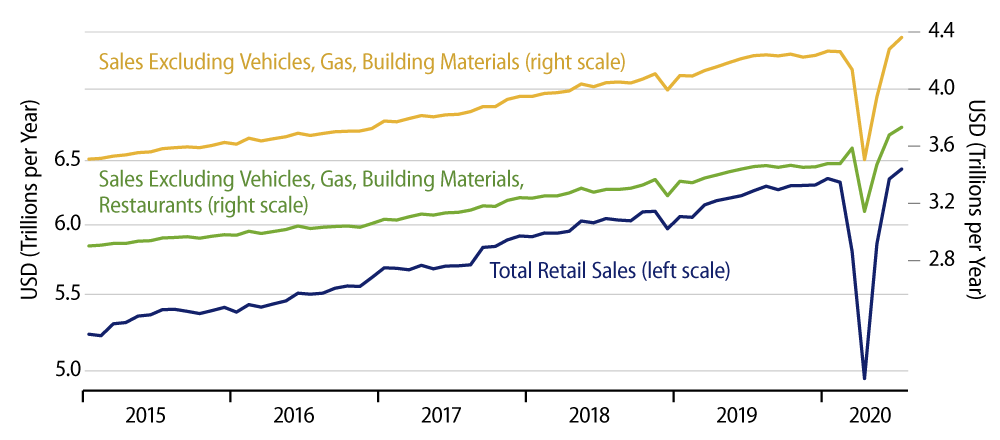

Headline retail sales rose 1.2% in July, with the estimate for June revised up by 1.0%. So-called “control” sales—excluding car dealers, service stations, building material stores and restaurants—rose 1.4%, also with a 1% upward revision to June.

Our title above echoes the title used a week ago with respect to the payroll jobs data. Various media comments had cited a supposed summer stumble in the economy’s rebound from the COVID shutdown. Last week’s payroll data offered no hint of that, and neither do today’s data.

Judging by the accompanying chart, you might think that Americans are already fully back to the mall, rather than just “getting back.” That would not quite be right. While July sales levels outside of restaurants are well above pre-COVID levels, a good bit of this overage is due to a surge in online sales. So, some traditional brick-and-mortar stores have yet to see sales return to February levels.

Sales of building material and at vehicle dealers, book/sporting goods/hobby, and drug stores have all rebounded to well above February levels, after having plunged in March and April. For these store types, consumers are satisfying pent-up demand, purchasing merchandise that they were unable to buy when stores were closed during the shutdown.

For clothing, furniture and appliance stores, sales have rebounded nicely from their March/April swoon, but are still a bit short of February levels. These are stores that have given up sales to online vendors.

Meanwhile, among grocery and general merchandise (warehouse) stores, as well as online vendors, the opposite pattern has emerged. Sales there surged in March and April, thanks to hoarding and shutdowns elsewhere. They have pulled back a bit recently, but remain elevated well above February levels.

Finally, there are restaurants. With partial shutdowns, social distancing and ongoing fears continuing to restrain food services (as well as various other service sectors that are not considered retailing), restaurant sales have done well to see a 74.7% increase over the last three months, following a 54.1% sales decline in March and April. However, thanks to the realities of compounding, these swings leave restaurant sales still 19.7% below February levels.

Obviously, the retailing sector has seen a variety of experience in these “novel” times. Generally, the rebound has been as robust as one could have expected. Until shutdown and distancing regulations are lifted, it is unlikely that restaurant sales will fully recover, but the near-term outlook is better for other store types…with one proviso.

Just as sales at grocery and warehouse stores have pulled back in recent months as hoarding proclivities have waned, so too sales of vehicles, books/sporting goods (firearms?), and other currently elevated categories are likely to see a sales pullback when pent-up demand is sated. In this charged media environment, many will be quick to pounce on such news as evidence of impending doom. Instead, it will more likely be merely a return to normal. (Wouldn’t we all love some normalcy?) The more informative perspective will be continued sales growth in other sectors that are not currently enjoying sales above February levels.