Headline retail sales rose 0.1% in August as the closely watched ''control'' sales measure rose 0.3%, with both aggregates seeing slight upward revisions to July sales estimates. These gains are not large, but retail prices are generally falling slightly, so the real sales gains were a touch better. More to the point, there has been no visible slowing in retail sales growth to date, despite a slowing labor market and fears that consumers were overextended. In other words, consumer spending appears to have held up through August, despite fears of an impending softening.

Yes, we are among those who thought consumer spending growth would slow. Our take has been that personal saving rates are unsustainably low, while growth in real incomes is slowing alongside slowing job growth. Whatever merits these arguments hold, consumer spending has so far refused to comply.

Sales declined in August at grocery, furniture, electronics, clothing and department stores, as well as gas stations. Furniture store sales had bounced back nicely over April to July after early-year declines, and the August declines offset only a slight portion of the earlier gains. For the other aforementioned sectors, the August sales changes were in line with the previous months’ movements.

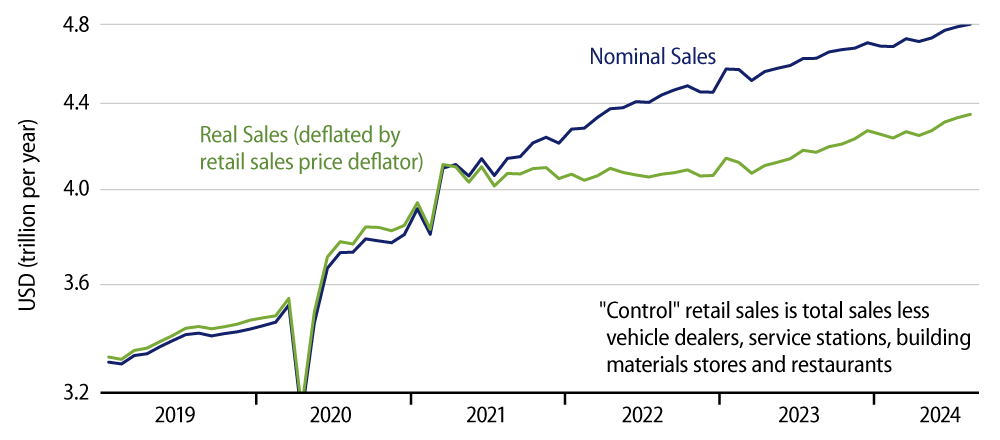

Gains in sales were primarily at drug stores and online vendors. These sectors have supplied most of the sales gains in recent months as well. While the ranks of declining sectors outnumber those of the gainers, keep in mind that online vendors continue to take market share from brick-and-mortar stores, so ongoing softness in real sales at merchant types such as clothing, food and durables stores does not imply declining consumer spending on those items. If nothing else, this can be seen by looking at the aggregate retail sales data, as shown in the chart, and the lack of any recent softening there.

This week, all eyes are turned to the Federal Reserve (Fed) and the choice of whether to cut rates by 25 or 50 basis points (bps). As we have asserted—admitted—before, there is nothing in the current economic data pushing for a 50-bp cut. The case for such a move revolves solely around the fact that the trend in labor markets is for slowing job growth—alongside slowing inflation—and if the Fed wants to prevent those ''downtrends'' from going too far, it should act aggressively now. We’ll see how cogent that argument is when the Fed reports later this week.