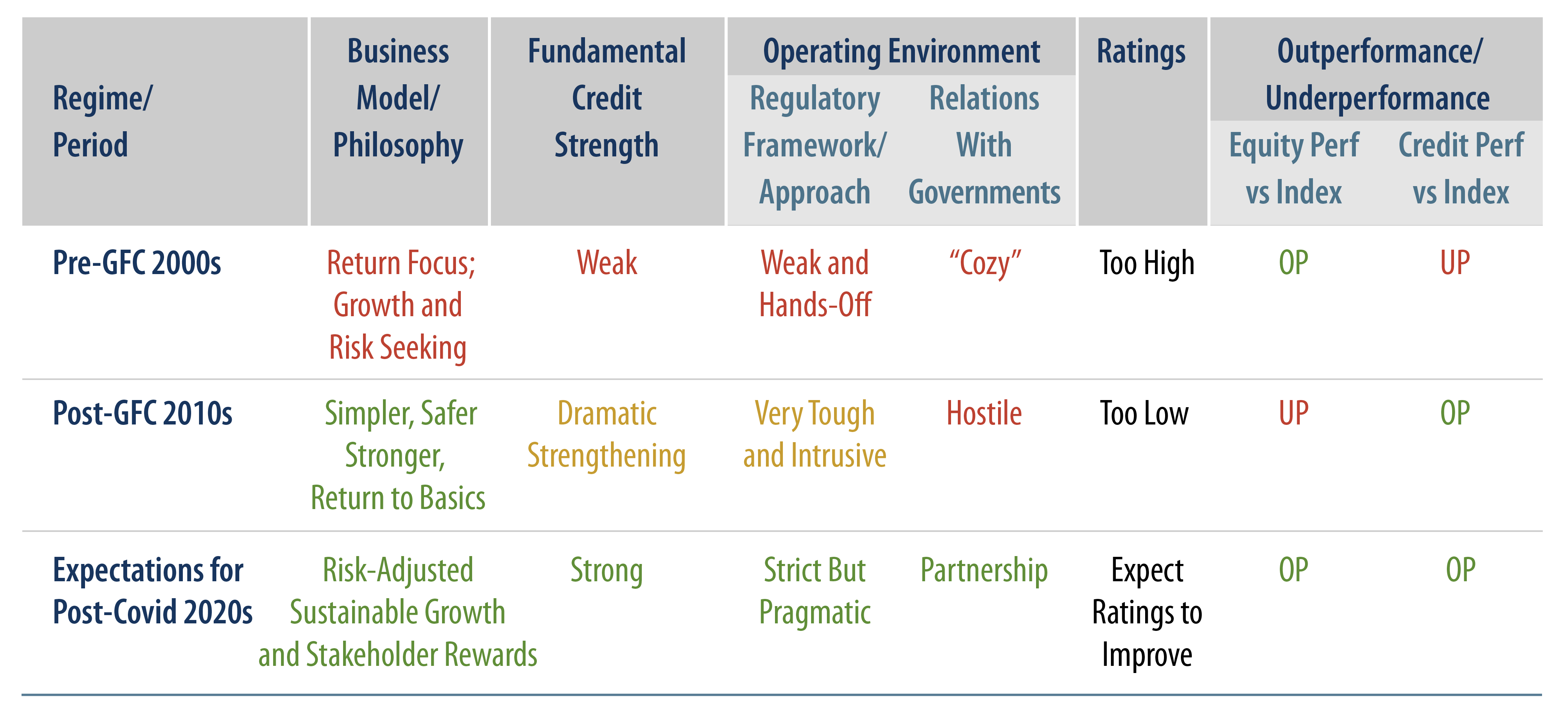

The global financial crisis (GFC) exposed the former banking business model as high-risk and unsustainable based on weak balance sheet fundamentals, primitive risk management and inadequate regulation. The subsequent decade of lackluster economic growth in the US and Europe provided very expensive lessons that forced regulators, politicians, rating agencies and investors to de-risk a dangerous and broken business model. Investors and regulators learned the hard way that scale, diversification and big acquisitions were false safeguards against systemic banking system problems. Despite the banks completing a decade-long de-risking journey, most market participants remained skeptical of how the new business model would fare in a sharp, unanticipated global economic downturn. Against this widely held view and the emerging COVID-19 pandemic, we presented our perspective in March 2020 that banks were likely to fare better in global downturn than the market expects, and explained why we believed that the market underestimated the resilience of the post-financial crisis business model. Looking back over the last 15 months, it is clear that banks fundamentally outperformed even the most optimistic expectations. Looking forward, we believe that banks are in a fundamentally strong position for future outperformance.

