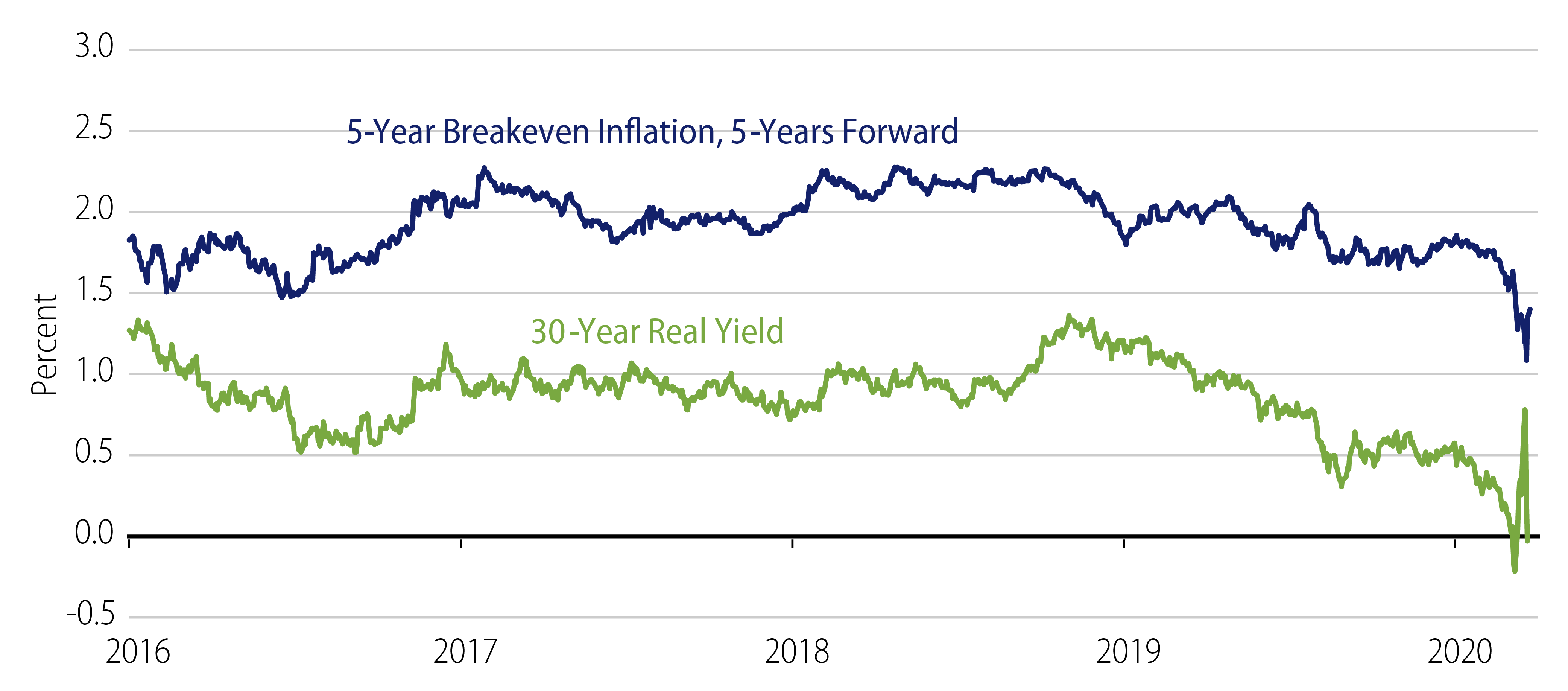

Since the beginning of the year and with the onset of the global coronavirus outbreak, inflation expectations have plummeted (Exhibit 1). This is due to concerns over falling global demand as business activity is at a standstill with people throughout the world hunkering down to avoid COVID-19 infection, and an unexpected price war between Saudi Arabia and Russia that has caused the spot price of crude oil to collapse. While both the coronavirus and the oil price collapse are deflationary events for 2020, we believe they will likely have much less impact on future years. Oil prices are unlikely to fall from their current levels as much as they have fallen recently. In fact, oil futures are now implying higher energy inflation in one to five years’ time than it was earlier this year, when oil futures were in backwardation. This implies that the drop in core inflation expectations has been even sharper than the drop in total inflation.

