New orders for durable manufactured goods declined by -5.4% in October, with the September orders estimate revised down by a substantial -0.5%. Usually when durables orders swing down or up by such a large magnitude in one month, the swing is dominated by downs or ups in aircraft orders. This was indeed the case with today’s release, with orders for nondefense aircraft plunging 50%.

Net of aircraft and other transportation equipment, durables orders were unchanged in October from a September estimate that was revised down by -0.3%. This is not a strong showing, but it is not as decidedly weak as the headline number would suggest.

As for the aircraft sector, the October decline merely offset a similarly sized September increase. Thus, the October orders level for aircraft is largely in line with prevailing levels of this year. The September orders spike was preceded by an even larger gain in June. Aircraft orders tend to come in “lumpy,” such as we have seen this year. Such order spikes are then filled over the next few years in a smoother manner.

Actual shipments of nondefense aircraft have been trending lower over the last five months, presumably still reflecting a dearth of orders during the pandemic years. This year’s spikes in aircraft orders will help steady actual aircraft production (and shipments), but likely not for a while yet.

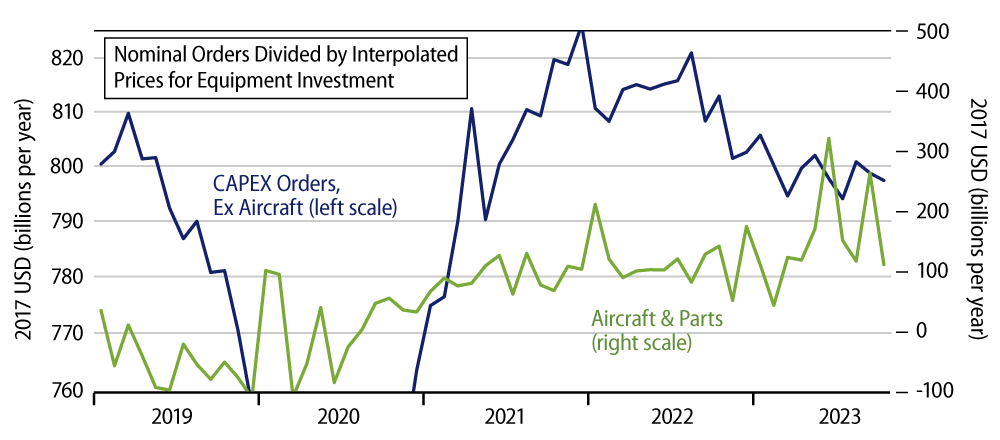

An important component of durables orders (ex. transportation equipment) is orders for nondefense capital goods excluding aircraft. That aggregate showed a slight, -0.1% decline in October, though the September estimate was revised substantially lower, by -0.6%. The accompanying chart shows our estimates of real orders for nondefense, non-aircraft capital goods, as well as repeating the aforementioned data for aircraft. (While prices for most goods in the US are declining, those for equipment are still rising slightly, thus we’re seeing a somewhat larger October decline for real CAPEX orders than was indicated by the -0.1% drop in nominal data.)

As you can see, these have been declining substantially for the last 14 months, as higher interest rates have cut down domestic demand for new equipment and as economic growth has foundered abroad. The Fed’s hiking regime has not (as yet) sunk the overall economy, but there have been pockets of response to the higher rates, and equipment investment has been one of them.

We should remark that investment in high-tech equipment continues to hold up relatively well, and as we have reported previously, the surge in the last year of construction of new manufacturing plants has held up business investment in structures. Still, there are pockets of softness within business capital spending, and investment in “traditional” equipment has been one of those areas.

Indeed, the manufacturing sector in general has been in a state of modest decline for the past year plus, and the ongoing flat trend in overall durable goods attests to this. Manufacturing output is not declining dramatically, as it would during a full-blown recession. However, the rebound in factory output we saw coming out of the pandemic ceased around May of last year, at least it did for the 90% of US manufacturing not involved in high-tech or motor vehicles.

We are closing in on 10 years of producing these posts. Thanks to all our readers for following our commentary, and a most Happy Thanksgiving and gratitude to everyone in our global community.