Recently, Saudi Arabia successfully raised $5 billion through the sale of dollar-denominated sukuk. This issuance follows recent sukuk offerings from countries such as Indonesia, the Philippines, Egypt, South Africa and Nigeria, as well as numerous financial institutions, development banks and government-related entities across the Middle East. According to S&P, global sukuk issuance is projected to reach approximately $170 billion in 2024, compared to $168.4 billion in 2023 and $179.4 billion in 2022.1 This surge in activity has pushed the total global outstanding sukuk to an estimated $875 billion, spanning 27 currencies and surpassing the size of both the European high-yield market and the Swiss bond market.2

What’s a Sukuk?

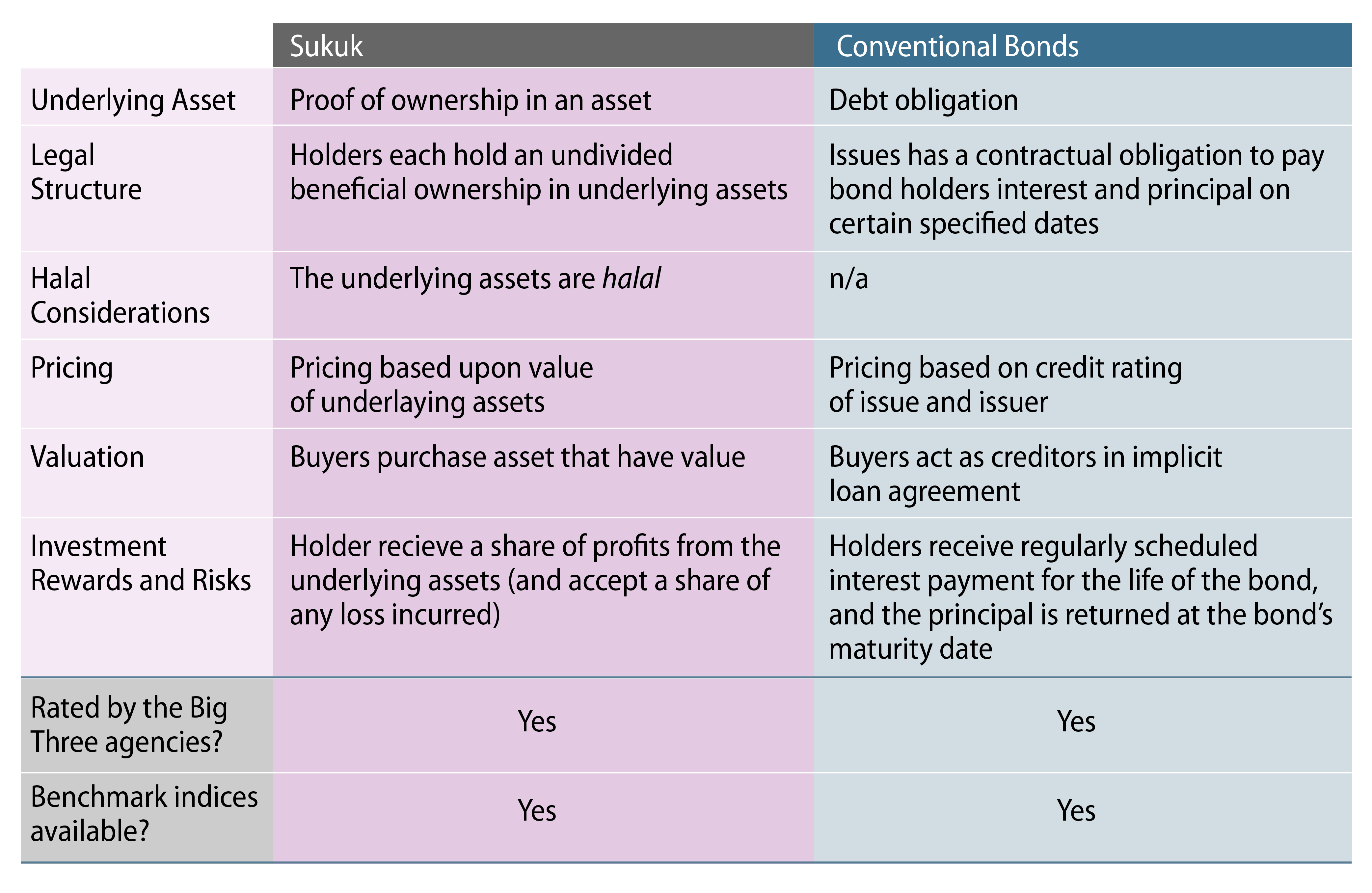

Sukuk is the Arabic name for a bond-like instrument that complies with Shariah or Islamic law, which forbids speculation and the payment or receipt of interest on loans. While sukuk operate similarly to conventional bonds, they stand apart in their structure and method of generating returns. Unlike typical debt instruments, sukuk represent ownership stakes in underlying assets, which can be tangible (such as real estate or operating assets) or intangible (like goodwill or copyrights).3 Their returns are derived from profit-sharing arrangements based on the underlying assets, further setting them apart from typical debt instruments. Exhibit 1 highlights the differences between sukuk and conventional bonds.

How Issuers Are Using Sukuk Financing

Sukuk have emerged as a vital alternative financing tool for several countries across the Middle East, Asia and Africa, complementing conventional bonds, IMF stand-by facilities, multilateral financing and bank credit facilities. They help finance national budget shortfalls, raise corporate working capital, boost bank capital under Basel rules and refinance costly conventional debt.

