Responsible investing, when combined with strong performance, is a powerful way to impact society while meeting investors’ specific goals. It can be a true win-win situation.

Environmental, social and governance (ESG) factors are most often cited as the criteria for socially conscious investors to assess potential investments. Typically, corporations are judged on their ability to improve upon or mitigate environmental impacts, foster a healthy society or exemplify fair and transparent managerial practices. While these criteria are often applied to equities or corporate bonds, we strongly believe that the municipal bond market offers a natural fit for responsible investing.

Municipal bonds form the cornerstone of infrastructure investing in the US. Moody’s reports that over $800 billion of municipal infrastructure debt is outstanding, much of it dedicated to funding environmentally sound projects including efficient, renewable power resources, clean water, sustainable waste management and eco-friendly transportation systems. Officially designated as “green bonds,” this important subset of infrastructure debt targets climate change mitigation and is becoming a fixture in the marketplace. According to the Climate Bonds Initiative’s 2018 Green Bond Market Summary.

Global issuance reached $167 billion in 2018—a 15-fold jump since 2013. Last year 20% of that total flowed from the US; looking ahead, the municipal market is expected to play a leading role in this sector’s growth.

Municipal bonds are also instrumental in financing social infrastructure. Very often, every time a school is built, affordable or senior housing developed, or a university or not-for-profit hospital project completed, municipal bonds are employed. In 2018, $134 billion of debt was issued for these purposes, per Bond Buyer’s annual publication of market statistics. Not only does the goal of the project itself contribute to the social good, but so do the rules and regulations governing labor relations, which promote fairness and diversity among project contractors.

Analysis of governance plays a critical role when investing in the corporate and municipal worlds. Policies and regulations implemented by city councils or non-profit boards can be measured for effectiveness in promoting transparency and stability. Most governmental entities provide regular disclosures and timely audits as required by the Municipal Securities Rulemaking Board (MSRB); non-compliance is publicly reported. Employment and financial policies are routinely disseminated to the public. Citizens’ groups overseeing government practices from small villages to the largest cities provide checks on management. Ultimately, governance is judged by the public through voting power. The public nature of municipalities within the US enables a clear assessment of governance-related risks.

The Western Asset ESG Assessment

While many municipal bonds would be appropriate for ESG-focused portfolios, some debt issuances would be inconsistent with those goals. Western Asset has developed an approach to assessing the appropriateness of a municipal bond as an ESG investment that we believe is consistent, easily applied and eliminates the need for value judgements which reasonable people could easily disagree on.

Western Asset’s approach focuses on the use of proceeds for a particular issue. If proceeds are clearly used for the public good, whether it is for environmental or social needs, then the issue is deemed to have passed one prong of our process. In the case of a public utility offering electric service, consideration is also given to the size of the utility’s carbon portfolio. Governance factors are then measured, using ratings as a proxy for effectiveness. In addition, our criteria allow an analyst to use judgement in the case where it is commonly known that a particular bond issuer is a “bad actor” or particularly ineffective despite the use of proceeds and ratings.

Bonds are then scored using an internally developed scale. A bond must meet a minimum threshold to be considered acceptable for an ESG portfolio.

Western Asset recently applied these objective criteria to a portfolio of 800 holdings. Eighty-five percent of the issues were found to be compliant with our criteria, while the remaining 15% were not, supporting the concept that municipal bonds are a natural fit for ESG portfolios.

