Over the last six months, we’ve seen extensive media coverage of the potential valuation impact of tariffs, a stronger US dollar (USD) and higher US interest rates for emerging markets (EM). Despite the noise, EM delivered a respectable year of performance in 2024, led by frontier markets. The only outlier was EM local debt, which underperformed its EM hard currency peers due to fewer central bank rate cuts and higher-than-expected exchange rate depreciation across key EM countries, driven by the sustained strength of the USD. As we look ahead, it’s worth noting that factors beyond the Trump agenda and US macro forces are developing, which could set the stage for EM to deliver the type of performance comeback that earned the asset class its mainstream appeal in global and multi-sector bond portfolios.

Factors to consider include:

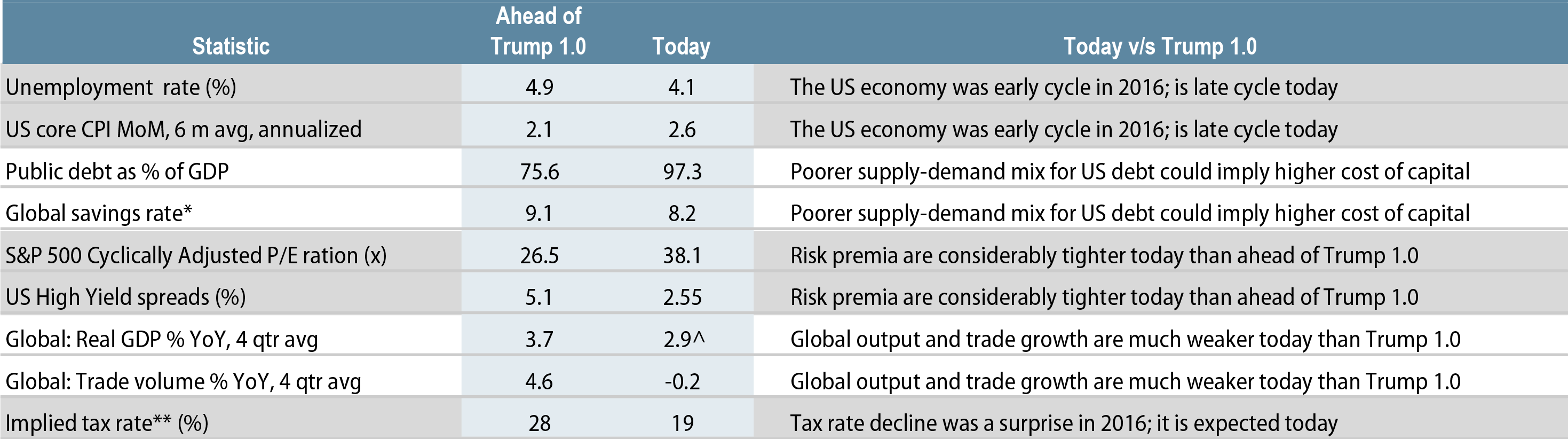

Plenty of Pessimism Priced In: EM assets have already priced in a lot of pessimism. Exhibit 1 shows that we’re in a much more fragile place today compared to 2017 when Trump first came into office. This time, EM foreign exchange (FX) and rate markets may struggle even more, but FX and rate levels across key countries such as Mexico, Brazil (mainly fueled by fiscal concerns) and China (mainly fueled by fears of a trade war exacerbating domestic woes) have materially readjusted over the past months in anticipation of more Trump-related turbulence. Given that backdrop, what else should investors consider?

Limited EM “Blowups” Expected: Over the past few years, many EM countries have been cautious not to expand their external, hard currency debt obligations in the face of rising US interest rates, volatile commodity prices and a stronger USD. Moreover, countries with strong capital market access took advantage of the low-interest environment since 2009 to refinance debt at lower coupons. As such, it will take more time and consistently higher yields to significantly move coupons higher. As a result, EM countries exhibit more stable fundamental profiles supported by lower leverage, stronger private sector balance sheets and limited external borrowing needs. This stability has led to double-digit rating upgrades and more positive rating outlooks over the past year. According to JP Morgan, only 12 names within their EM index universe have spreads north of 1,000 bps; if we concentrate only on the performing credits, the number shrinks to five (Ecuador, Ukraine, Bolivia, Maldives and Belize).

EM Technical Positioning Appears Primed for a Bounce-Back: Net portfolio flows to EM have been negative since 2018 and worsened post-Covid. Market expectations are for another tepid year of EM bond flows given uncertainty around US rates and idiosyncratic headline risks. However, we would note that the net supply of EM sovereign and corporate paper is forecast by JP Morgan to be lower this year compared to 2024 due to rising amortizations—a positive market technical. Additionally, we shouldn’t discount the possibility of key catalysts that could reignite investor flows back into EM. These include a reversal of the US exceptionalism narrative, a surprise decision by Chinese authorities to pursue a significant stimulus package or a Trump tariff agenda that ends up being much more watered down than initially expected.

EM Comebacks Do Not Need a Green Light From the US: It’s important to remember that the EM asset class comprises countries from different regions with varying balance sheet strengths, regulatory regimes, debt profiles and sociopolitical risks. Frontier markets take these diverse risk factors even further due to their lower sensitivity to US interest-rate changes or tariff-related risks. Therefore, investing in EM shouldn’t be fully predicated on developments in the US.

At present, all-in yields on EM sovereign and corporate debt appear to be attractive relative to other classes such as US credit. In the EM local debt space, we do acknowledge that the prospect of fewer developed market (DM) and EM central bank rate cuts and a stronger USD will weigh on EM FX and rates markets. With Trump poised to enter the White House on January 20, markets will be on edge, and rightly so given the market volatility observed during Trump’s first administration. However, we believe the EM asset class has discounted plenty of the potential headline risk. This, combined with much cleaner technical positioning and resilient asset class fundamentals, supports our view that EM should continue to perform well, driven by high carry and the potential for strong outperformance in the near term on any positive surprise regarding the new Trump trade policy, economic stimulus from China or a reduction in geopolitical tensions. Conversely, any downside surprises that trigger a meaningful repricing of the asset class likely would represent a prime buying opportunity for EM credit and select FX and rates plays.