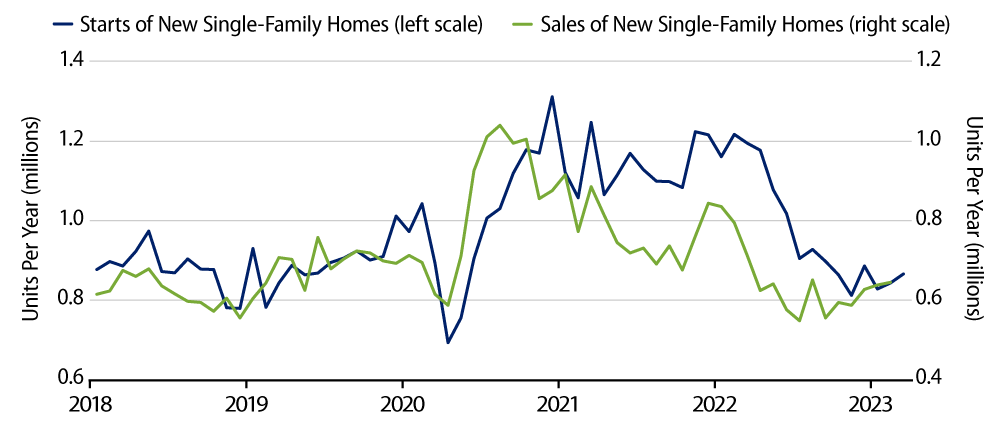

Single-family housing starts rose 2.7% in March, with some upward revisions to the January and February starts level estimates. Both single-family starts and new-home sales look to have stabilized over the last six months at levels roughly equal to what we were seeing prior to the pandemic, after both had dropped sharply in 2021 and early 2022.

The problem we see for homebuilding is the gap between starts and sales that opened up in 2021 and continued through most of 2022. With starts declining much later and initially more mildly than sales, inventories of unsold new homes rose dramatically, and with starts and sales roughly in line with each other recently, inventories have not declined much since then.

Inventories of unsold new homes have stopped increasing, but they have been stuck for a while at eight months’ or more worth of sales—way above historical norms of about four months’ sales. Granted, this is the opposite situation from the existing-home market, where inventories remain at historical lows.

However, in the existing-home market, almost every home for sale represents an owner looking to buy somewhere else. So, inventories there reflect the rate of home turnover more than they reflect a shortage or glut of housing. In contrast, in the new-home market, a rise in inventories of unsold new homes indicates an increase in the nation’s housing stock that has not been absorbed by demand. It is most likely this oversupply that has led to falling home sales prices, both for new and existing homes, since last May.

Now, the new-home inventory overhang has led us to be bearish on homebuilding since early 2021, and yes, we thought single-family housing starts would have to drop another 25% from recent levels to work down excessive inventories, even if new-home sales managed to hold at their recent lows. So far, this has not been the case, as builders have continued to hold single-family starts at recent levels despite the inventory overhang and declining prices.

If this continues, the drag on economic growth from declining homebuilding will soon subside. The question is how it can continue, where builders are sitting on such a mass of product, when carry rates have risen with the funds rate, and when banks are tightening lending standards.

Housing bulls claim that the demographics favor strong homebuilding activity. Our retort is that those potential homebuyers among Gen Xers and Millennials couldn’t afford to buy a home prior to the pandemic, so how can they afford to buy now with employment levels millions below pre-Covid trends, with both mortgage rates and home prices substantially higher, and with post-GFC lending standards requiring substantial down payments?

Meanwhile, a similar situation exists in the multi-family market, where only now builders are starting to complete projects begun in 2020 and 2021, with the number of multi-family units under construction more than double what it was at the onset of the 2005 housing crash, and with government data indicating extremely low (zero, really) rates of multi-family unit absorption over the last five years.

Bottom line: current homebuilding conditions look unsustainable, yet builders have sustained them anyway for the last six months or so.