At the National Association of Insurance Commissioners’ (NAIC) Summer 2021 National Meeting, the Risk-Based Capital (RBC) working groups for P&C and health insurers both adopted their respective proposals for new bond-level factors.1 The adoption of these new bond factors parallels work already completed by the life insurer RBC working group, and the new factors will go into effect at the end of this year. Essentially, these new factors in almost all cases are more punitive to health and P&C insurers than are the existing factors. In the following, we show a comparison of the current factors and the new factors, and provide some brief comments about how this will change the investment allocations for these insurers going forward.

New Factors

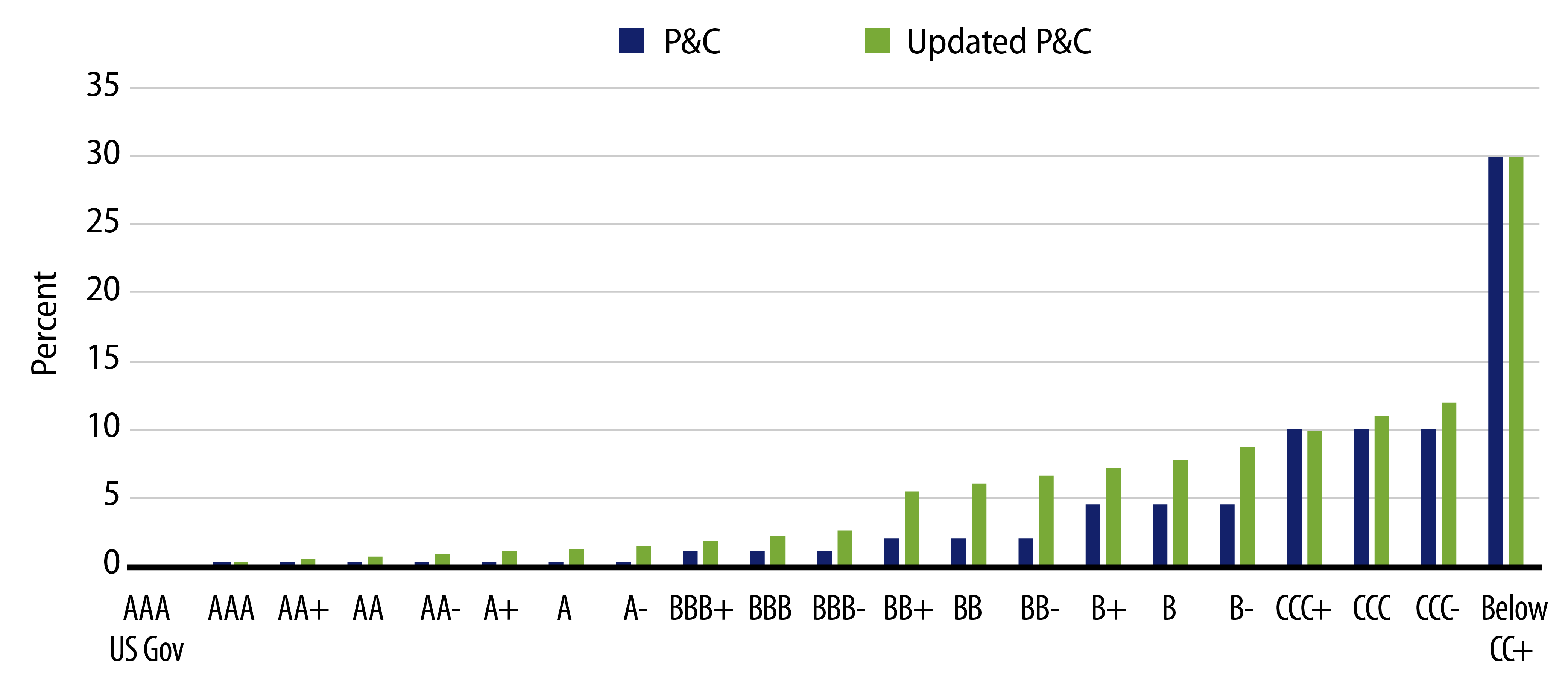

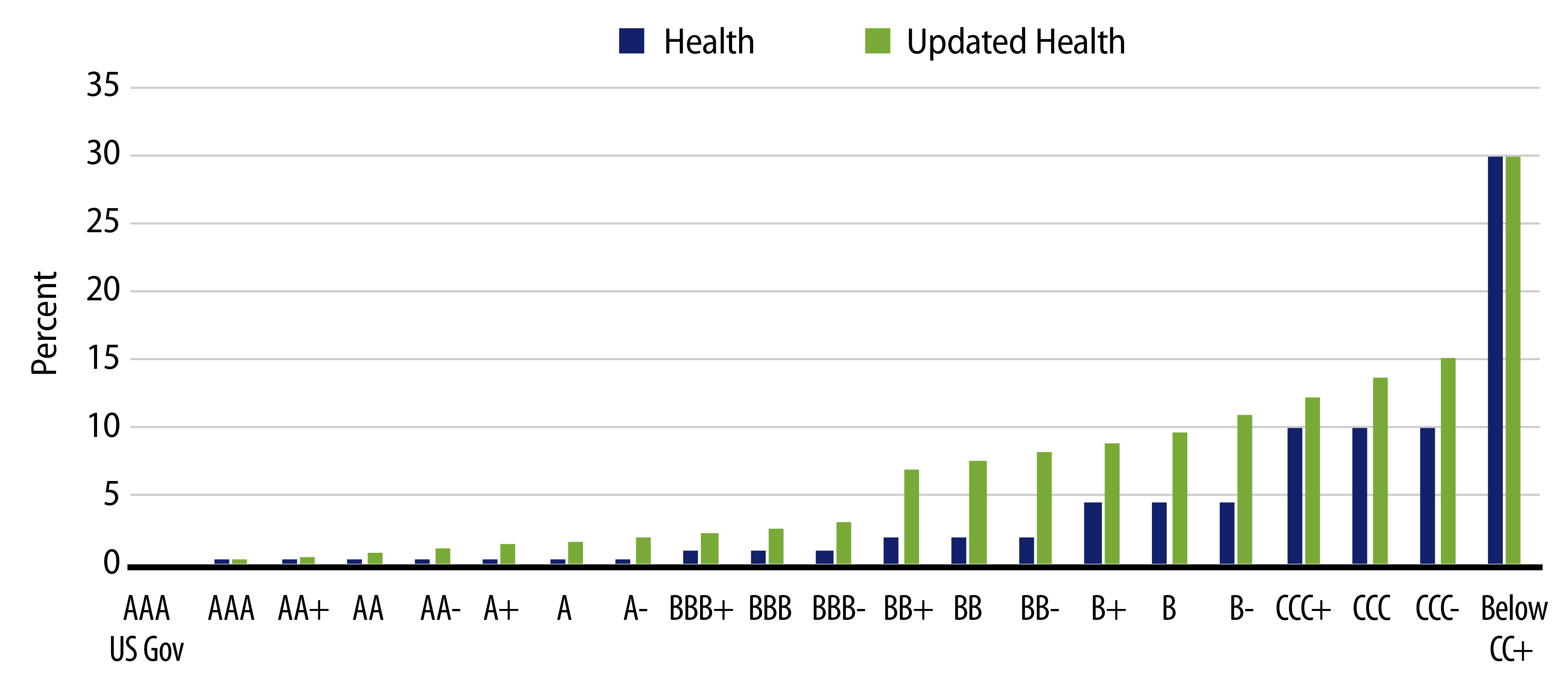

Exhibits 1 and 2 illustrate the change in the bond-level factors, broken down by issue ratings.

As expected, the NAIC is looking to further protect the interests of policy holders and is thus subjecting more risky investments to increased capital requirements. This proposal has been expected for a number of years. The absolute percentage increases are greatest for the upper tiers of the high-yield space (generally speaking), while the greatest ratio increases (new factor divided by old factor) are in the bottom end of the NAIC 1 designation category (followed closely by the BB/NAIC 3 category). The adoption of the updated RBC factors eliminates the prior incentive for insurers to go down in credit quality (e.g., to A- or BBB-) for yield pickup while staying within the NAIC rating bucket.

We can draw a few conclusions about the attractiveness of risk for these insurers on a go-forward basis, as well as suggest some possible changes that may occur in asset allocation (book yield not being a consideration here).

