Over the past year, investors have been hit with a whirlwind of market-moving headlines—elections, wars, central bank policy shifts, you name it. Throughout all this volatility Western Asset has remained focused on the fundamentals instead of getting caught up in day-to-day speculation and punditry. Despite a flood of conflicting data, we believed that deflationary pressures in China, tighter financial conditions in the US and Europe, and a slump in demand for manufacturing and services across several countries would eventually ease global price pressures. These trends, along with major central banks taking a slow and steady approach to easing monetary policy, were expected to further dampen economic growth and inflation. This, in turn, would lead to lower developed market (DM) government bond yields.

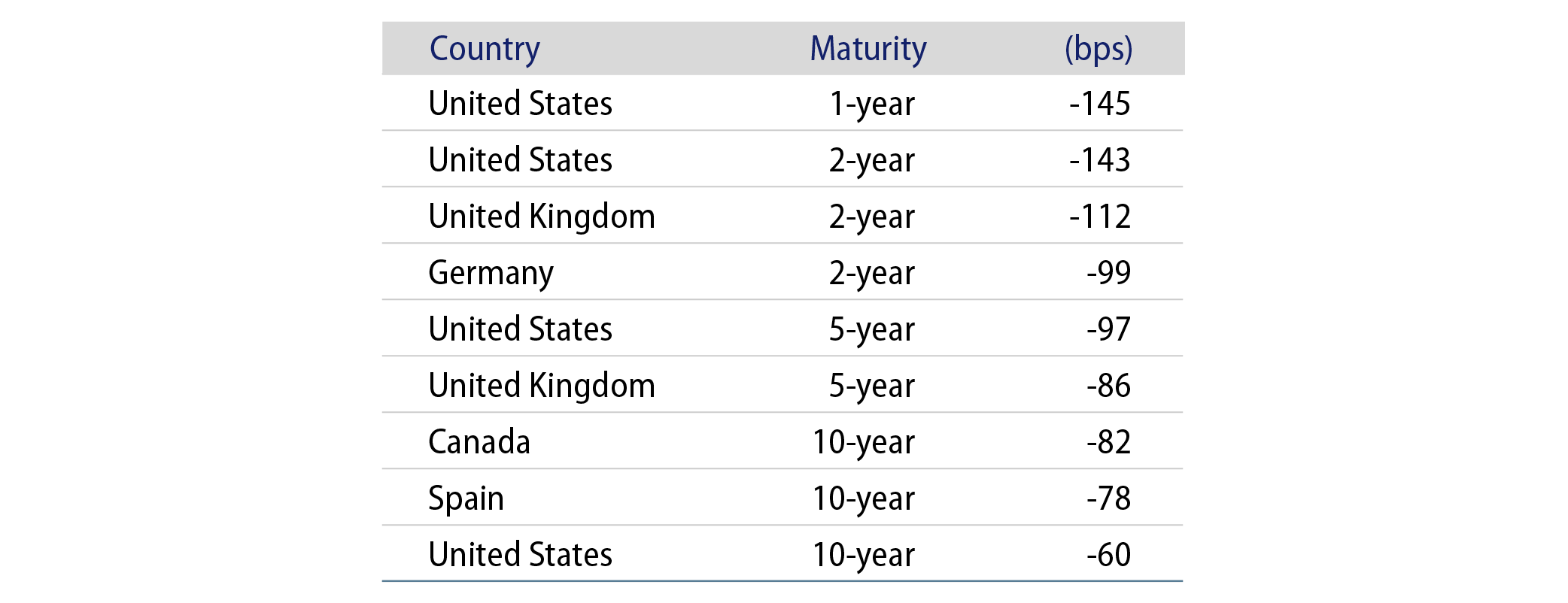

Well, that moment has finally arrived. With the global rate-hiking cycle behind us, it’s refreshing to see DM bond yields finally reflecting the long-awaited easing in short-term rates. Here we highlight the most notable moves over the past year (as of September 17, 2024).

We expect this trend of lower DM rates to persist for a few reasons. In the US, we expect the Federal Reserve (Fed) to be cutting rates through 2025. Although growth is slowing, mainly due to weaker consumer spending, we don’t foresee a recession on the horizon. Real yields across the US yield curve are now near their highest levels in the last two decades, even as inflation declines, with the core Personal Consumption Expenditures (PCE) price index already at levels consistent with the Fed’s 2% inflation target and the labor market normalizing. We anticipate short-term US yields to further decline over the next few months and a steepening of the US yield curve due to rising concerns over the deficit. Despite these factors pointing to lower rates, we believe that a soft-landing scenario in the US—characterized by slower, yet still-positive growth—is constructive for spread products.

In Europe, the market is currently pricing in around an 80% chance of two further cuts from the European Central Bank (ECB) this year. More progress is needed on services disinflation for these cuts to materialize, which we expect. Growth remains lackluster, as evidenced by continued weakness in the manufacturing sector. It is our focus on ongoing sub-trend growth rather than current ECB pricing which encourages us to maintain an overweight in 5- to 10-year German duration.

In the UK, the growth outlook remains subdued while inflation returned to the 2% target earlier this year. Concern over sticky wage growth and price pressures in the services sector has eased. The Bank of England delivered its first policy rate cut in August. Further monetary policy easing is expected, and we think that the market’s terminal rate expectation is too high. If we are right, then gilt yields have further room to fall.

