The U.S. Census Bureau reported today that new orders for durable manufactured goods declined by -6.1% in January. That drop mostly came from nondefense aircraft orders, which plunged by -58.9%. Such wild swings are fairly typical of aircraft orders, which is why most analysts focus on a durables goods orders metric that excludes transportation equipment. That measure declined by -0.3% in January—still a drop but a much smaller one.

A closely watched measure within the durable goods aggregate is new orders for nondefense capital goods, or CAPEX. That measure showed a scant +0.1% January increase. Capital equipment is one part of the manufacturing (goods) sector where prices are still rising. Extrapolating 4Q23 price behavior for capital goods onto 1Q24, our guess is that capital goods prices rose 0.1% in January, so that real capital goods orders were unchanged.

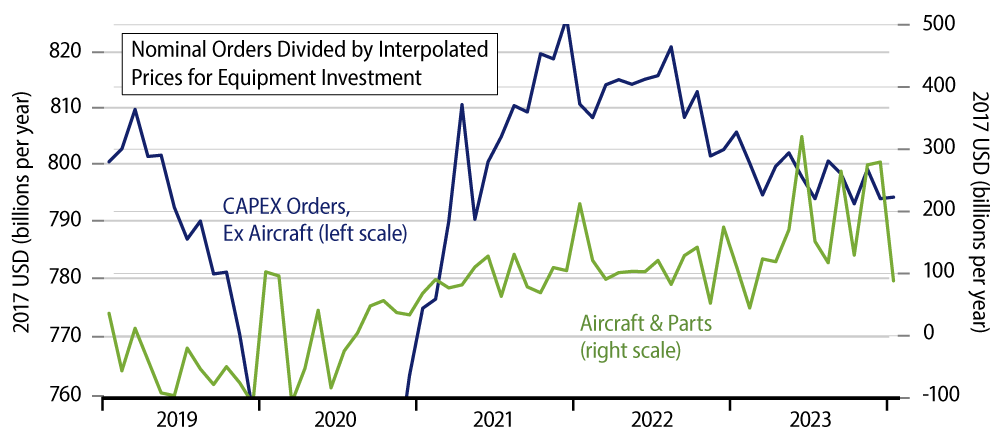

The chart plots real orders for nondefense capital goods, both aircraft and other (non-aircraft) equipment. We estimate real orders by taking the quarterly price indices for capital goods spending from the GDP data, interpolating them to monthly readings, then deflating the (nominal) capital goods orders data by our interpolations of monthly prices. (In case you’re wondering, yes, data within the GDP accounts do show real business investment in equipment declining over the last two years, just as is depicted in our chart.)

It is widely contended that the Federal Reserve’s (Fed) tightening of monetary policy has failed to affect the US economy. However, capital spending—and manufacturing activity in general—is one area that has clearly softened as interest rates have risen. Not only is equipment investment declining steadily, but manufacturing output is as well. That is, the (real) factory output data published within the Fed’s industrial production release show a steady decline since mid-2022. For factory orders data (from the U.S. Census Bureau), nominal orders have gone flat since mid-2022, and real orders have declined in sync with the industrial production data.

No, the rates of decline registered by factory activity and CAPEX are not dramatic and not suggestive of recession in the overall economy. However, they are at least one indication that tighter policy has taken a bite out of US growth.

As for the aircraft sector, you can also see from the chart that the extremely sharp-sounding January declines in aircraft orders merely bring them back to where they were in early-2023, before a summer/fall surge. Aircraft orders often come in big bunches, followed by months of sogginess. These are the first such wild swings we have seen in five years, but they are fairly typical of aircraft orders activity prior to the pandemic. Keep in mind that while these aircraft orders come in big bunches in one or two months, it takes two to five years to fulfill those orders. So, even the string of big monthly aircraft orders of late-2023 will result in only a slight pickup in aircraft shipments—if that—in months to come.