Lower-Risk Business Model and Revamped Regulatory Framework Support Credit Profiles

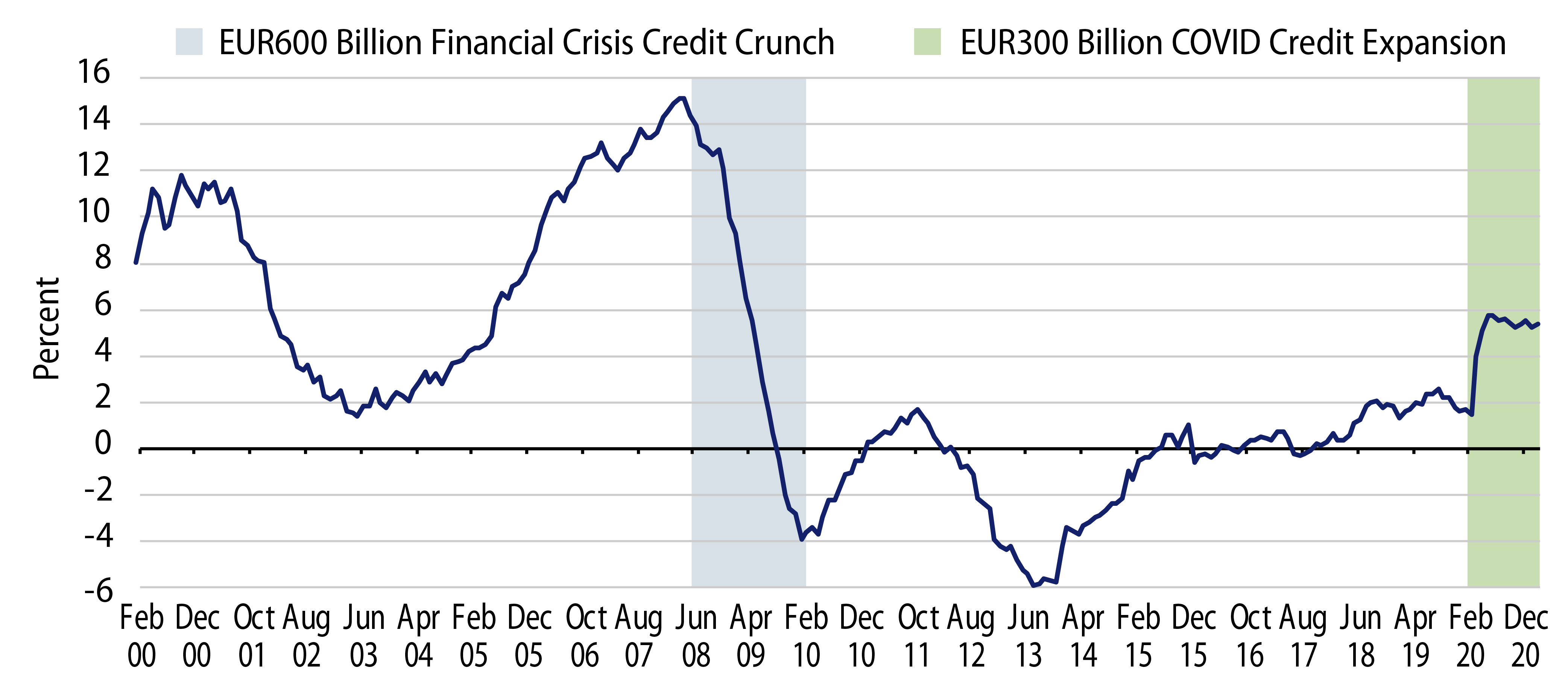

In the decade following the GFC, banks dramatically increased their capital levels and liquidity cushions to record levels and de-risked their funding profiles. We continue to believe that bank collapses are generally traced to four problems: (1) excessive credit growth, (2) overreliance on wholesale funding, (3) overpriced transformational acquisitions and (4) unethical and high-risk behavior. Led by Dodd-Frank and the DoJ, regulators have levied massive fines and established a comprehensive maze of new and tougher rules and requirements since the GFC. Fortunately, none of these pre-conditions for future banking problems were present when the pandemic-induced economic shock hit since the banks were forced to adopt the historical banking basics built on conservative underwriting and maintaining low costs (e.g., operating, credit, funding and litigation). We believe that the strong fundamental performance of banks during the pandemic has highlighted the benefits of a low-risk, financially sound and tightly regulated banking system for both internal and external stakeholders.

Banks Have Been Transformed From “Causing a Crisis” to Becoming “Part of the Solution”

Over the past decade following the GFC, banks have been rebuilding their beleaguered reputations and unhealthy relationships with customers, regulators and governments. We expect to see more constructive and pragmatic relationships between banks and their regulators, and possibly also governments. We believe that banks strengthened these fragile relationships during Covid in three important ways: (1) extending credit/preventing a credit crunch, (2) quickly and efficiently disbursing government funds and (3) supporting customers through various forbearance programs/payment holidays. Regulators shifted their focus from letting market forces regulate the system to creating a financial system with the following goals: stay out of trouble, avoid a repeat of the need for taxpayer-funded bailouts and shift future losses to investors. We believe that this mutually beneficial partnership approach will enable banks to play an important role financing the green transformation and create a more sustainable economic system. This approach should also decrease the risks of digital disruption or major “forced” changes on the banking system.

Investment Implications

We believe that banks will emerge from the Covid crisis with a stronger credit profile despite the transitory profit impact in 2020. We expect US banks to possibly surpass record profits in 2021 with the strongest balance sheets in recent history. Recent US stress tests show the regulators’ confidence in the system and the regulatory response in Europe—aimed at freeing up bank lending capacity—highlights a more pragmatic, partnership-based approach with banks. The crisis response also provided clear evidence of the dominance of debt DNA in even the most junior capital instruments which continued to pay coupons to investors while shareholder distributions were severely limited. Following significant outperformance since the GFC, we maintain a constructive investment thesis and currently favor an overweight across the capital structure for the strongest US and European banks based on improving fundamentals, credit rating upgrades, benign technicals and reasonable valuations.