Investment Implications

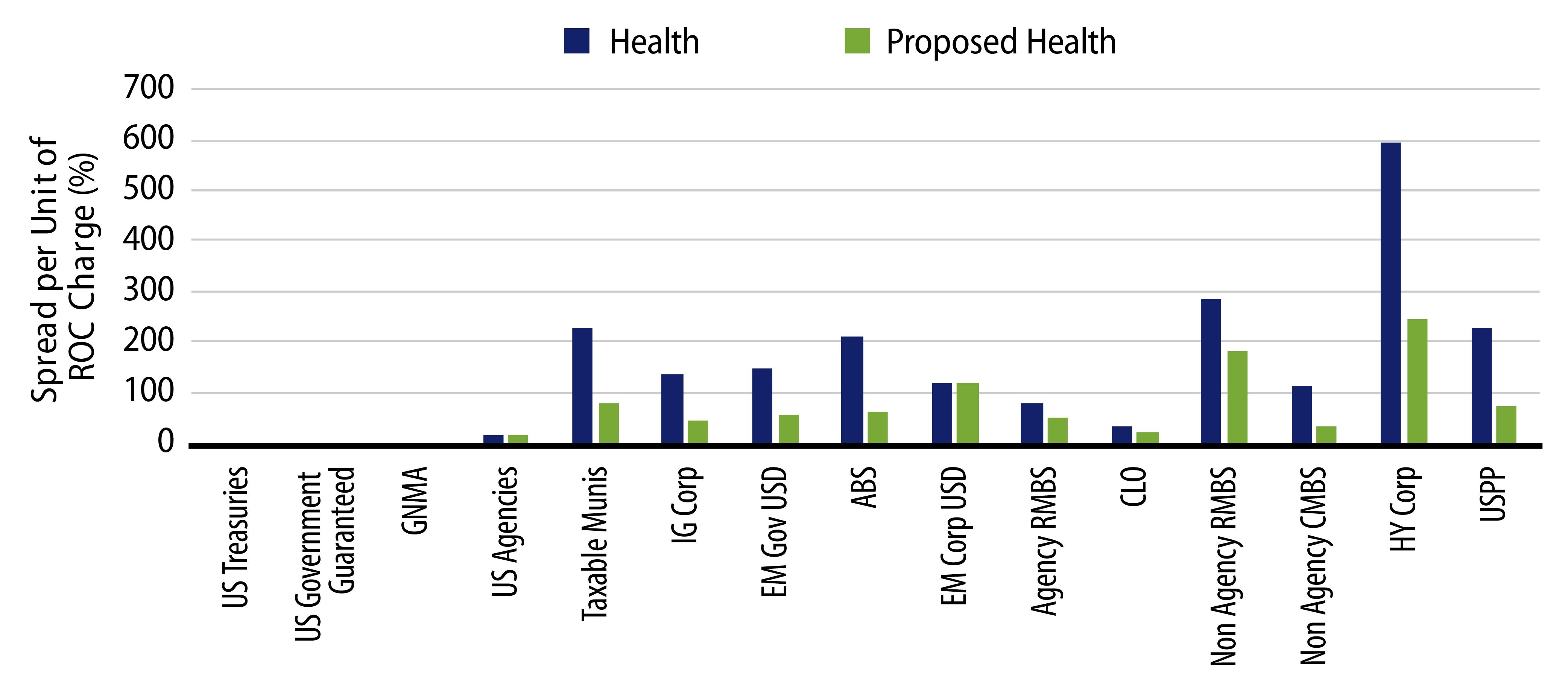

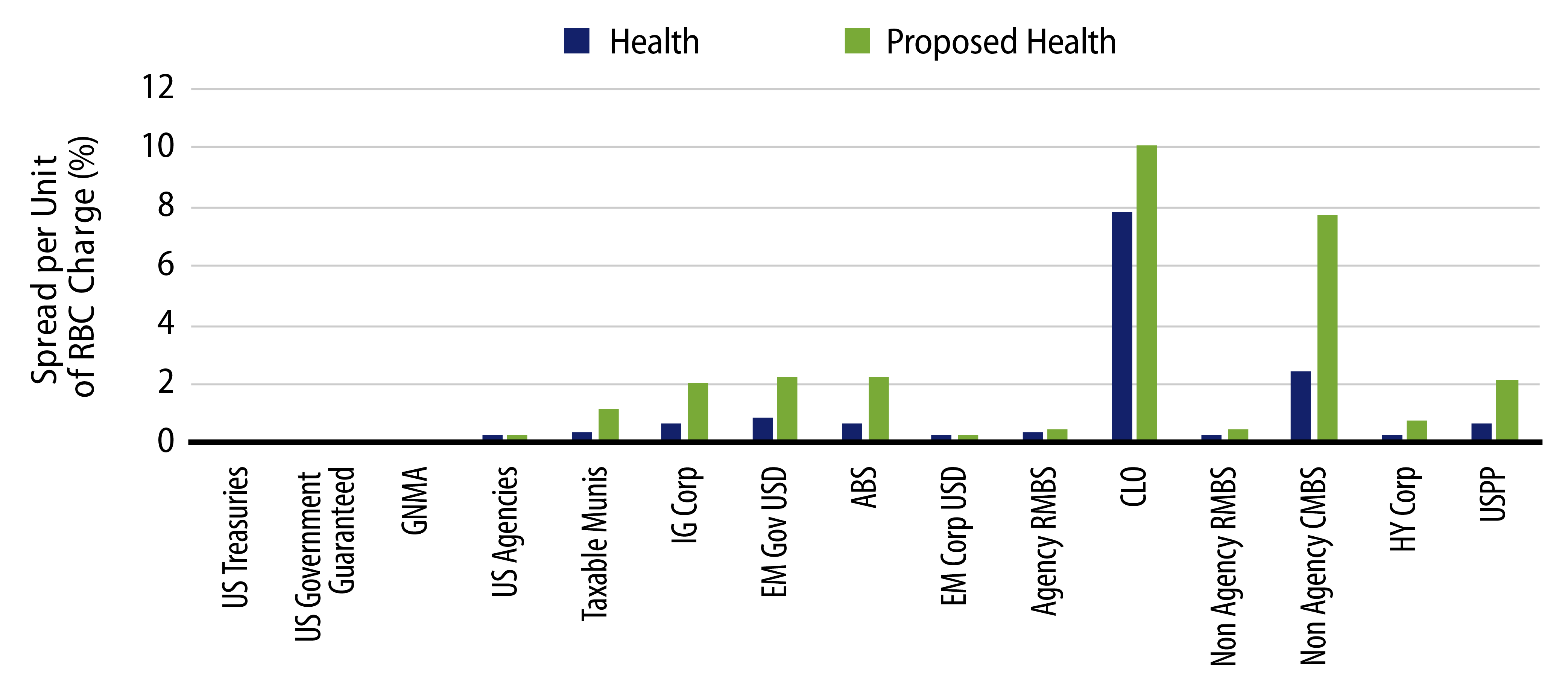

Using our preferred measure of return-on-capital (ROC)—in this case, looking at spread per unit of RBC—we find that most sectors do indeed suffer a decline in ROC; however, they don’t all decline to the same degree. The absolute percentage decline is greatest for CLOs, US private placements and USD-denominated emerging market (EM) corporates, in that order. However, relatively speaking, the attractiveness of CLOs, for example, remains quite high due to their higher spreads versus like-rated securities. There are a few sectors that show relatively mild declines (the securitized asset classes), and one that actually increases in attractiveness (agency MBS).

So, what does this likely mean for insurers’ asset allocations going forward? We continue to believe that CLOs are attractive for all types of insurers—with the change in ROC doing relatively little to dent the comparative advantage CLOs offer relative to other asset types. We would expect somewhat less investment in high-yield on a go-forward basis, with spreads having compressed to a point that reduces their attractiveness versus the capital required. Within the investment-grade corporate and non-corporate spheres, EM bonds do maintain an advantage over domestic corporate bonds and therefore should continue to benefit from marginal flow. As a result, we continue to expect healthy allocations to agency MBS and will look to continue to increase holdings in commercial MBS (CMBS).

