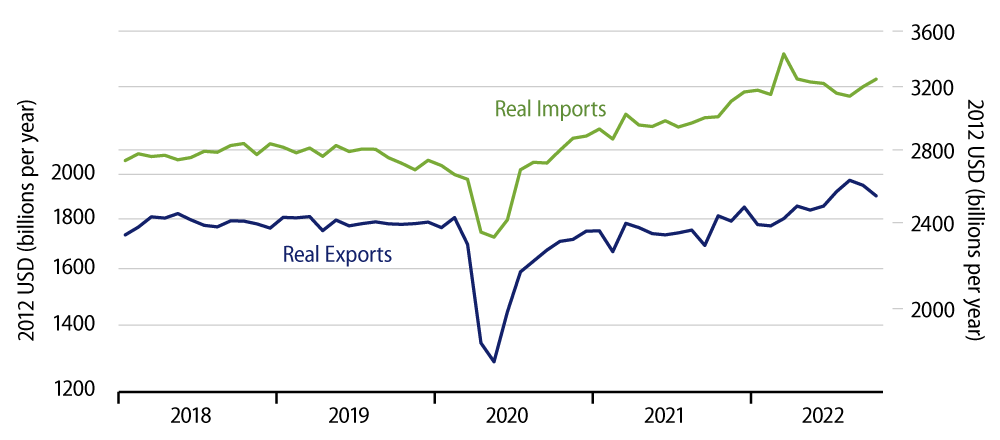

The US foreign trade deficit on merchandise swung to the downside—that is, to a larger deficit—in October, as exports declined and imports rose. Before adjusting for price changes but after adjusting for seasonal variation, exports declined 2.0% to a rate of $2.09 trillion per year, while imports rose 1.0% to a rate of $3.286 trillion per year. After adjusting for both seasonality and price changes, so-called real exports declined 2.5% to a rate of $1.75 trillion per year in 2012 dollars, while real imports rose 1.6% to a rate of $2.83 trillion per year in 2012 dollars.

These trade swings reflect the unwinding of two trends. First, as we have mentioned before with respect to inflation and GDP growth, US merchants rapidly built up inventories early this year in response to a shortage of goods in late-2021, then they scaled back the rate of inventory accumulation in more recent months as inventories were replenished and even became excessive. The early-2022 inventory build-up was associated with a ramping up of imports, and the slower rate of inventory growth more recently led to declines in imports in spring and summer. The rebound in imports in October suggests a return to more normal trends for imports and inventories.

Second, US exports rose noticeably this year thanks mostly to large gains in exports of raw materials, not just oil, but also metals, plastics, lumber and non-metallic minerals. For all these products, foreign demand appears recently to have been met, and both production and export volumes have begun to fall back.

Meanwhile, both exports and imports of capital goods continue to grow steadily. In fact, it is worth noting that while we hear a lot these days about supposed deglobalization due to Covid realities, the fact is that foreign trade volumes (both export and imports) have expanded substantially in the last two years after having been flat in 2018 and 2019, prior to the pandemic. While US and global GDP are barely back to—or even below—pre-Covid trends, foreign trade volumes are well above those pre-Covid trends. Deglobalization, where is thy sting?

Getting back to more immediate matters, with US exports of industrial supplies apparently fading and US imports growing more normally, foreign trade looks to be reverting to its “normal” role of a net drag on GDP growth. The US trade deficit eased enough in 3Q to boost GDP growth then by 3.4 percentage points. The October data suggest that trade will be a drag on 4Q GDP growth by at least as much. So much for forecasts of robust 4Q growth.

Meanwhile, import prices look to have declined again in October, the fifth straight month of declines. This should contribute further to easing inflation pressures in the US. Prices of US exports other than oil dropped in October for the fourth straight month, though the price of US petroleum exports rose for the first time since June.