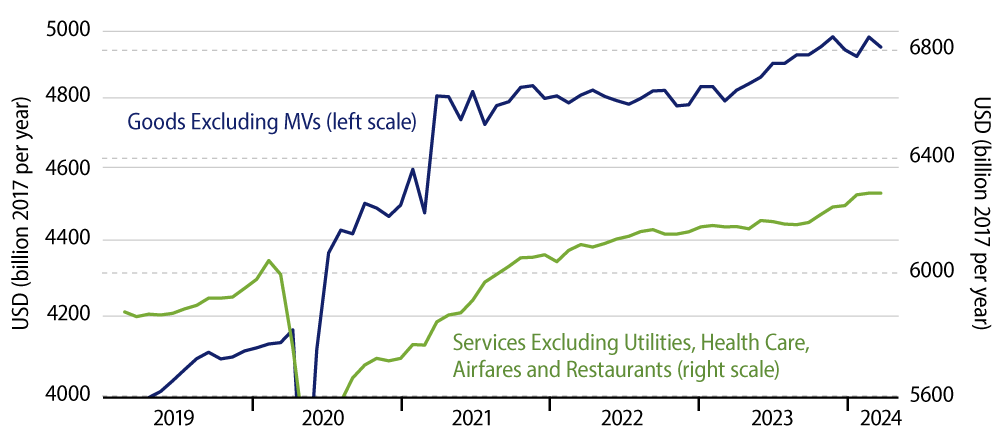

Consumer spending in real terms declined -0.1% in April, and there was a substantial, -0.3% revision to the spending estimate for March. The net spending softness was broad-based, with declines in goods spending occurring over the last four months and services spending basically flat for the last two months.

Our constant mantra is ''one month doesn’t make a trend.'' For goods spending, again, the softness has been in place for a while and is starting to look significant. The services spending softness is more recent, therefore more tentative, but as you can see in the chart, services spending is less volatile month to month than goods spending, so even two months of ''flatness'' there bears watching going forward.

The declines in goods spending concur with what retail sales data have been reporting and are widespread, though mild. Spending continues to grow nicely for electronics and slightly for food, but is declining for most other types of goods.

For services, we regularly discriminate between those sectors heavily affected by the Covid shutdown—health care, restaurants, hotels, passenger travel and recreation (movies, ballgames, etc.)—and other services not so heavily affected. The late-2023 upturn in services spending shown in the chart occurred mostly in non-Covid-affected sectors. Well, spending in those other sectors has shown much slower growth over the last two months, and spending in most Covid-affected sectors has gone flat (the exception being health care). This is what we mean when we say the recent spending softness has been widespread, though incipient.

Truth to tell, we have been expecting consumer spending to slow for a while now, based on very low saving rates, rising consumer debt burdens and income growth that is barely exceeding the rate of inflation. Both the mid-2023 upturn in goods spending and the late-2023 upturn in services spending occurred at odds with those expectations. Possibly, things are changing now. We’ll see if the movements of the last few months become firmly entrenched as a trend.

Meanwhile, income growth did soften in April, just about offsetting the slowing in inflation. The April gains in the Personal Consumption Expenditures (PCE) price index were slower than what we saw over January-March, but somewhat above the inflation rates recorded over the last half of 2023. So, there was some modest improvement—so far as bond investors are concerned—in income and inflation data, and perhaps a more meaningful ''improvement'' in consumer spending.