In addition, investment-grade private placement securities may be an option for portfolios of P&C and health insurers as the additional spread on those securities gives them a significant ROC advantage over their public peers. While the majority of issuers do not issue in public markets, the market contains many recognizable organizations including US sports leagues, auditing firms, asset managers, REITs and manufacturers. Western Asset recently participated in two new issues for a marquee alternative asset manager with new issue spreads of 225 bps and 250 bps versus their three- and five-year reference Treasuries, respectively. In the current low-yield environment, the trade-off of a higher premium received from investment-grade private placements for lower liquidity may help clients meet their income needs. For health insurers, many of whom carried more than a quarter of their investment assets in cash as of year-end 2020, according to S&P Market Intelligence, the added flexibility to purchase investment-grade pure privates may make even more sense.

The RBC factor changes for P&C and health insurers are here and with change comes opportunity. While the asset allocation changes to new factors will be slow and steady, we believe US insurers may be able to fine tune their fixed-income exposure to get the most capital efficient bang for their buck.

END NOTES

1. https://content.naic.org/sites/default/files/call_materials/072221%20PC%20RBC%20summary.pdf, https://content.naic.org/sites/default/files/call_materials/Health%20RBC%20%28E%29%20Working%20Group%20Summary_0.pdf

2. https://content.naic.org/sites/default/files/call_materials/7-12-21%20HRBCWG%20Agenda%20%26%20Materials_1.pdf

3. https://content.naic.org/sites/default/files/call_materials/7-12-21%20HRBCWG%20Agenda%20%26%20Materials_1.pdf