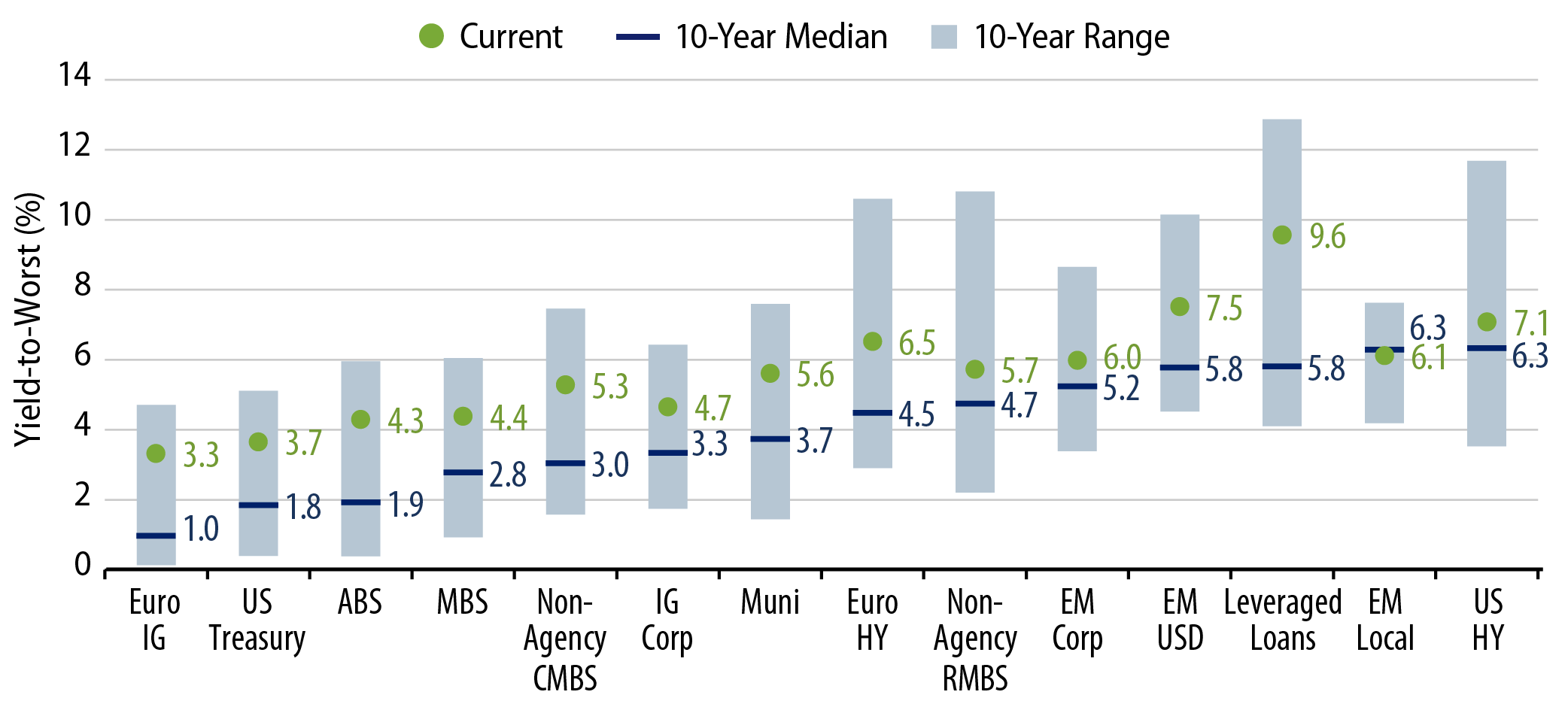

This DM rates backdrop further supports our long-standing view that global credit markets have more room to run. Fundamentals across key sectors remain resilient, and all-in yields are attractive. We’re especially constructive on the following sectors.

High-Yield Corporate Credit

Default rates have ticked up recently due to aggressive liability management exercises that triggered default statuses by the rating agencies. However, leverage profiles and interest coverage ratios across high-yield-rated corporates still support the asset class. Market technicals have created ongoing tailwinds with both retail and institutional inflows into high-yield credit and limited net new-issue supply via the primary calendar, keeping spreads rangebound. We’re confident in the income-generation narrative for this opportunity set, favoring cyclicals, financials, energy and potential rising stars. Our focus is on upcoming new issuance at appropriate concessions in the higher quality segment of high-yield credit.

Bank Loans and CLO Tranches

Bank loan yields remain attractive, offering limited duration and potential outperformance during periods of rate volatility. We continue to favor high-quality loan borrowers and more defensive sectors at this stage of the cycle. Collateralized loan obligation (CLO) debt has experienced significant tightening and outperformance this year, thanks to its floating-rate nature and attractive yields. We expect this performance trend to persist through the rest of the year. For broad market investment portfolios, we prefer higher-quality AAA rated CLO tranches, while for more total return-focused investors, we favor BBB and select BB opportunities.

Structured Credit

The commercial mortgage-backed securities (CMBS) market is recovering. Investor demand is rising on greater recognition that underwriting standards have tightened and select CMBS investments are exhibiting among the lowest loan-to-value (LTV) ratios and highest debt yields (net operating income over principal balance) in market history. Low leverage exposures on high-quality real estate with meaningful borrower equity present compelling opportunities in both the conduit and single-asset, single-borrower (SASB) market. In the non-agency residential MBS space, subordinated tranches of credit risk transfer (CRT) securities were among the best performers in the credit market over the past 12 months. We remain opportunistic on CRTs as well as on non-qualified mortgage deals that present strong borrower profiles and higher credit qualities.

EM Debt

Emerging market (EM) bonds have generally performed strongly since mid-year, with lower UST yields and a weaker US dollar serving as helpful tailwinds. Our focus remains on frontier market sovereigns which offer high carry and idiosyncratic credit improvement stories, as well as select EM local markets which offer high nominal yields and the potential for currency appreciation.