Real consumer spending grew by +0.26% in May, but that was net of a -0.29% downward revision to the April estimate. As you may recall, that previous April estimate was itself a decline from March levels. In other words, consumer spending has softened in recent months.

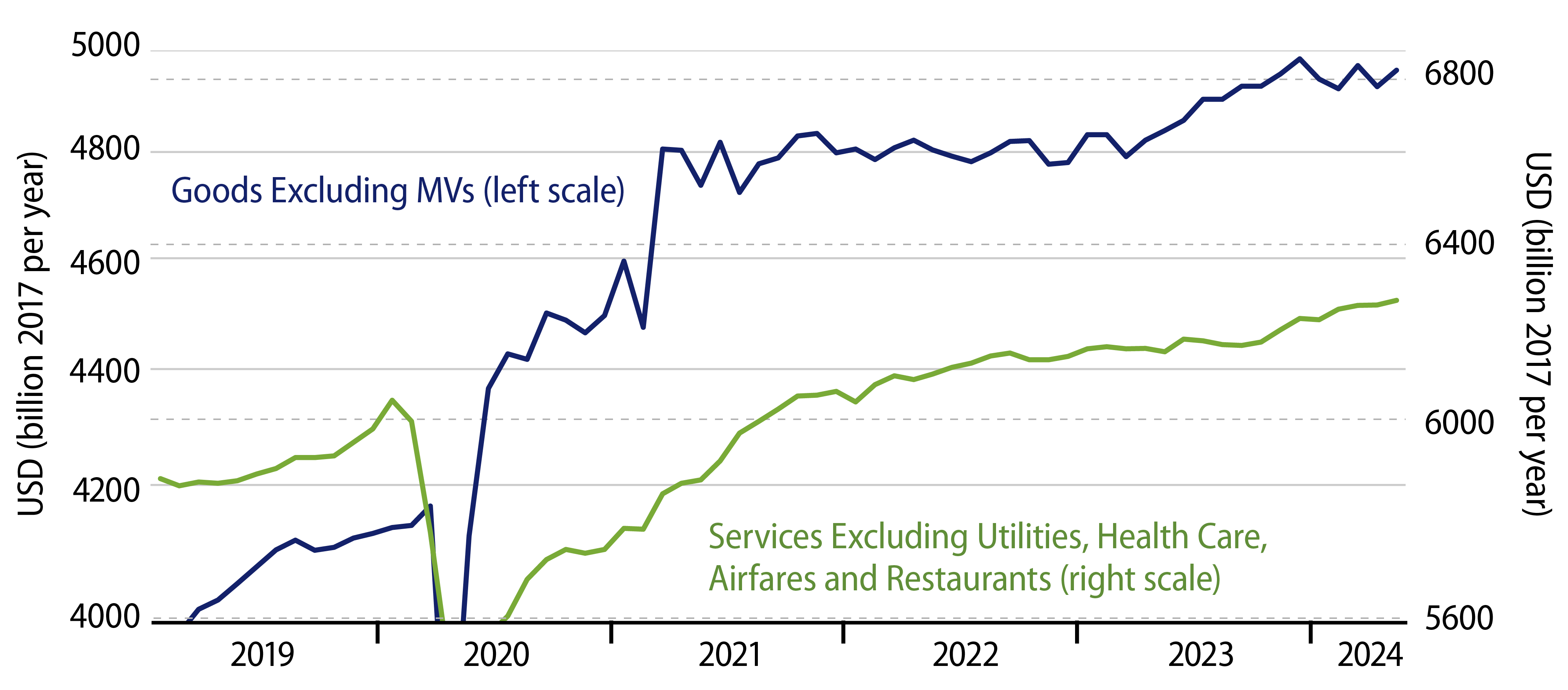

That softening is broad-based, as you can see in the chart. After growing nicely over the last nine months of 2023, real spending on goods has been choppy but trending down so far in 2024. Similarly, after a pick-up in late-2023, spending growth on services has also moderated since February.

What is interesting also is that even the modest real spending gain in May was courtesy of falling prices. The headline Personal Consumption Expenditures (PCE) price index declined slightly in May. It fell more substantially for goods prices, and as you can see in Exhibit 1, much of the “rebound” in consumer spending in May was in goods. (We put air quotes around “rebound” here, because the May rise in goods spending did not fully offset the reported decline for April.)

Consumer spending was credited for much of the pick-up in GDP growth last year. Consumption growth then slowed to a 1.5% annualized rate in 1Q24, and that was a big factor behind the slowing in 1Q GDP growth. If consumer spending can grow in June as much as it did in May and if there are no more downward revisions to previous months’ data—both big ''ifs,'' it would register a 1.7% rate of increase in 2Q. While the consumer is not flat on his back, it certainly is the case that spending growth has downshifted so far this year. We think this will continue, given that real income growth has been sporadic in recent months and that personal saving rates are very low, not to mention reported increases in credit card delinquencies.

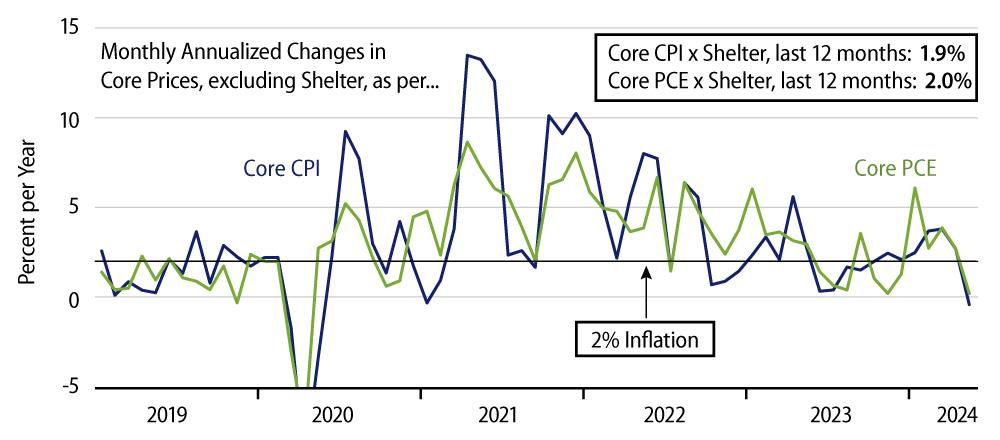

Getting back to inflation, the headline PCE index declined at a slight -0.1% annual rate in May. True, the core PCE rate was higher, at 1.0% annualized. However, first, that monthly rate is well below the 2% inflation target the Federal Reserve (Fed) has set, and second, core PCE inflation was again held up by reported shelter prices. Excluding shelter, core PCE prices rose at only a 0.2% annualized rate in May and show just 2.0% inflation over the last 12 months.

It was Fed Chair Powell himself who pointed out the technical ''issues'' with reported shelter prices and the different readings that market-based measures of rents were emitting. In looking at core inflation excluding shelter, we are only analyzing in concert with Mr. Powell’s own statements. Note also that the 2% average inflation for this measure is over the last 12 months. It is not a momentary thing.

The Street’s take on Mr. Powell’s comments has been to focus on supercore inflation, that is, core services prices excluding shelter. That supercore measure rose at only a 1.2% annualized rate in May and has been decelerating through recent months.

These data put a September Fed rate cut very much in play.