February payroll data showed a 265,000 gain in private-sector jobs, with the January job level revised downward by a whopping -94,000. Workweeks declined, reversing most of the very sharp increase previously reported for January. Average hourly wages for all workers rose at a very modest 2.9% annualized rate, following a similarly modest 3.3% annualized rate in January.

We were perplexed a month ago when the January payroll data appeared to disrupt a number of trends that had appeared to be in place. Well, the February report, between February changes and revisions to January data, has brought those trends mostly back in line.

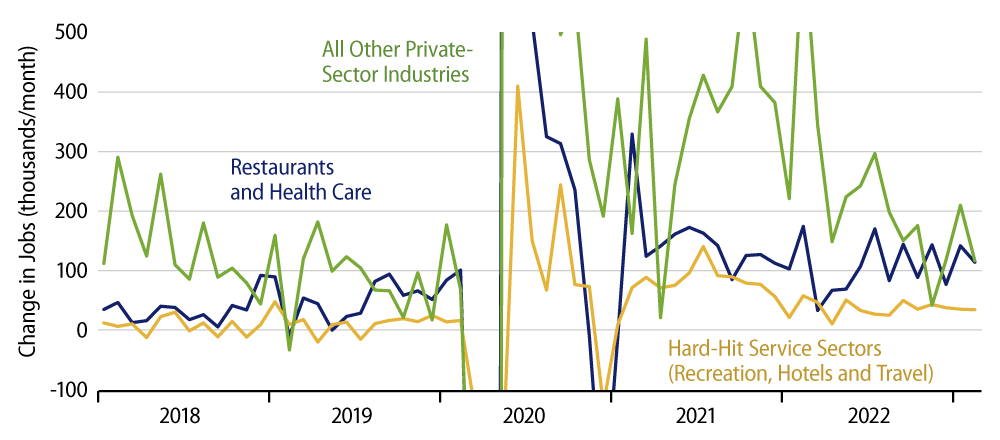

To wit, through December’s data, job growth appeared to be on a steadily decelerating trend, especially in industries not hugely affected by Covid restrictions. Then January showed large job gains, especially in industries outside the Covid epicenter. Well, as you can see in the chart, for “All Other Private-Sector Industries” (green line), that is, for all industries outside Covid “epicenter” sectors, the January job gain is now more modest, and the February gain was barely above 100,000. Rather than a newly emerging acceleration, the January gain now looks more like merely a reversal of especially soft data in November.

Most importantly, the underlying trend for this sector now once again looks to be a steadily slowing one. Yes, job growth is still healthy. It should be given that employment levels are still woefully below the pre-Covid trend path, but the recent gains do not look especially sharp, and, again, the trend is toward ever-lower monthly gains as staffing gradually returns to more normal levels.

As for workweeks, while it wasn’t reported much in the financial press a month ago, the reported January increases in workweeks contributed three times as much to reported January personal income gains as did job gains. Here too, there were downward revisions to the January gains and reported declines in workweeks in February. Together, these changes put workweeks back on the steadily declining trend that had been in place through the December data.

When Covid restrictions constrained staffing, employers worked the staff they had especially hard: workweeks grew extremely long. As staffing has since returned toward normal levels, workweeks have declined in turn. And yes, with today’s February data, that downtrend appears intact once again after the January data suggested possible disruptions to that trend.

As for wages, they were the one indicator that came in benign in January (so far as Fed predilections were concerned). Well, February data actually revised January all-worker wage data downward and followed on with even slower growth in January. Production-worker wages showed a slight bounce in February, off especially benign January readings. Even there, the trend in wage growth looks clearly downward.

A month ago, we argued that seasonal noise was likely present in the January data, January being an especially volatile month for weather and holiday hiring patterns. The February data support this assertion, as the most egregious “outliers” in the January payroll report were either revised away or partially reversed. These data should be much more of a comfort to the Fed than last month’s release.