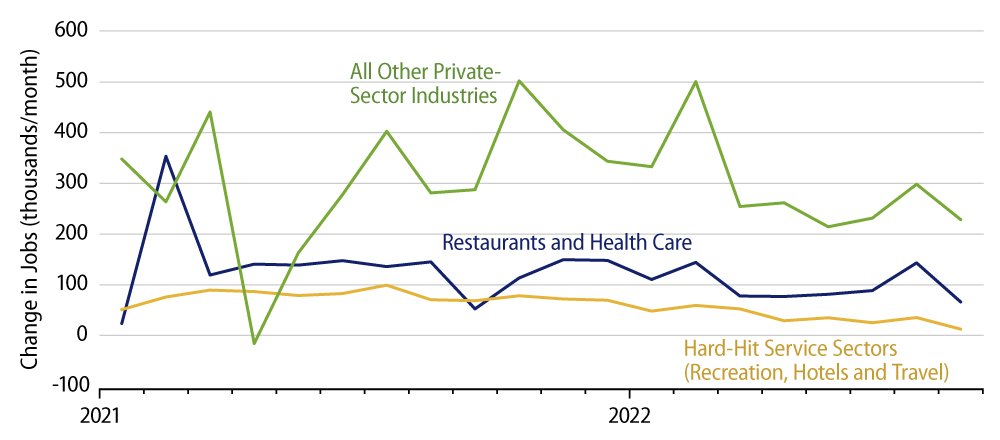

In the service sectors, both output and staffing remain depressed, and so both have continued to grow at an ostensibly strong pace in recent months. The recent gains are clearly less feverish than what was seen in late-2020 and 2021 (see Exhibit 1), but still faster than what would have been seen as “normal” prior to Covid.

Overall, we have a situation where most of the economy (i.e., services) has yet to fully recover from the induced 2020 recession, where unemployment is low only because millions of former workers have yet to rejoin the labor force. Yet the Federal Reserve (Fed) is trying to stifle growth (and, presumably, raise unemployment) in order to address the inflation problem.

The Fed will have to look hard to find any succor in today’s data. Again, a 300,000-job gain is strong by any pre-Covid standard, and there is no ostensible pain in hiring conditions in any sector. Unemployment rose 0.2% in August only because the labor force rose even more strongly than did household survey jobs (up 786,000 versus up 442,000). Workweeks are indeed declining, and wage gains are moderating, but it is not clear that these blips will register on the Fed’s radar screen, when jobs themselves are rising so nicely.