The headline Consumer Price Index (CPI) rose by 0.4%, or at a 4.6% annualized rate in March, according to data released this morning by the U.S. Bureau of Labor Statistics. The more closely watched core CPI also rose by 0.4%, or at a slightly slower 4.6% annualized rate. Within the headline index, energy prices rose a brisk 1.1% non-annualized, while food prices showed zero change after declining very slightly in February.

Within core prices, commodities excluding food and energy showed a slight, -0.2% decline, a return to form after these core goods prices had risen in both January and February. However, the improvement in goods prices was offset by an increase in services inflation. Shelter prices rose 0.5%, sustaining their pace of the last 10 months, while prices of other services rose at a faster pace in March than February.

Shelter remains a major puzzle. A year ago, Fed Chair Powell remarked that market prices for homes and market rents had been moderating since the middle of 2022, yet shelter costs within government’s indices failed to fully reflect this. We expected "reported" shelter costs to decelerate sharply. This has not happened. Over the last 10 months, shelter inflation has been stuck in the 5%-6% annualized range.

For other services, costs of medical and car insurance rose fairly rapidly in March, as did vehicle maintenance costs. These offset moderations in prices for services such as car rentals, airfares, sporting events, and education and communication.

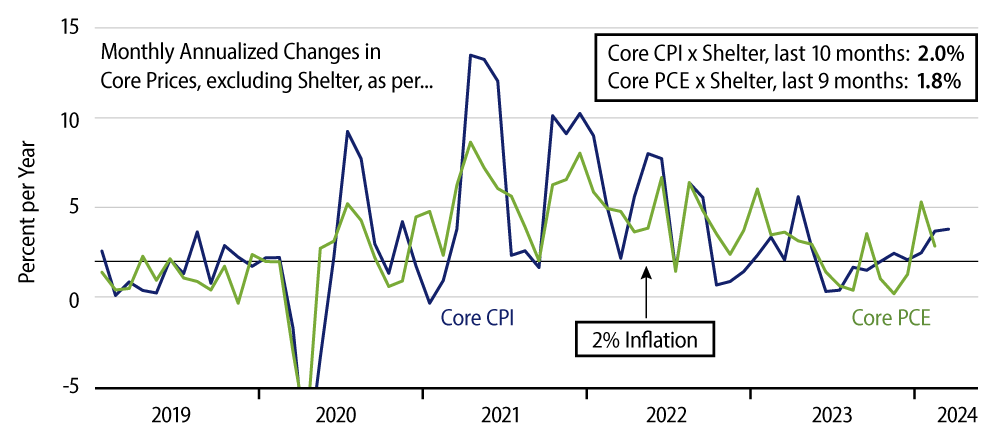

Inflation held at very low rates in the seven months from June through December, but it has bounced in the last three months. In view of Mr. Powell’s remarks about shelter inflation, we have been tracking core inflation excluding shelter (as well as food and energy). The CPI version of that measure shows a 2.0% annualized inflation rate over the last 10 months. The companion version for PCE prices stands at 1.8% for the nine months through February.

Even with the more elevated inflation of the last three months, both of these stand at or below Fed targets. So, a major sticking point for the inflation data is shelter costs. Does the 5%-6% inflation rates for shelter shown by official data really track current realities, or are the near-zero change in home prices and 3% annualized change in rents indicated by real estate markets more accurate?

Meanwhile, of course, even for core inflation excluding shelter to hold at a 2.0% or lower pace, the coming months’ data are going to have to look more like the June-December experience and less like that of January-March.