Sales of new homes rose 4.1% in September, though that was off an August level that had been revised downward. In fact, sales levels for each of the previous three months were revised lower, and those revisions more than offset the September increase. Last week, it was announced that single-family housing starts also increased in September.

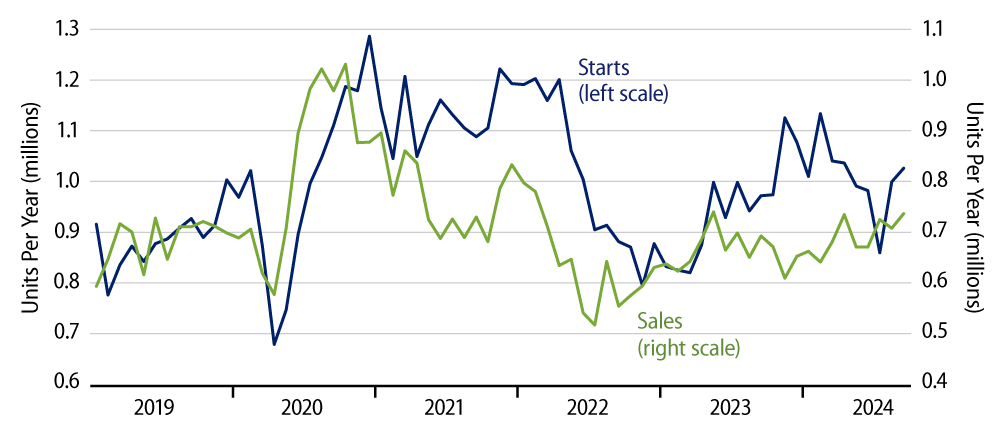

Exhibit 1 compares the paths of single-family housing starts and sales of new single-family homes. The scales of the chart are staggered to reflect the fact that owner-builds are included in housing starts, but not in new-home sales. The inference is that when the starts line lies above the sales line in the chart, builders are starting new homes faster than they are selling them, and inventories of unsold new homes are rising.

The starts line has been ''above'' the sales line for most of the last four years, and, indeed, inventories of unsold new homes have been rising throughout that period. As of September, new-home inventories were equivalent to nearly 8 months of sales. This compares to ''normal'' inventories of 4 to 5 months’ sales.

New-home inventories were much higher at the peak (nadir?) of the housing bust in 2008-2009, and they were also briefly higher in 2022. It can’t quite be said that new-home inventories are at crisis levels, but it is questionable whether builders will be willing continue to build new single-family homes at a faster rate than they can sell them. Starts levels have pulled back over the last year, but judging by new-home inventory levels, starts have not yet pulled back enough.

Housing optimists say that the recent decline in mortgage rates will stimulate home demand enough to obviate further declines in starts. The question arises whether the recent mortgage rate declines will make much difference given how high mortgage rates (and home prices) still are versus the levels three years ago.

Housing optimists also point to the bounce in starts over the last two months as signaling a stabilization in single-family starts. This is possible, but it is worth noting that the last two months’ increases in starts came off July levels that were severely depressed by hurricane activity. One would think that after some new starts were foregone in July due to adverse weather, starts should have jumped sharply in August and September to make up for lost time.

From that perspective, the August/September starts increases look pretty meager. That is, the average level of single-family starts across the last three months is well below the levels of preceding months. Then again, one might assert that hurricane activity has continued in August and September and may still be depressing starts.

So, that is how the debate stacks up for homebuilding activity going forward: slightly lower mortgage rates and currently hurricane-depressed starts (and sales) arguing for better homebuilding activity going forward, while high inventories of unsold new homes and lack of any noticeable recent net strength in new-home sales arguing for further declines in homebuilding. We are leaning toward the latter position, but it is fair to say that the available data are mixed on the issue.