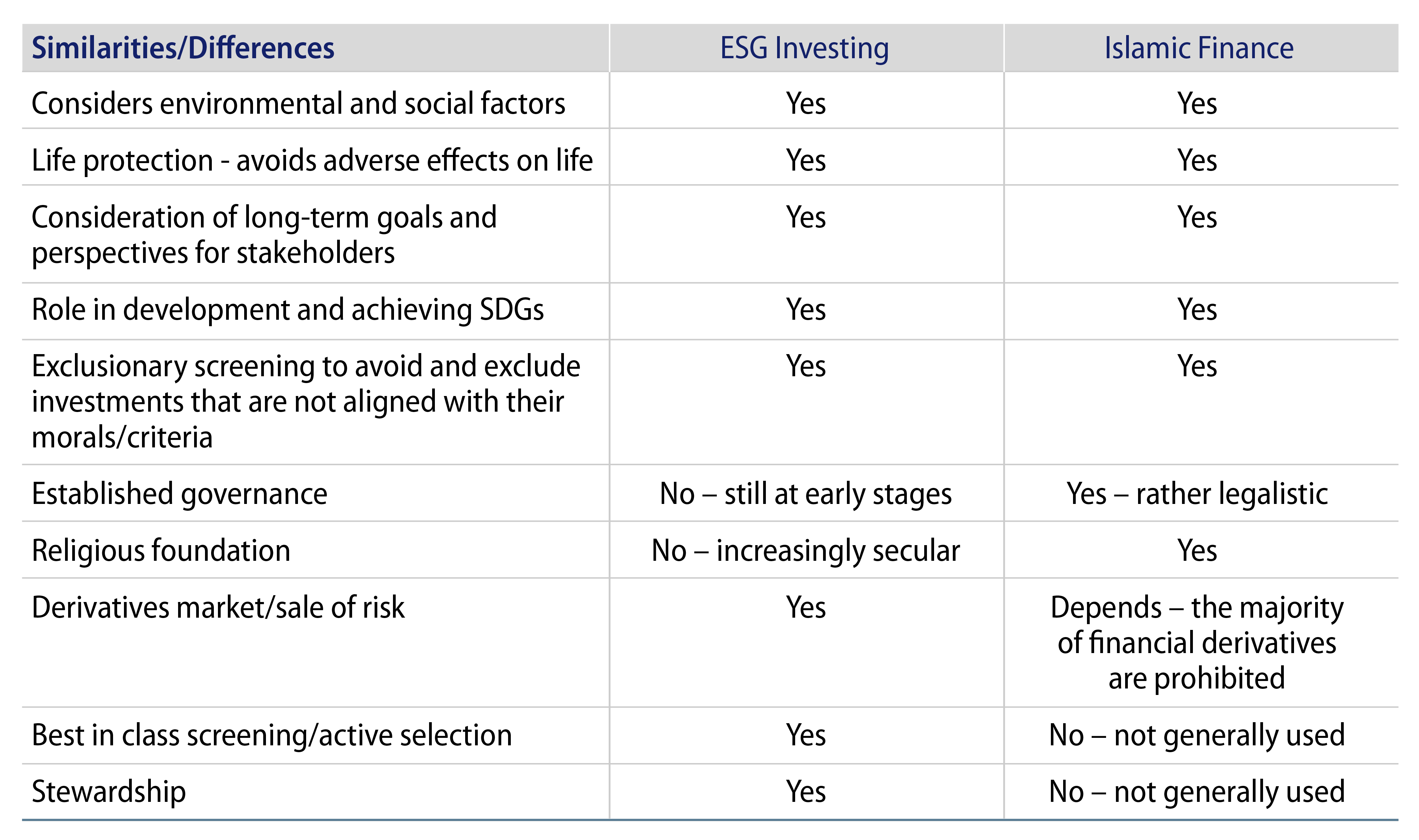

The G20, IMF, World Bank and Basel Committee for Banking Regulation and Supervision recognize sukuk's potential in financing both infrastructure and green projects as the principles-based and exclusionary nature of Islamic finance—prohibiting investments in alcohol, drugs, pork products, gambling and weapons manufacturing—aligns well with ESG-related initiatives (Exhibit 2).

For example, Indonesia issued its first sovereign ''green sukuk'' of $1.5 billion in March 2018, followed by several more issuances capped off by a $2 billion sukuk offering in January 2024.4 In May 2024, Aldar Investment Properties, the largest real estate management company in Abu Dhabi, successfully raised $500 million through an inaugural green sukuk.

Under the auspices of the International Capital Market Association, the Islamic Development Bank and London Stock Exchange Group (the main global venue for sukuk listings), ESG sukuk have expanded beyond green issues to include sustainable and sustainability-linked sukuk, boosted by the decarbonization strategies of governments and corporates in the UAE, Indonesia and Saudi Arabia.5 According to S&P, green sukuk accounted for 63% of sustainable sukuk issuance in 2023, in line with Islamic countries’ energy and climate transition agendas.6

Investor Risks

