Private-sector payrolls jobs rose by 150,000 in November, according to data released today by the Bureau of Labor Statistics (BLS). This gain was substantially offset by a -61,000 revision to the estimated October jobs level. Also, the November gain was overstated by the cessation of the United Auto Workers (UAW) strike, which boosted November job growth by +30,000, after having reduced October job growth by a comparable amount. Net of the auto industry, private-sector jobs rose by 120,000 in November, about equal to the 117,000 ex-auto gain now reported for October.

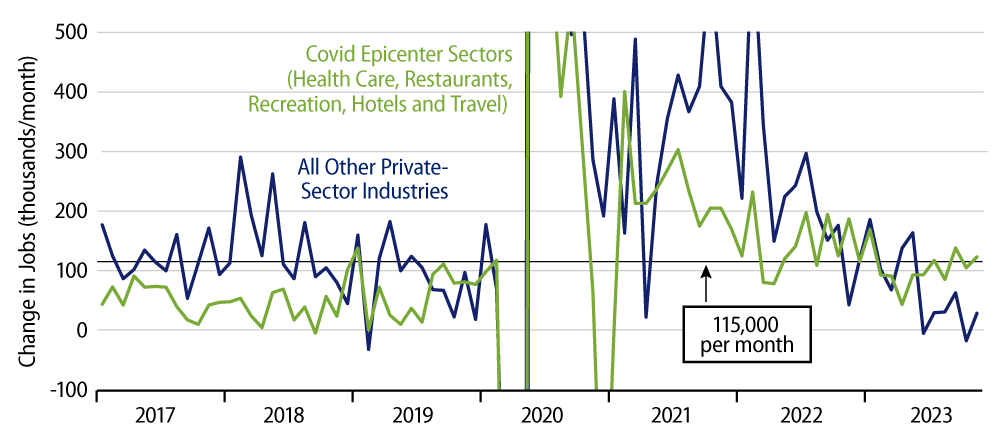

Also, it continued to be the case that the vast bulk of the reported job growth occurred in what we call “Covid epicenter” sectors: health care, restaurants, hotels/motels, passenger travel and venue recreation, all sectors that had been especially decimated by the Covid shutdown three years ago and that are still working to reattain pre-Covid staffing levels. It is only to be expected that job growth in these sectors will be relatively rapid until more normal staffing levels are achieved.

For other sectors that had already fully recovered from the Covid shutdown, job growth has dropped precipitously over the last six months, averaging only 20,000 per month over June-November, compared to 128,000 per month over the preceding six months. Furthermore, 18,000 of that 20,000 recent average occurred in construction, which had continued to add jobs at a handy pace before sputtering in November. In other words, outside the Covid-epicenter sectors, job growth has slowed to a virtual halt recently, and the November data continued this development.

With the data announced this morning, every month of 2023 has seen significant downward revisions to the initially announced job growth numbers. Final data are now in for September, and the average downward revision from “advance” to “final” data is now -55,000 per month for private-sector payrolls. Such a string is unprecedented in our memory (and these are in addition to the benchmark revisions BLS has announced).

There were non-weak developments in today’s release. After declining especially sharply in October, average workweeks rebounded in November to September’s level. The trend for this series still looks to be downward. Employers are easing the burdens on existing staff as new workers are added to the rolls. However, the especially sharp workweek declines announced for October are no longer in play.

Similarly, growth in average hourly wages bounced a bit in November, after having been especially soft over August-October. Average annualized growth in hourly wages over August-November now stands at 3.3% per year for all-worker wages and 3.8% per year for nonsupervisory worker wages. Federal Reserve comments indicate it believes a 3.5% growth rate in wages is consistent with its 2% inflation target.

So, yes, there are elements to today’s payroll report that led some analysts to tout a “strong” report. However, looking through strike effects and at revised data, a) the slowing trend in job growth is still in place, b) what job growth is occurring is concentrated in still-understaffed Covid-affected sectors, and c) even with a November bounce, wage growth has been coming in essentially at Fed targets for the last four months. All this makes our title above an apt description of today’s news.