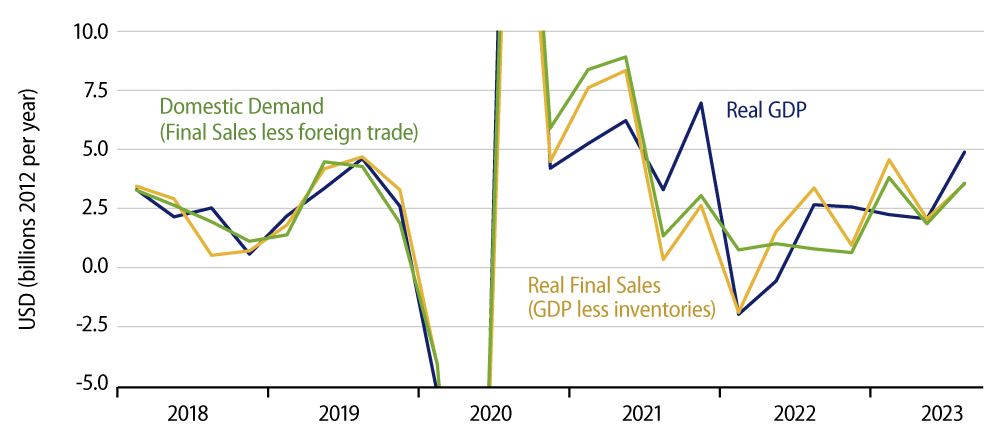

Real GDP grew at a 4.9% annualized rate in 3Q, according to preliminary data published today by the Commerce Department. That pace was markedly faster than the 2% growth occurring over the previous four quarters, but it was slightly lower than some financial market analysts had predicted. Within that same data release, overall GDP inflation was reported to have come in at a moderate 3.5% annualized rate in 3Q, despite a sharp increase in oil prices, thanks to a substantial slowing in the core Personal Consumption Expenditures (PCE) inflation rate that the Federal Reserve (Fed) professes to target.

Growth was led by a sharp reported increase in inventories, after inventories had been a drag on growth over the two previous quarters. Foreign trade was expected to provide a big boost to 3Q GDP growth. Instead, it exerted a very slight drag. Consumer spending provided the bulk of the increase in GDP, with a 4.0% rate of increase, although we can’t quite say that consumers “led” 3Q growth, when that increase was somewhat slower than that of GDP as a whole.

Government purchases of goods and services also provided a substantial boost to 3Q growth. Business spending on equipment declined slightly in the quarter.

With consumer spending on goods rising especially strongly and with inventories also building strongly, the data indicate that goods-sector output rose very sharply in 3Q, up at a 7.6% annualized rate. Yet, Fed data show 3Q output in the manufacturing and mining sectors was essentially flat. This disparity leads us to believe that the GDP data are overstated a bit, but there is no denying that service and construction sectors did better in 3Q than in previous quarters.

As for inflation, the data show a 2.9% annual rate of increase in overall consumer prices in 3Q. The core PCE price index, the Fed’s actual target indicator, rose at a 2.4% rate in 3Q, and will likely show a 2.8% annualized increase for September when monthly data are released tomorrow. The Fed has stated it is looking beyond reported shelter prices, for technical reasons we have discussed previously. Excluding shelter, core PCE inflation registered a 1.7% annualized rate in 3Q and will likely show a 2.0% annualized rate for September. Core services excluding shelter (so-called supercore inflation) registered a 3.6% rate for 3Q and likely 3.7% for September.

With declining goods-sector prices offsetting services inflation above 2%, underlying rates of core inflation (excluding shelter) have tracked right at Fed targets on a monthly basis for the last four months now. We believe this is at least enough to forestall further Fed rate hikes, and if and as recent rates are sustained, it could pave the way for some relief on interest rates even early next year.