At first glance, sukuk appear to offer the potential of securing a spread or yield premium over sovereign bonds, in addition to potential diversification benefits and the backing of a strong sovereign credit. This perception is supported by the fact that a significant portion of sukuk issuance is tied to investment-grade-rated oil-exporting countries such as Saudi Arabia, the UAE, Malaysia and Indonesia. Furthermore, as highlighted in a recent Fitch report, the proportion of sukuk issuers with stable outlooks rose to 93.6% in 2023 from 69.9% in 2022, with defaulted sukuk representing only 0.2% of all issued sukuk.7

However, it's crucial to acknowledge that not all sukuk are created equal. Smaller, lower-rated sovereign issuers such as Senegal, Togo, Morocco, Mali and Côte d’Ivoire also have outstanding sukuk paper. Given the current strong global appetite for yield, it's possible that additional frontier market countries, which typically have more strained balance sheets and greater financing needs, will turn to the sukuk market for capital. Therefore, thorough due diligence is imperative.

Finally, sukuk are often portrayed in the financial press and sell-side marketing materials as having lower volatility and correlation profiles compared to conventional bonds. While there may be instances where this holds true, it's essential to consider that the buy-and-hold behavior of sukuk investors in the Gulf Cooperation Council (GCC) region, particularly large Islamic banks, can have the effect of dampening mark-to-market volatility. 8

