Real GDP grew at a 2.8% annualized rate in 2Q24, according to data released today by the Commerce Department. This was above the 1.6% rate we projected. Consumer spending was in line with our projections, rising at a 2.3% annualized rate. However, there was much less drag from foreign trade than expected, and business investment and motor vehicle production both rose more than anticipated.

On the other side of the ledger, construction spending declined slightly, as expected. Both private-sector residential and nonresidential construction spending declined, offset partially by some further growth in government construction outlays. All in all, the drop in total construction spending was only slight. However, that marked a big slowdown from its rapid growth of 2023 and 1Q24.

Consumer spending saw a bounce in spending on goods and a roughly equal slowing in spending on services. The goods spending bounce was in line with retail sales data released last week, which showed not only good gains in June but also upward revisions to sales data for April and May. Previous data had indicated flat real sales through May and softening sales growth for online vendors, but the revisions put a much better spin on both aspects, and this was fully reflected in the GDP data.

On the pricing side, the price index for GDP rose at a 2.3% annualized rate in 2Q. The price index for personal consumption expenditures (PCE) rose at a 2.6% annualized rate, core PCE increased at a 2.9% rate, and core PCE ex housing grew at a 2.4% rate. All these rates measure the change from the average price level for 1Q to the average price level for 2Q. With monthly inflation having slowed substantially in April and after, it is to be expected that inflation rates for these measures for June compared to March will be noticeably lower than the ''quarterly'' changes listed here. (The June PCE price index data will be released tomorrow.)

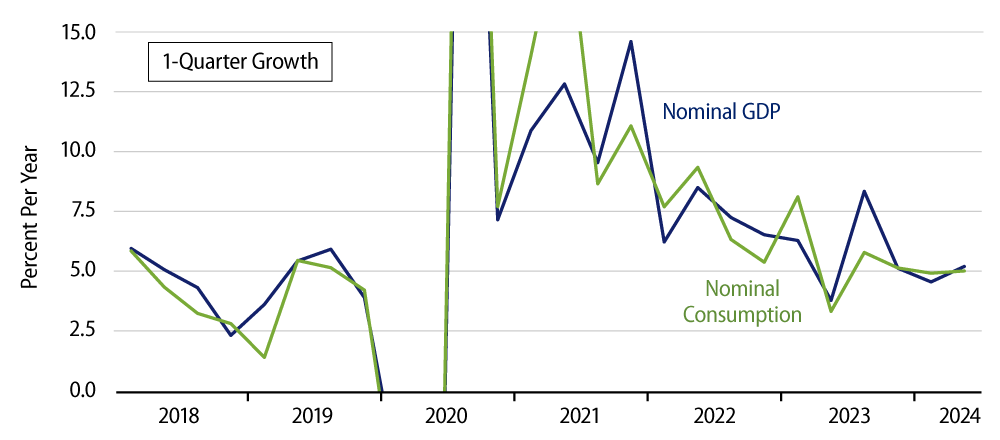

Our position has always been that the impact of Federal Reserve (Fed) policy on the economy can be determined by looking at the growth in nominal GDP. In other words, Fed policy influences the path of total dollar spending, and the economy then determines how this is split between real growth and prices, though persistently slower or faster growth in nominal GDP will eventually be reflected in slower or faster inflation.

So, the accompanying chart is relevant. As you can see, growth rates in both nominal GDP and nominal consumer spending have been hovering right around the rates seen prior to the pandemic for quite some time. This indicates a substantive, sustained easing of inflationary pressures, and it is a compelling indication that inflation will remain at the recent low rates.

At the same time, the fact that nominal spending growth has not dipped below pre-pandemic rates also suggests that Fed policy has not yet been sufficiently restrictive to induce actual weakness in the economy. We still have some suspicions that nominal spending and economic growth will slow further, as a lagged response to the Fed’s actions of 2022 and 2023. However, the existing data are not pointing in that direction.