While no one has a crystal ball to predict accurately the length and severity of the current downturn, or to be sure what inflation will be in five years, it seems unlikely that the market has permanently changed its view that future inflation will be substantially lower over the longer term. Recent measures by the Federal Reserve and Treasury have caused a substantial bounce in long-term breakeven inflation rates, though they remain below pre-OPEC+ collapse levels.

Exhibit 2 illustrates the enormity of the decline in breakeven inflation rates. Breakeven inflation is the difference in yields between a nominal government bond and an inflation-linked security of the same maturity—it’s the inflation rate you need to break even between either investment.

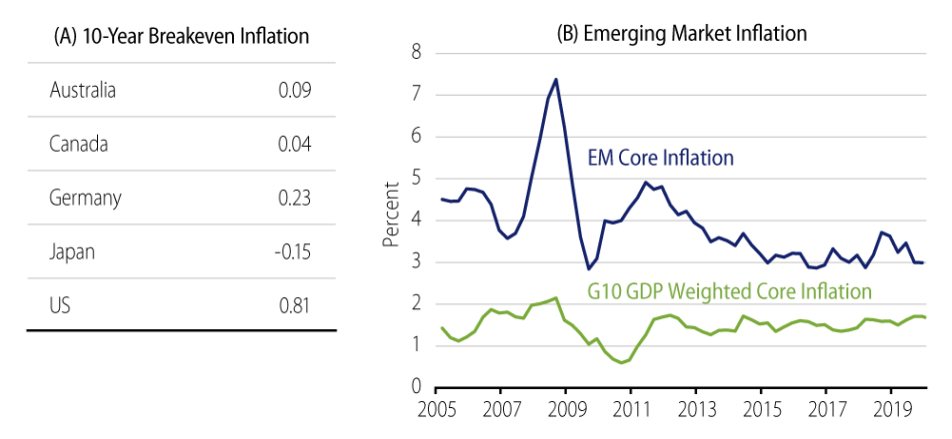

The line chart on the right-hand side of Exhibit 2 makes the point that the interest rate decline we’re seeing is occurring in an environment in which inflation was already very, very muted all over the world.

The table on the left-hand side indicates the inflation rates that you would need to see over the next 10 years in order to justify the investment in long-term bonds. These are at spectacularly low levels.

From an investment standpoint, these breakeven inflation rates represent the expected inflation in each of these countries going forward for the next 10 years. To place into context, these inflation rates are lower than any experienced after the Great Depression in these countries.

Think about that for a moment. These breakeven inflation levels mean that going forward, the market expects inflation lower than anything we’ve ever seen that will persist not just for a year or two but for over 10 years. It’s indicative of the market’s concern that policymakers around the globe are completely incapable of practically ever achieving any uptick in inflation again. It reflects incredible pessimism about both growth and inflation for a very long period of time.

At Western Asset, we take the other side of this trade. We recognize that the impact of COVID-19, both in human and economic terms, is immense. However, we view the virus as an exogenous shock to the system that will run its course, however painful that may be, and then dissipate.

While the contours of the eventual recovery are not known, we suspect the economy will recover from this shock as people come out from quarantine, businesses reopen and travel normalizes. Inflation may remain subdued relative to historic levels, but should move above the levels implied by current breakeven inflation rates once it becomes apparent that economic recovery has begun. As such, we have added modestly to long-dated inflation-linked securities in appropriate strategies given both the fundamentals—our expectation of higher inflation post-coronavirus—and today’s compelling valuations of inflation-linked securities.