Real consumer spending rose 0.4% in July, or at a 4.6% annualized rate. Healthy increases occurred for both goods and services, with real goods spending rising 0.7%—or 9.3% annualized—and services up 0.2%—or 2.4% annualized. Spending gains were distributed relatively evenly across various types of goods and services.

In contrast, personal incomes rose much more slowly, with real personal income up 0.2%, or at a 1.9% annualized rate, and private-sector wage-and-salary income up 0.2%, or at a 2.2% annualized rate. While the income gain was actually stronger than what the payroll jobs report earlier this month suggested—pointing to a -0.2% monthly real decline—the income gain was still much softer than the spending gain, so private saving fell to 2.9% in July. The low this cycle for saving rates was 2.9% in June 2022. You would have to look back to the recession of 2007-2009 to find lower saving rates.

In other words, consumer spending continues to plug along, according to the data, despite moderating job and income growth. We have been expecting some pullback in spending activity, considering the job and income data, but there was no sign of it in the release today.

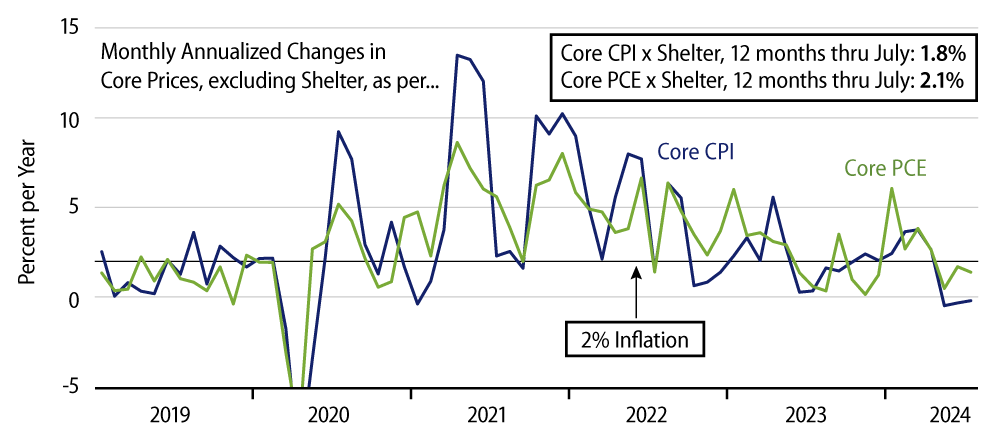

The Personal Consumption Expenditures (PCE) price index inflation data were more in line with expectations. Headline PCE prices were up 0.2% in July, or at a 1.9% annualized rate, while core PCE was up 0.2%, or at a 2.0% annualized rate, and core PCE excluding housing was up 0.1%, or at a 1.1% annualized rate.

It will be interesting to see how the Federal Reserve (Fed) responds to these developments. A September Fed rate cut has already been telegraphed by Mr. Powell and company, and the benign inflation data only strengthen the inevitability of such a cut. Some analysts have predicted a 50-bp cut next month. While the soft July payroll jobs report might support such strong action, consumer spending data don’t. How much the Fed cuts next month—and how strongly it comments on the need for such action—will reflect whether it pays more attention to jobs data or spending data. Of course, next Friday’s payroll report for August will be a factor in the Fed’s decision as well. See you then.