Consumer spending registered some nice gains in May, following two months of cataclysmic declines. Total real consumer spending rose 8.1% in May, with the April spending level revised upward by 1.3%. These gains still left May spending 11.2% below the pre-COVID level of February.

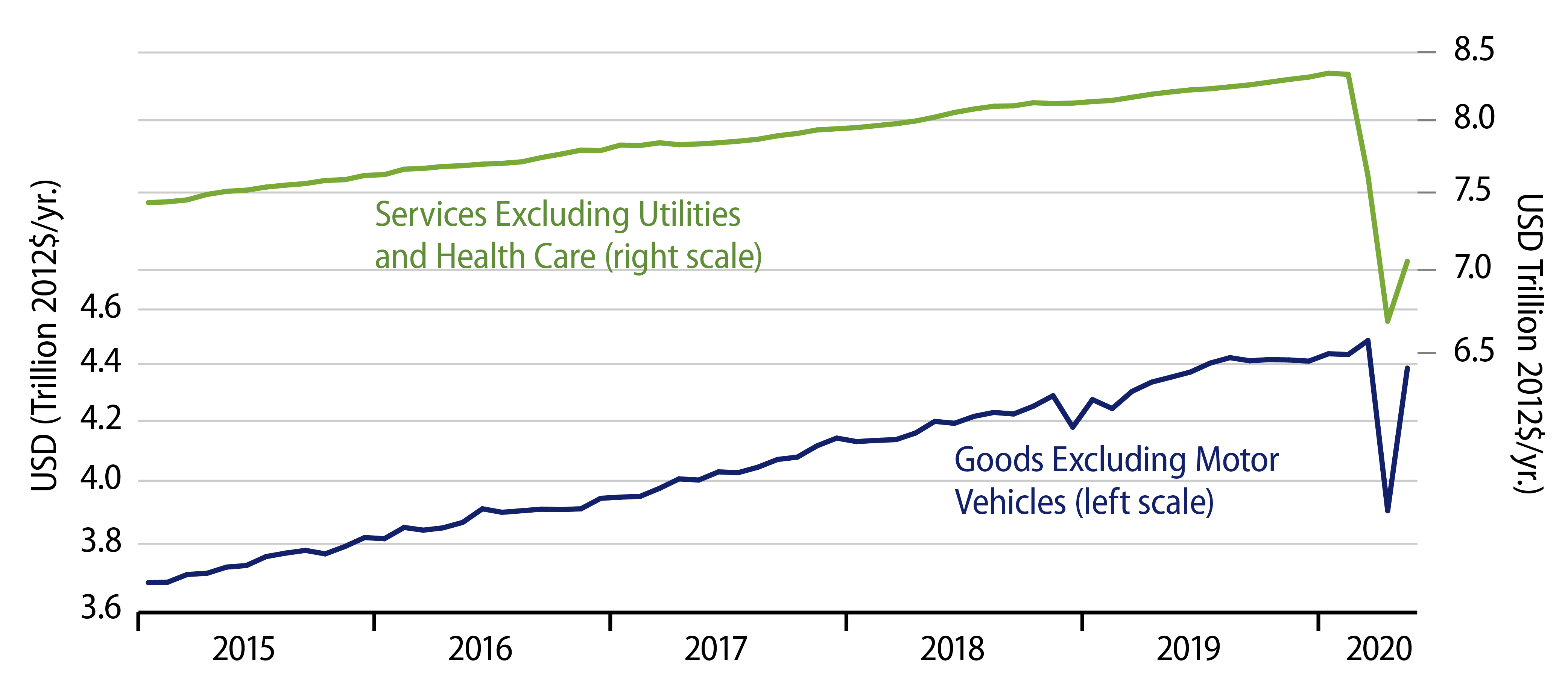

For goods consumption excluding motor vehicles, spending rose 12.3% in May, with a +3.2% revision to April, leaving it only 1.1% below pre-COVID February levels, after what had previously been announced as a 15% decline February to April. For services consumption excluding medical care, spending rose only 0.6%, with April spending actually revised lower by 0.3%, leaving this aggregate 11.8% below February levels.

When we analyzed the May retail sales data in our 6/16 post here, we were not as favorable about the May gains as we should have been. Our control sales measure includes restaurant sales, which is normally fine. However, in present circumstances, with restaurants one of five service sectors hit especially hard by COVID and related shutdowns, our control sales measure thus does not reflect the more complete rebound that goods retailers have experienced. Similarly, on 6/16, we pointed out that clothing, furniture, and personal care retailers had not seen much rebound in sales through May, but this ignored the offset in consumption of these items contributed by online retailers.

On net, allowing for these, “control” sales of merchandise rebounded in May fully back to pre-COVID levels, and you can see in this chart that this is almost also the case for goods consumption ex autos. Meanwhile, again, the rebound in services consumption is just beginning, at best.

There has been more of a bounced in medical care spending than was evinced by other services. Medical care consumption rose 23.7% in May, with a substantial upward revision to April. These gains still leave spending there 24.5% below February levels, but note that net decline compares very favorably with those seen in other hard-hit service sectors. Hotel spending fell 68.7% February to May, recreation 74.6%, air travel 89.4%, and other passenger travel 84.1%. Thanks to a shift to curbside service and takeout, restaurants were able to register a 24.0% gain in consumer spending in May, which left them “only” 36.2% below pre-COVID levels.

For other sectors excluded from the charts and commentary so far, vehicle spending has rebounded very nicely and utility spending is up from February, with shut-in households using more electricity and gas.

All in all, goods consumption has already rebounded resoundingly at only the outset of the economic re-opening, but services sectors are lagging, as would be expected. The biggest contributors to services spending are medical care and restaurants, and they saw the largest May gains and smallest net declines from February. Still, both of these sectors remain substantially below pre-COVID norms. The May data show a very good first step toward economic recovery, but there is a long ways yet to go.