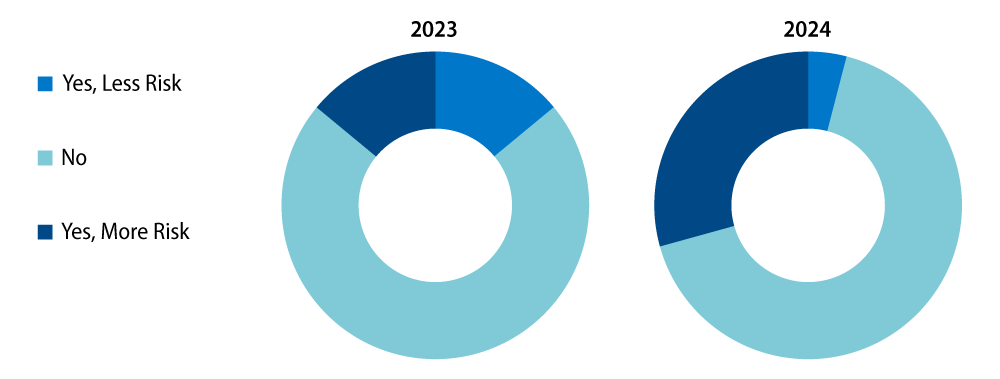

Central bank reserve managers have adopted a wait-and-see approach to asset allocation for several years due to the volatile global rates environment. There is now renewed interest in their appetite for fixed-income investments. As highlighted in Exhibit 1, the share of reserve managers looking to take on additional risk in investment portfolios over the next one to two years has more than doubled relative to a year ago. This is a welcome development.

As we’ve previously noted, central banks hold foreign exchange reserves to support several critical objectives such as maintaining confidence in the country’s exchange rate, providing liquidity during crises, supporting external debt obligations and maintaining reserves for national emergencies.1 In addition to these functions, central banks manage liquidity portfolios and separately managed, longer-term fixed-income accounts to meet different goals and satisfy certain constraints. These separately managed accounts are typically outsourced to external investment managers such as Western Asset.

In our conversations with some clients, there has been a generalized concern about the US presidential election, which Trump ultimately secured last night, as the prospect of social unrest regardless of the winner coupled with a potentially worsening US deficit may heighten market volatility. Several of our sovereign clients are also thinking about the prospects of a US economic soft landing and the impact of escalating conflict in the Middle East on global energy prices. While reserve managers remain concerned about geopolitical risk and the pace of global economic activity, there’s a growing consensus that global recession risks are abating, inflation is gradually coming under control and that short-term rates will decline over time. The bottom line is that reserve managers are actively seeking additional yield and diversification in primarily US dollar-denominated assets for their investment portfolios as global financial conditions stabilize.2

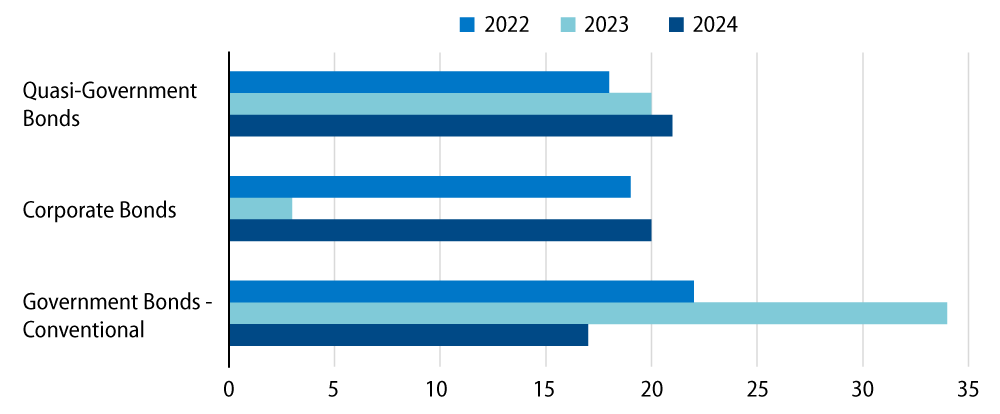

Exhibit 2 illustrates a shift away from conventional government bonds, with increased interest in quasi-government debt and a notable pivot back to corporate bonds. We observe that central banks are looking to modestly extend duration by moving into 2- to 5-year US Treasuries (USTs) and diversifying into areas such as US agency mortgage-backed securities (MBS). We also see a growing appetite for BBB rated intermediate maturity debt as well as green bonds and social bonds issued by multilateral organizations. These ESG-related investments reflect the rising number of central banks taking steps to integrate sustainability considerations into their investment frameworks.3

