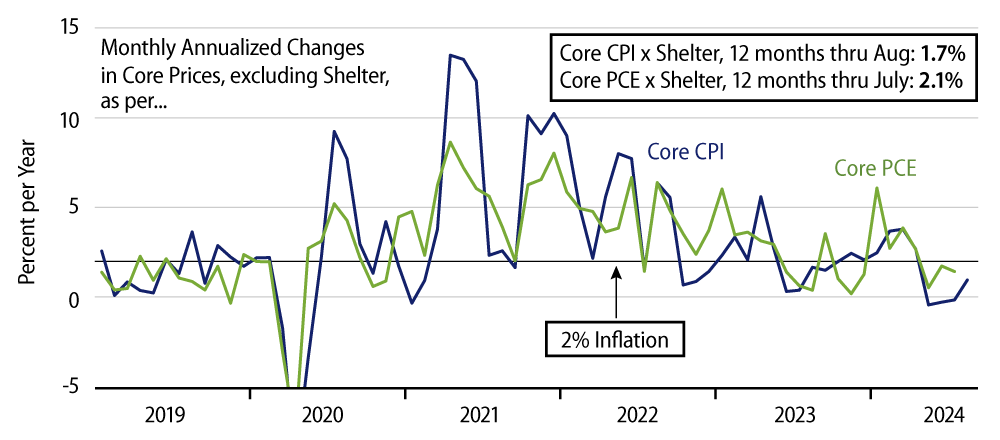

Core Consumer Price Inflation (CPI) bounced a bit in August, running at a 3.4% annualized rate (0.28% non-annualized), thanks mostly to a jump in homeowner costs. For over a year, Federal Reserve (Fed) Chair Powell has pointed out that reported shelter costs are subject to technical lags that cause them to run hotter than what is actually happening in the real estate market. We have therefore tracked a core inflation measure that excludes reported shelter costs over that period.

That core ex shelter CPI measure rose at a 1.0% annualized rate in August (0.08% non-annualized) and has shown zero net change over the last four months and just a 1.7% increase over the last 12 months. In August, both goods and services prices ''cooperated,'' with core goods declining at a -2.0% annualized rate (-0.17% non-annualized) and so-called ''supercore'' services (core services ex shelter) up at a 4.0% annualized rate (0.33% non-annualized).

The August supercore rise is a bit of a bounce from the readings of May through July. For the last four months together, supercore services inflation ran at a 1.3% annualized rate, well below the 2.5% rate consistent with 2% overall inflation. Since goods prices typically run softer than services, a 2.5% rate for services is consistent with 2% overall inflation. Similarly, this measure has shown a clearly decelerating trend over the past year, and it is reasonable to think that future readings will be more in line with the average for the last four months.

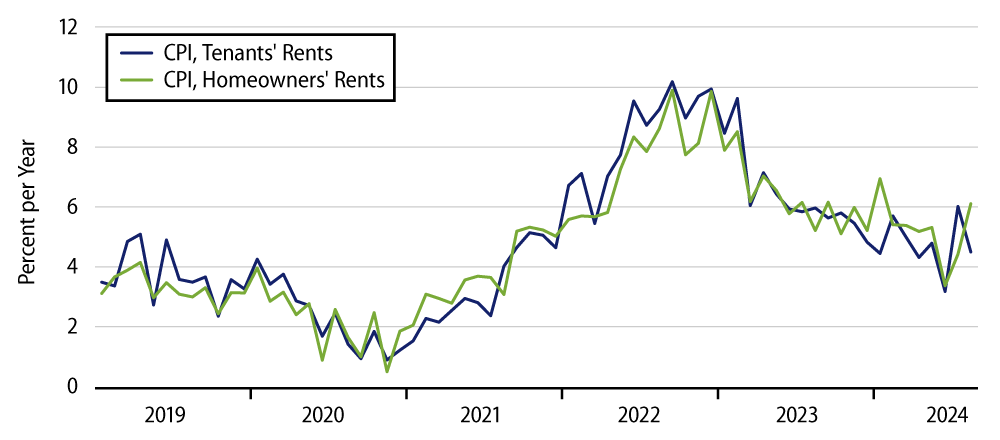

More problematic are the continued elevated readings for shelter costs. We and most other analysts have been looking for reported shelter cost increases to abate, given that home sales prices have shown a near-zero net change for more than two years and that market measures of rents have slowed to a 3% rate of increase over the same period. Instead, CPI measures of renters’ costs have been running at a 5% annualized rate, and homeowners’ costs jumped to a 6.1% annualized rate in August, after having posted only a 3.4% annualized rate of increase in July.

Maybe the August bounce in homeowners’ costs is merely an offset of an unusually low July print. However, even if it is, that still leaves the trend rate for this measure in the 5% per year range, which is too high.

This is a dilemma for the Fed. If the shelter costs estimates are inaccurate, the Fed could ignore them and focus on core ex shelter, which, if anything, has been below its inflation targets lately. However, if the shelter costs are indeed indicative of reality, then the Fed must decide if it wants to ''kill'' the housing market in order to bring down reported shelter costs.

Housing construction has already begun to decline in recent months, for both single-family and multi-family units, and, again, reported shelter costs nevertheless are still running hot. Given the lags from housing activity to housing market prices, and from housing market prices to shelter costs as reported within the CPI, it is likely that we would have to see further sharp declines in housing activity before reported shelter costs slow enough to sustain overall core inflation (including shelter) at acceptable rates.

No one can be sure how Fed officials will react to all this. However, it would not be surprising to see Mr. Powell and company step up their musings on the possible flaws in reported shelter costs and ramp up their focus on the very benign readings given recently by inflation upon abstracting from shelter costs.