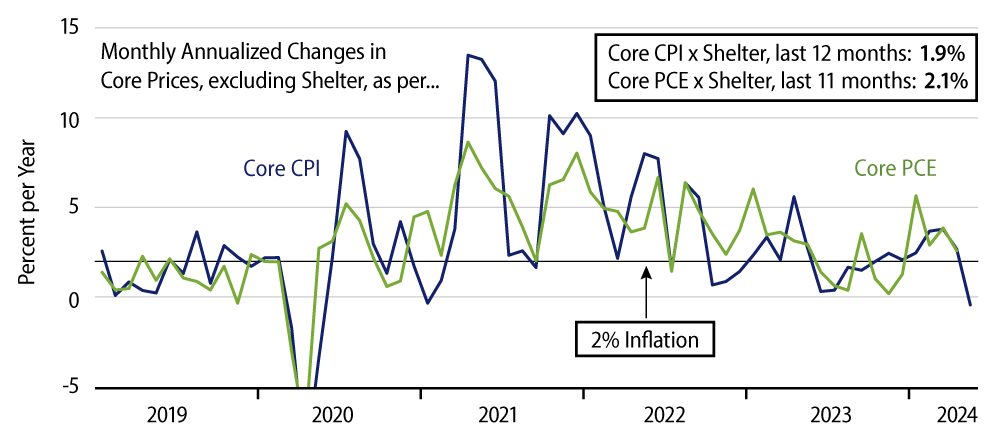

The Consumer Price Index (CPI) was unchanged in May, with core CPI up 0.16%, or at an annualized rate of 2.0%. On a 12-month (year-over-year) basis, core CPI was up 3.4%. Potentially more important was the fact that upon excluding reported shelter costs, core CPI inflation was negative, down -0.2%, or at a -2.6% annualized rate. For the last 12 months, this measure has risen at a rate of only 1.9%, below the 2% target rate.

Granted, the Federal Reserve’s (Fed’s) 2% inflation target officially pertains to the Personal Consumption Expenditures (PCE) index, for which May data won’t be available until late this month. However, as you can see in the chart, the two measures generally move in line with each other, and, if anything, there is reason to believe that core PCE excluding shelter will come in even lower in May than did the CPI measure. This has been the trend of recent months.

In looking at core inflation ex shelter, we are only following the lead of Fed Chair Jerome Powell. Over a year ago, he pointed out that technical lags in the data were causing reported rates of increase in shelter costs to far exceed what was occurring in the housing market, so that a ''super core'' measure, or core inflation ex shelter, would be more relevant. Such a super core inflation measure is what we reported in the second paragraph here, what is shown in the chart, and, again, what has been right in line with the Fed’s targets for a full year now.

It is the case that private-sector analysts have typically interpreted super core inflation as pertaining to services, as Mr. Powell acknowledged a year ago that goods prices were already under control. Still, again, overall super core—both goods and services—would be more consistent with the Fed’s overall inflation focus. Even so, it is noteworthy that super core services inflation itself came in negative in May, declining -0.04%, or at an annualized rate of -0.5%. Those reported declines in non-shelter services were paced by substantial declines in car rental rates, airfares, video fees and legal fees.

It is unlikely that prices for these services will continue to decline. Still, again, the pace of inflation on average has remained low for a full year now.

As for shelter costs, the May CPI report had them increasing at a 4.8% annualized rate for tenants’ rents and 5.3% for homeowners. These may be showing a grudgingly slow decelerating pace. For reasons known only to government statisticians, they continue to come in much higher than the trends for rents and home prices that have been in place for more than two years.

Now, Fed officials other than Mr. Powell have been complaining that inflation was stubbornly high. It would seem they are not minding their chairman’s own advice.

Today’s inflation news should put a possible Fed rate cut back in play, even for those fixating on reported shelter costs. While the labor market hasn’t clearly weakened ostensibly, the pace of job growth is merely in line with what we were seeing in the non-inflationary pre-pandemic economy, and unemployment is rising, if only modestly. Meanwhile, consumer spending, home sales and factory activity are all suggesting softening growth. And with inflation within target ranges for a full year now upon abstracting from possibly misleading shelter costs, the Fed has a mouthful to chew on.