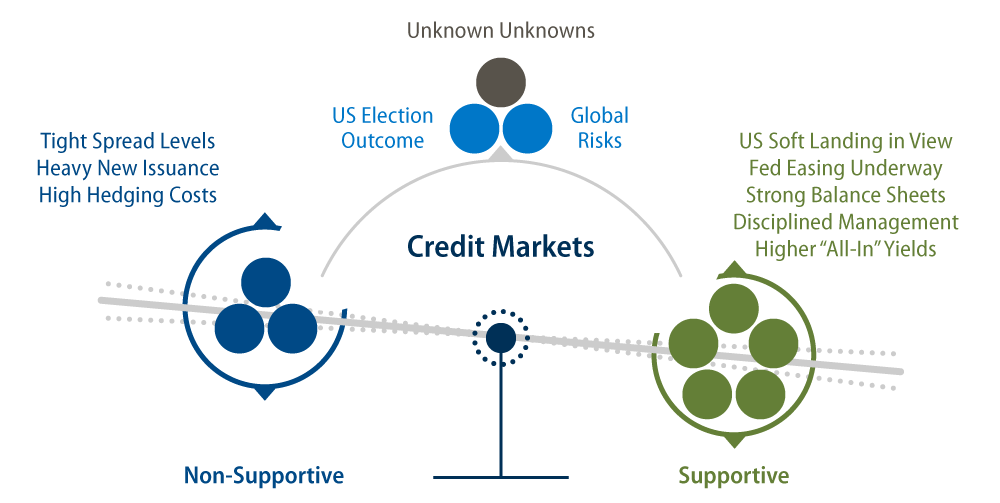

Reserve manager interest in corporate debt may seem surprising given current spread levels, which are hovering at or near historical tights. However, corporate debt has been an area of focus for central banks in the past few years and, as highlighted in Exhibit 3, we believe there are meaningful fundamental and technical factors supporting the corporate credit market as we move into 2025.

First, corporate balance sheets are much stronger today, global financial conditions remain accommodative, and yields across credit markets are still above decade averages. Moreover, the Federal Reserve (Fed) and other central banks in developed and emerging markets have started cutting rates after much anticipation—a trend likely to continue amid the ongoing global economic slowdown and subdued inflation.

While some investors remain cautious about potential spread widening, we believe valuations reflect resilient underlying fundamentals and that management teams are largely exercising balance sheet discipline and defensive behavior. Meanwhile, the technical backdrop remains supportive as demand remains robust from yield-based buyers even as supply has surprised to the upside.

Last, the size of the US investment-grade corporate bond market is estimated at over $7 trillion dollars. Deep and liquid markets are an important consideration for sovereign investors seeking attractive returns while taking moderate credit risk.

While central bank liquidity portfolios continue to enjoy relatively high yields, we have started to see evidence of modest allocations outside of the money market spectrum. This suggests a gradual move out of cash into slightly longer-dated, high-quality securities. These allocations are in line with reserves management broad-market mandates typically comprised of USTs or global sovereign bonds hedged to the US dollar, with short-to-intermediate duration guidelines. We expect to see a continuation of this trend as the Fed continues to ease monetary policy.

In conclusion, central bank reserve management in rapidly changing market conditions requires a dynamic and adaptive approach. As global financial landscapes evolve, central banks must balance multiple objectives, including liquidity, safety and return. Implementing robust risk management frameworks and leveraging advanced analytical tools are essential to navigating volatility and uncertainty. By fostering a culture of innovation and open communication, Western Asset partners with sovereign clients to continuously monitor macroeconomic indicators and global fixed-income market trends to facilitate proactive investment decision-making.

ENDNOTES

1. IMF, Revised Guidelines for Foreign Exchange Reserve Management, 2014

2. Despite headlines about the de-dollarization of reserves, data from the IMF shows that the US dollar’s share of global reserves remains unchanged at 60% since late 2020.

3. OMFIF Global Public Investor Survey 2024, p. 43