ESG Portfolio Impact

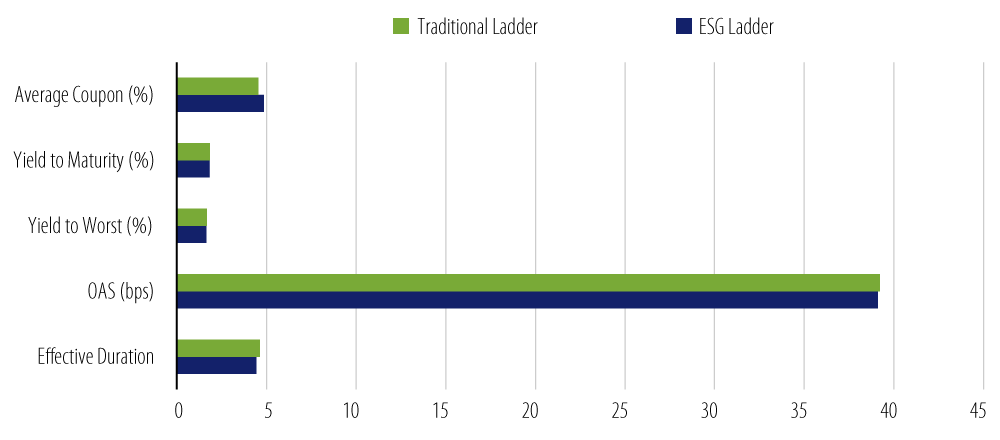

One concern an investor in an ESG portfolio may have is the effect on composition, ratings and, most importantly, returns. While many municipal bondholders are attracted by tax-exempt income, the opportunity to support the public good is an added bonus—as long as returns and portfolio metrics are not negatively affected. Western Asset constructed sample ladder portfolios (that each comprises a number of smaller bonds with varying maturity dates), ESG-focused versus traditional, to assess the impact of a targeted portfolio. As can be seen in Exhibit 1, yields and spreads were within 2 to 3 bps of each other.

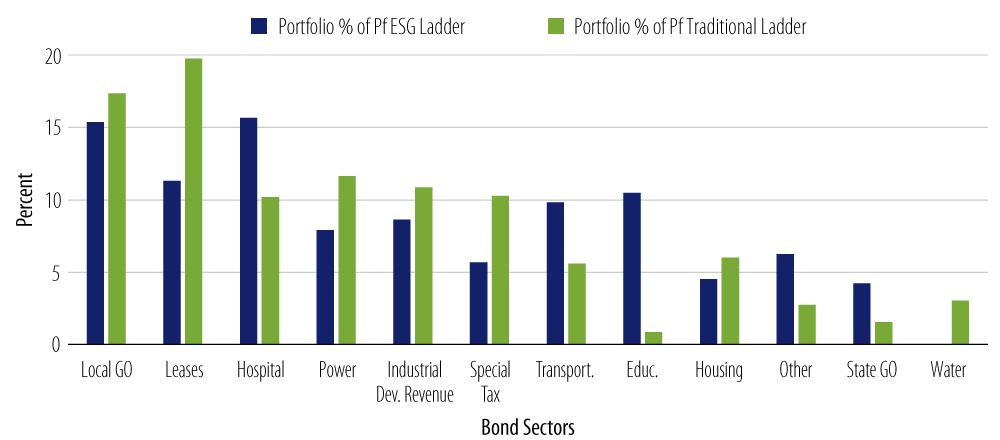

As shown in Exhibit 2, portfolio compositions shifted somewhat with more emphasis on healthcare, transportation and education; however, the number of holdings only differed by one. The ESG portfolio is actually more diversified by sector than the traditional ladder.

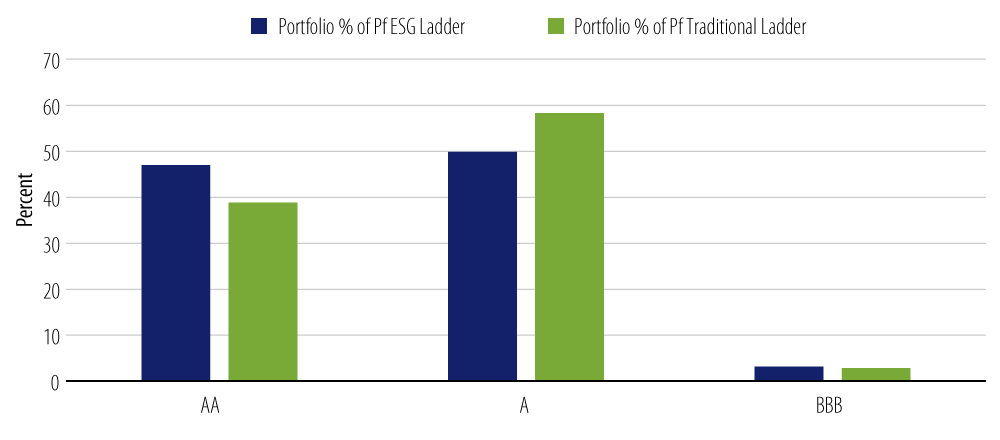

Finally, as you can see in Exhibit 3, rating quality actually improved, with a larger AA component in the ESG portfolio. Positively, this was accomplished without sacrificing yield.