Sukuk Market Outlook

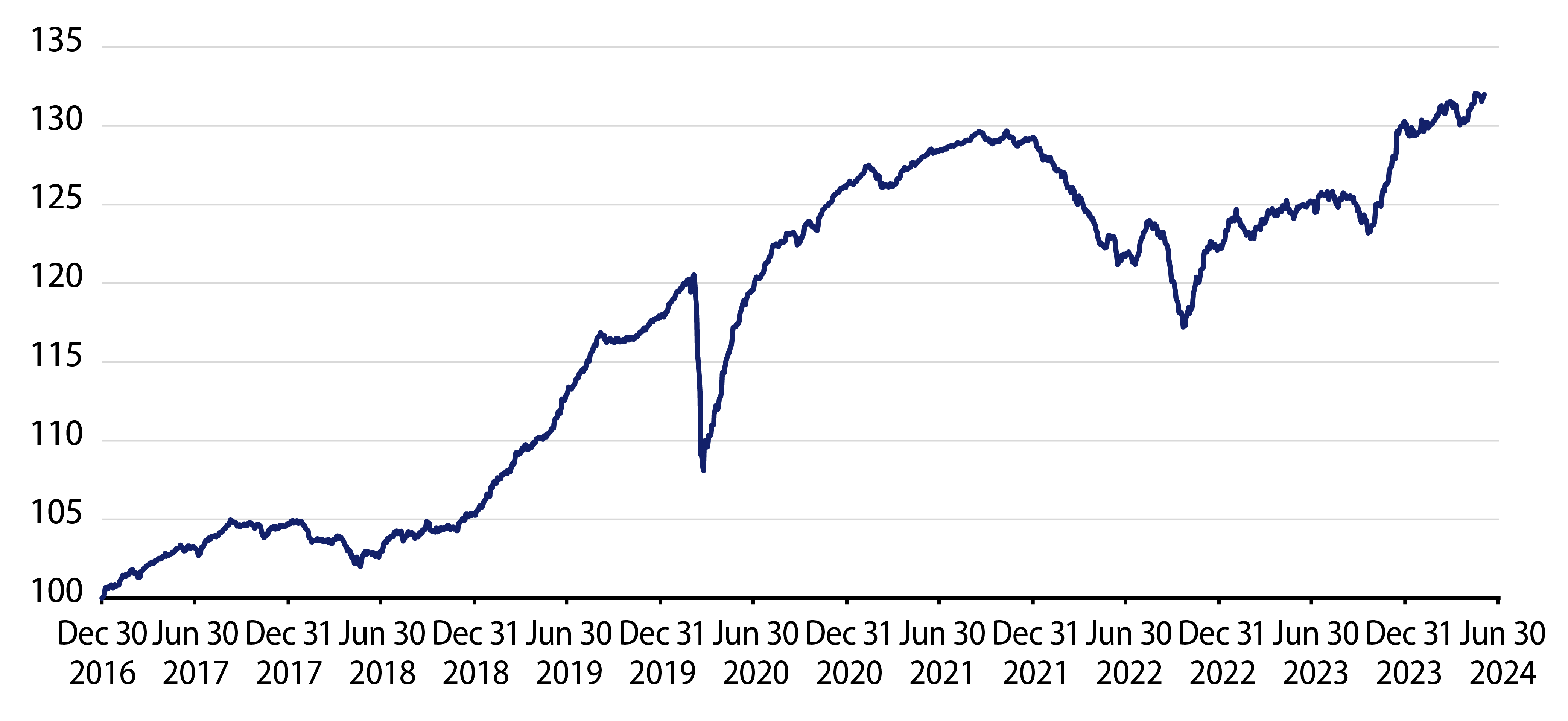

Looking ahead, we remain hopeful about the continued expansion and maturation of the global sukuk market, particularly as investor interest broadens beyond the core GCC and Asian countries. The availability of benchmark indices from leading providers such as FT Russell, S&P, Dow Jones and JP Morgan is a positive technical catalyst as these indices not only provide valuable information but also bolster the marketability and liquidity of sukuk instruments.

We see several factors that should spur future growth in the sukuk market. These include the resolution of regulatory standards related to existing sukuk structures, the establishment of clearer guidelines on rights and remedies in default scenarios, greater harmonization of legal documents and the development of a standardized interpretation of Shariah law across diverse regions. Additionally, the growing trend among issuers to leverage the sukuk market for significant financing needs in infrastructure and development projects across both developed and emerging markets should further propel market growth.

In conclusion, we maintain a positive outlook on the prospects for the sukuk market. There's a significant overlap between Islamic finance and sustainability. In an era characterized by heightened ESG awareness among both issuers and investors, we believe this alignment can effectively address various economic development challenges that go beyond purely financial objectives.

ENDNOTES

2. Rhodes, Fenella ''Inside the steady rise of Shariah-compliant sukuk funds,'' Citywire, January 31, 2024.

3. Sukuk are categorized into two distinct types: asset-based and asset-backed. Under the asset-based sukuk, the sukuk holders have beneficial ownership of the asset and have recourse to the originator if there is a shortfall in payments. Under asset-backed sukuk, the sukuk holders have legal ownership of the asset and as a result, do not have recourse to the originator if there is a shortfall in payment.

4. In June 2017, Malaysia issued the world's first green sukuk. According to S&P Global, ''A green sukuk is a form of Islamic financial instrument where issuers use the proceeds to finance investments in renewable energy or other environmental assets such as solar parks, biogas plants, wind energy projects, as well as renewable transmission and infrastructure projects.''

5. ''ESG Sukuk Growth Amid Regulatory Initiatives; Market to Cross USD50 Billion,'' Fitch Ratings, May 7, 2024.

6. Shibli, Aliya ''Sustainable sukuk issuance on the rise,'' Financial Times/The Banker, January 31, 2024.

7. ''Global Sukuk Outlook Dashboard,'' Fitch Ratings, April 17, 2024

8. The GCC comprises the United Arab Emirates, Saudi Arabia, Qatar, Bahrain, Kuwait and Oman.