In the first half of 2025, emerging market (EM) corporates demonstrated notable resilience amid persistent volatility driven by global trade policy uncertainties and ongoing geopolitical conflicts. The JPM CEMBI Broad Diversified Index returned 4% year-to-date (YTD), with spreads widening by 15 basis points (bps) to 221 bps and the overall yield ending at 6.3%, as of June 30. Investment-grade corporates outperformed high-yield credit, returning 4.1% versus 3.9%, respectively.

Regionally, Europe led with a 4.8% return, while Asia and Africa posted slightly lower returns of 3.9%. At the sector level, metals & mining and pulp & paper were the top-performing sectors, returning 5.1% and 4.9%, respectively, while oil & gas and transport lagged, reflecting the impact of trade tensions and geopolitical events. EM corporate spreads were volatile, starting the year in the low 200s and widening to as much as 280 bps in mid-April before retracing to the low 200s by the end of June. Despite weak flows into EM hard currency funds, the new-issue market remained robust, buoyed by strong demand from global investors.

Looking ahead, several key themes are likely to shape EM corporate performance. US trade policy remains the most significant driver as investors closely monitor tariff developments and policy signals from Washington. Uncertainty about whether the US government will roll back or extend recently announced tariffs and how these decisions will affect major EM economies such as India, China, Brazil and Mexico persists.

A notable example is the potential introduction of a 50% tariff on copper imports, which could have far-reaching implications for the global copper industry. Within EM, Peru and Chile—both major copper exporters to the US—would be directly impacted, as metals & mining represent a substantial share of their economies. At this stage, it remains unclear how the US intends to implement the tariff, or whether certain products or countries might be exempted.

Geopolitical risk also remains a central concern, as EM economies are highly sensitive to secondary effects such as commodity price swings driven by global uncertainty. While tensions in the Middle East have eased, the risk of renewed volatility persists. Politically, 2025 has been relatively quiet for EM elections, but notable events planned for the second half of the year include Argentina’s senate race in October and Chile’s presidential and senate elections in November.

EM local debt technical factors have strengthened, supported by stronger foreign exchange (FX) and yield compression. EM local mutual funds have seen $1.7 billion in inflows YTD, while external bond funds have experienced $8.4 billion in outflows so far this year. Importantly, crossover investors—global funds not dedicated solely to EM—are increasingly stepping in to support new issuance, offsetting the retreat of traditional EM buyers.

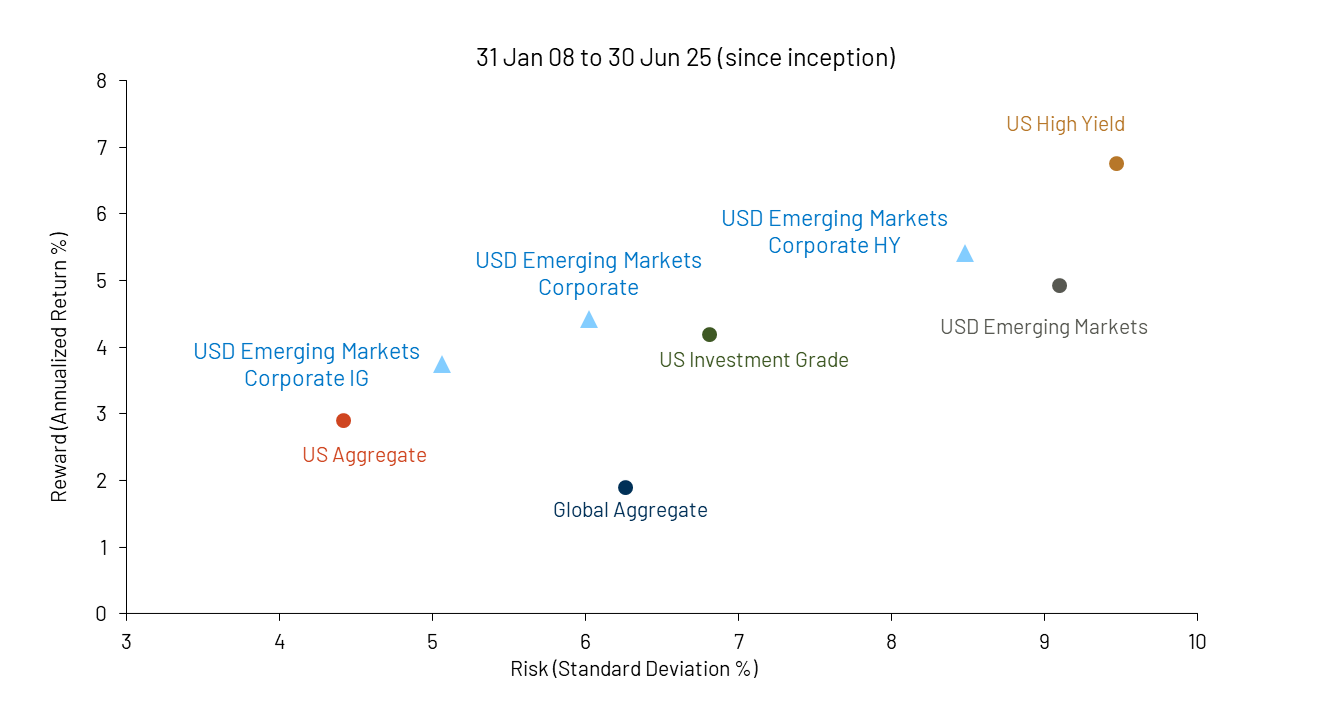

Our investment focus will be on issuers and sectors most exposed to shifts in US trade policy, with particular attention to Latin America, which stands to benefit from its strategic position between the US and China. While EM corporate valuations currently appear rich relative to other non-EM spread sectors, we continue to identify what we believe are attractive opportunities and compelling idiosyncratic stories. EM corporate balance sheets remain robust in our view. As a result, we expect the asset class to deliver strong risk-adjusted returns and a meaningful yield premium over developed market (DM) credits in the second half of 2025.

In Closing

We view the EM corporate sector as a dynamic extension of the DM credit universe that has the potential to deliver higher yields and powerful diversification benefits than DM assets alone. The EM corporate landscape is home to many world-class companies that remain underrepresented in traditional DM credit indices and offer investors unique opportunities for alpha. The market’s momentum is clear: according to JPMorgan, the investable USD-denominated EM corporate bond universe has surged to $1.2 trillion, up from $800 billion just 10 years ago. Meanwhile, the investor base is rapidly evolving, with a vibrant and growing domestic community joining what was once a predominantly foreign investor pool. We believe that this expansion and diversification will continue to drive compelling opportunities in EM corporate debt.