Headline retail sales rose 0.6% in February, but the January sales estimate was revised downward a hefty -0.5%, leaving the February sales estimate -0.9% below that for December. The more widely scrutinized “control” sales measure was unchanged in February. Its January sales estimate was revised down -0.2%.

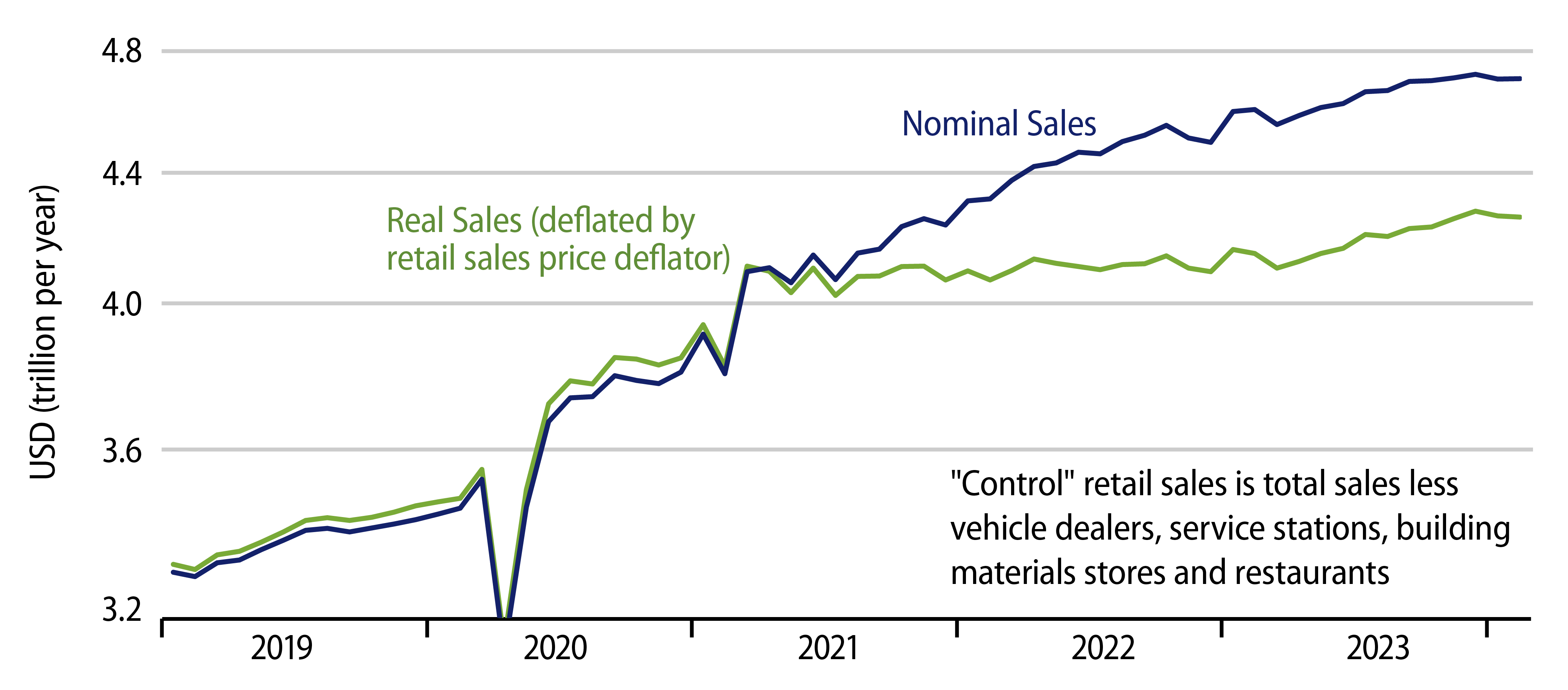

The control measure excludes sales at car dealers, building material stores, gas stations and restaurants. These are removed partly because of their month-to-month volatility, but mostly because they are frequented by businesses about as much as consumers, and the intent is to focus on consumer spending. In other words, the more consumer-oriented segments of retailing have shown a slight net decline in sales over the last two months, as seen in the chart.

The context of course is that the January/February softness comes off good fourth-quarter gains. We have emphasized lately that data over November-February are especially volatile due to the ups and downs of the Christmas holiday season. And with the reported softness of the last two months just offsetting the preceding strength, it is simply impossible to tell for sure at this point whether the January/February softness indicates an incipient downshift in consumer spending or just statistical noise.

With headline sales up 0.6% and control sales flat, the “excluded” sectors obviously showed sales gains in February. These were pretty evenly spread across cars, building materials, gasoline and restaurant food, but in each case the reported February gains merely offset reported January declines. Car sales have been declining on net for the last five months, after a September bounce with the new model year. Real sales at building materials stores and service stations have both been declining modestly for the last two years. Real restaurant sales have been declining on net since November, but here too, the recent declines came after nice gains in summer and fall.

For the more consumer-oriented sectors, essentially all the sales gains of the last eight months have occurred at electronics stores and online vendors. Electronics stores were one of the few sectors reporting sales gains in January and February. Online vendors show slight declines in real sales in both January and February, though here too, those declines came after good late-2023 sales gains.

In summary, we are just as circumspect with respect to the recent softness in retail sales as we are for the accompanying bounces in inflation and jobs (though the latter was largely erased with last week’s release). Our expectation is for moderating growth and continued low inflation this year. The data so far this year have given conflicting signals with respect to this view. Stay tuned to see whether spring data paint a clearer picture.