Headline retail sales rose 0.4% in September, with a +0.1% revision to the August estimate. A more closely watched ''control'' sales aggregate excludes sales at car dealers, building material stores, gas stations and restaurants, and focuses on store types patronized by consumers rather than other businesses. Control sales rose an even more hefty 0.7%, with no revision to the August estimate.

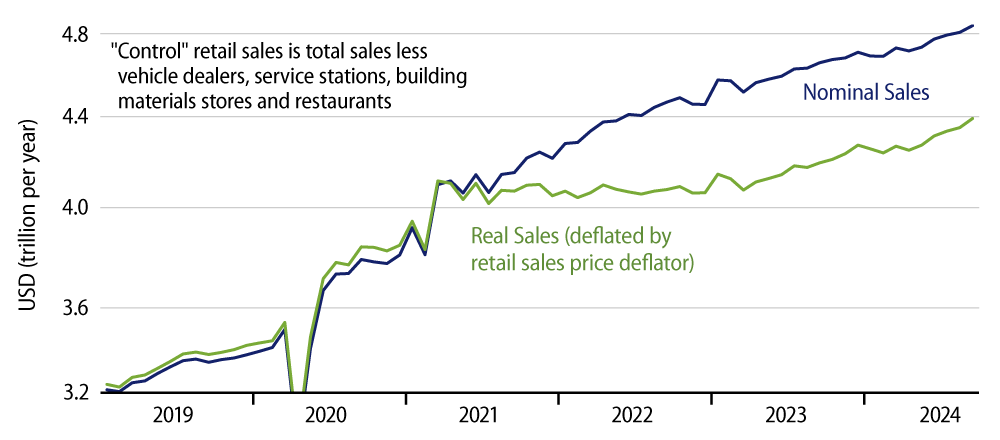

These sales gains translate into very healthy growth rates for consumer spending on merchandise. We have been looking for some softening in consumer spending growth, thanks to slowing job growth, low saving rates and rising levels of household debt, but any such slowing has yet to surface. Indeed, after a rocky start to this year, the pace of sales growth has rebounded nicely since April, as seen in Exhibit 1.

Through spring and summer, sales growth looked to be confined to online vendors, with sales at brick-and-mortar retailers flatlining. Recently, sales have also picked up at warehouse stores (think Costco and Sam’s Club), grocery stores, drug stores and restaurants. While sales gains are largely confined to these sectors, sales have NOT declined elsewhere and, on net, total sales and spending are growing nicely. So, while consumers may be prioritizing convenience (online) and economy (warehouse), there is no sign of an actual pullback; quite the contrary, recent trends suggest otherwise.

So far this month, we have seen readings come in above expectations for job growth, consumer inflation and consumer spending. None of this is suggestive of another aggressive rate cut by the Federal Reserve (Fed) at the next Federal Open Market Committee (FOMC) meeting on November 6. The Fed surprised us last month with an aggressive 50-basis-point cut. In light of recent economic data, if Fed officials are similarly aggressive next month, they will have some 'splainin' to do, barring the economy dropping off a cliff in the meantime.