In light of the recent announcement that Fitch Ratings downgraded the United States of America's Long-Term Foreign-Currency Issuer Default Rating from AAA to AA+, it’s worth recapping how money market fund (MMF) ratings typically work. Most MMFs are rated AAA by the nationally recognized statistical ratings organizations (NRSROs), or rating agencies, and we think those ratings are unlikely to be impacted by this news.

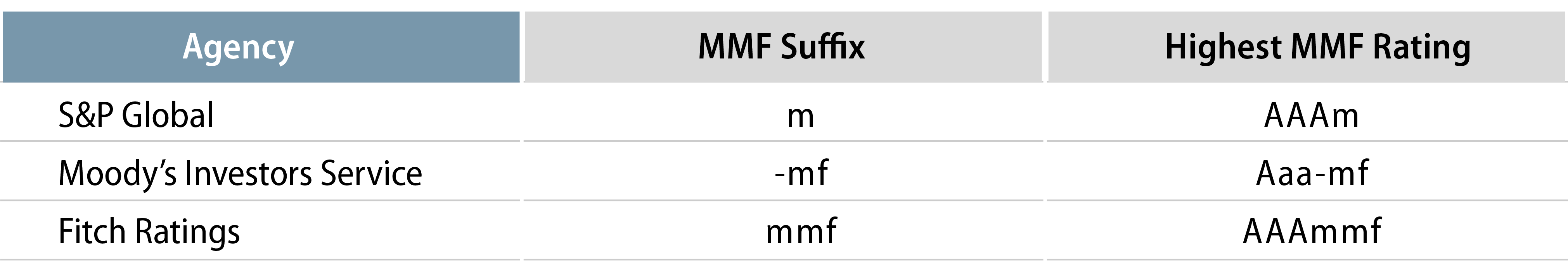

For MMFs, a rating is a forward-looking opinion about the overall risk profile of a fund. It reflects an agency’s views of the principal stability of a fund, the credit risks of its portfolio investments, the level of counterparty risk, as well as its liquidity and the risk of a fund manager’s ability to maintain a fund’s current credit quality. Unlike traditional credit ratings (e.g., issuer credit ratings), an MMF rating does not address a fund’s ability to meet payment obligations and is not a commentary on yield levels. This differentiation is highlighted by a suffix to the rating that indicates it is for MMFs only. The suffixes are specific to each of the three leading NRSROs that provide MMF ratings today (Exhibit 1).

The agencies differ in their methodology of assigning MMF ratings but will generally consider one or more of the following criteria, which are reviewed through a process of continual monitoring and engagement with a fund’s management team:

Principal Stability: The ability of the MMF’s portfolio to maintain principal stability is a key consideration, in combination with an assessment of the likelihood of principal loss. This is a key investor benefit for MMFs which, through existing regulatory frameworks such as in the US and EU markets, are often able to offer NAVs that maintain constant or stable prices, or that feature very low NAV fluctuations.

Portfolio Credit Risk: A quantitative assessment of the MMF’s portfolio credit risk may also reflect the weighted-average credit risk of its portfolio of investments, including those made through repurchase agreements.

Aggregate Credit Risk and Maturity Assessment: The MMF’s credit risk may be weighted by the aggregated percentage of investments held at each rating level and is further differentiated by remaining maturity. Historical default and transition data of long-term and short-term ratings can also be integrated at this stage.

Interest Rate Risk: Agencies will often estimate the MMF’s expected sensitivity to changes in interest rates, including “shocks” under certain extreme conditions.

Liquidity: The ability of the fund to provide shareholders a high level of liquidity, usually through redeeming their positions the same day, and under both normal and stressed market conditions.

Peer Group Comparison: A comparable rating analysis and contrast is performed on the fund with other funds that have a similar portfolio strategy and composition. This is designed to take a holistic view of the MMF portfolio’s credit quality and characteristics relative to its peers.

It can be seen from these steps that the specific rating, or MMF manager’s assessment of a single issuer, is only a small component of an agency’s decision matrix that drives the overall rating for individual MMFs. As such, a one-notch downgrade for US sovereign debt—with all else remaining equal—is unlikely to result in a negative change to MMF ratings, even for Treasury and government MMFs where the US government makes up a large portion of the issuer exposure of the fund.