The Census Bureau’s retail sales report released this morning showed a 0.3% increase in sales in November, partially offset by a -0.1% revision to the October sales estimate. Financial market participants more closely follow a “control” sales estimate that focuses on store types frequented primarily by consumers, that is, headline sales excluding car dealers, gas stations, building material stores and restaurants. That control measure shows a larger gain, up 0.4% in November, although offset by a larger, -0.2% downward revision.

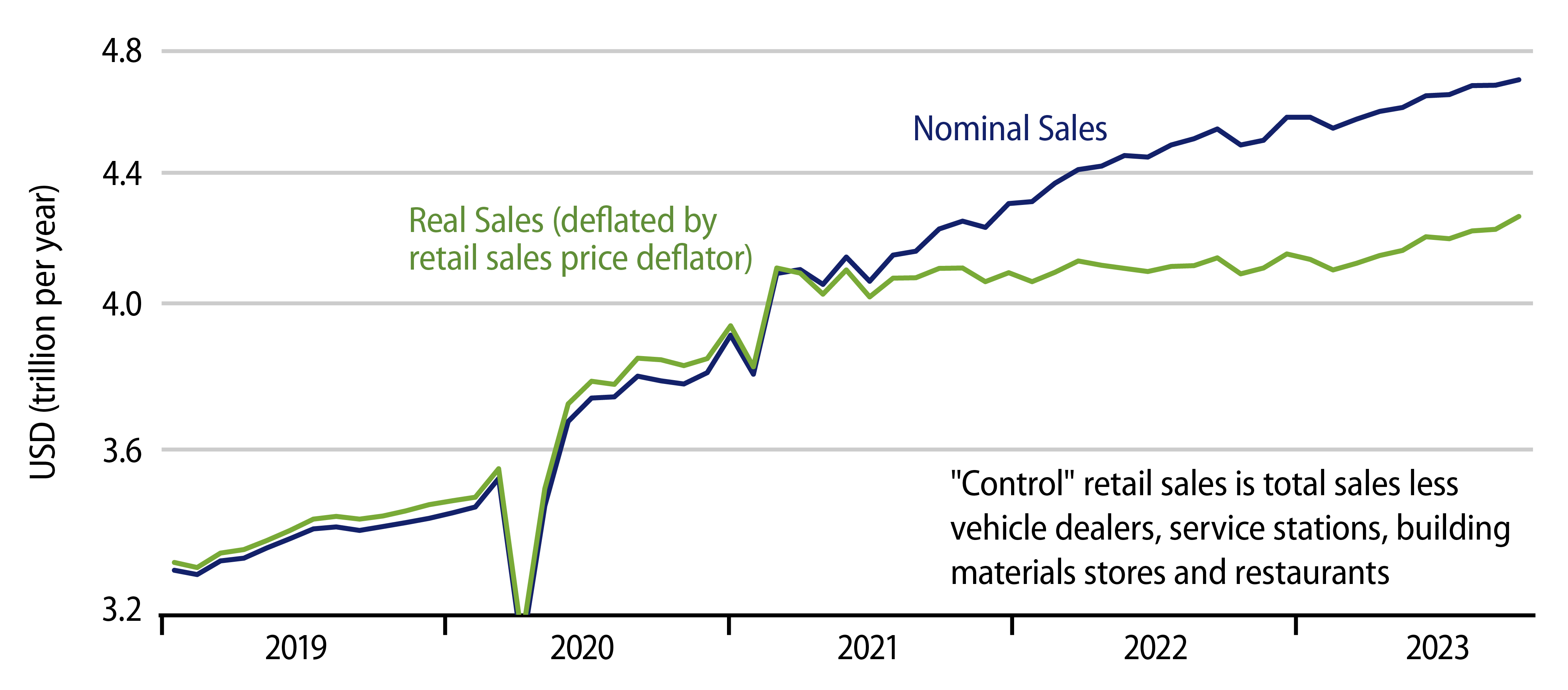

Keep in mind that with goods prices declining in November, according to Consumer Price Index (CPI) data released yesterday, the aforementioned gains in nominal sales understate sales growth in real—or volume terms. As you can see in the accompanying chart, in real terms, control sales continued to grow in November at the same elevated pace seen since June.

After a strong post-shutdown burst through March 2021, sales in real terms basically held flat for the next two years. However, they have resumed growth over the last six months. Ironically, the recent sales growth resurgence has occurred right when job growth and wage growth were slowing. It helps, of course, that goods prices have been declining over recent months.

Nevertheless, the fact that sales growth rebounded in the summer and has continued at a decent pace since then has been a surprise to this analyst and others. It is one of the factors that has caused recession fears among investors to diminish so substantially, recently.

Saving rates have declined sharply this year, consumer borrowing is showing signs of topping out, and credit card delinquencies are reported to be rising. All these factors would lead one to think that the pace of consumer spending growth would flag. Well, there is no sign of that in the retail sales data thus far.

It is the case that the reported retail sales growth is confined to only a few store types, namely online vendors, electronics dealers, drug stores and restaurants. However, online vendors are selling the goods that were formerly purchased at clothing stores, big box retailers, and even groceries, and are gaining market share for these goods types. Thus, data on actual consumer spending show decent growth in real consumption of most types of goods and services. In other words, the apparent softness in sales at the big box retailers and at furniture and clothing stores is likely explained by consumers shifting spending to online vendors.

To repeat, we have been looking for softer consumption growth in line with income, interest rate and bank lending conditions. That forecast has yet to be affirmed.