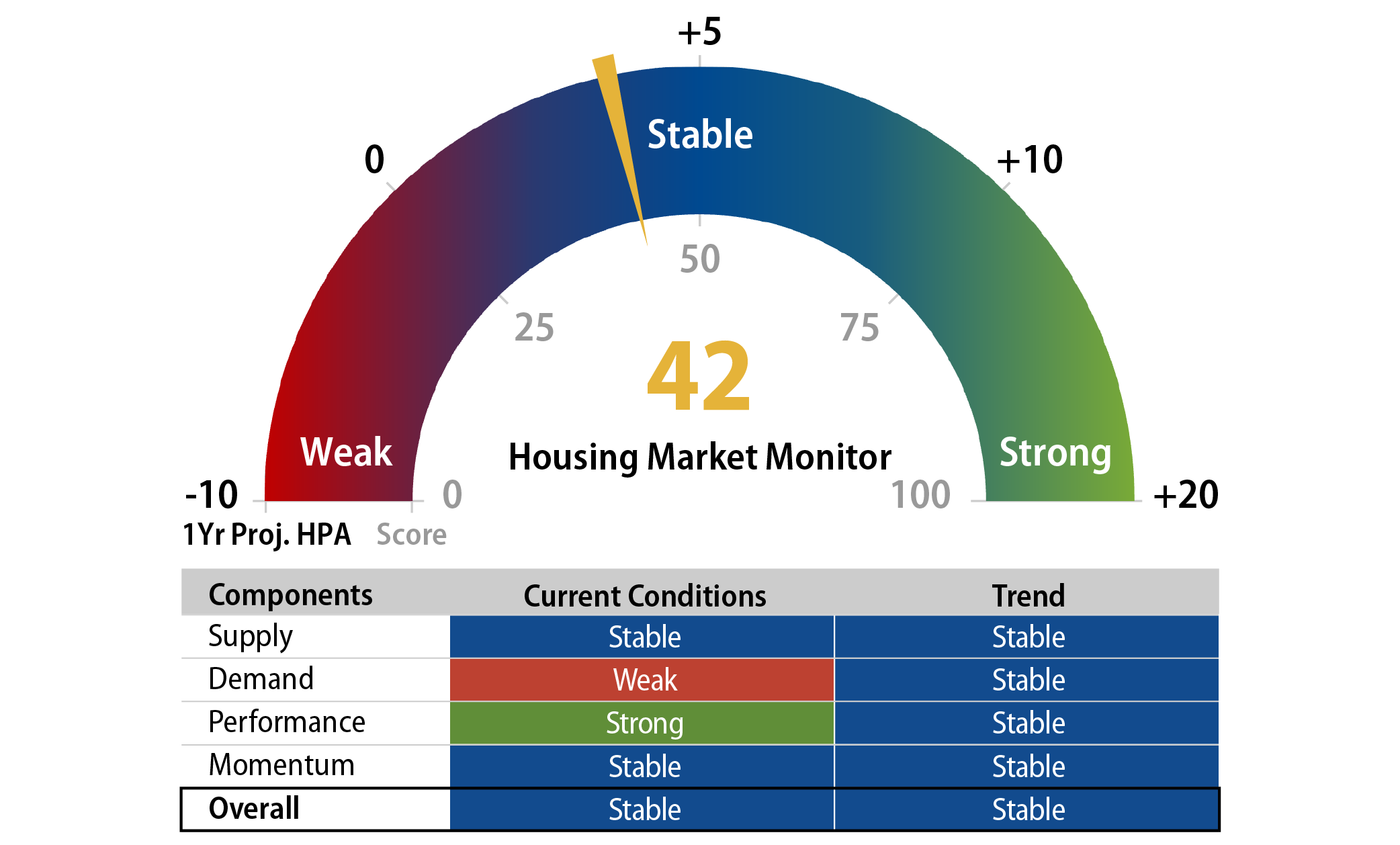

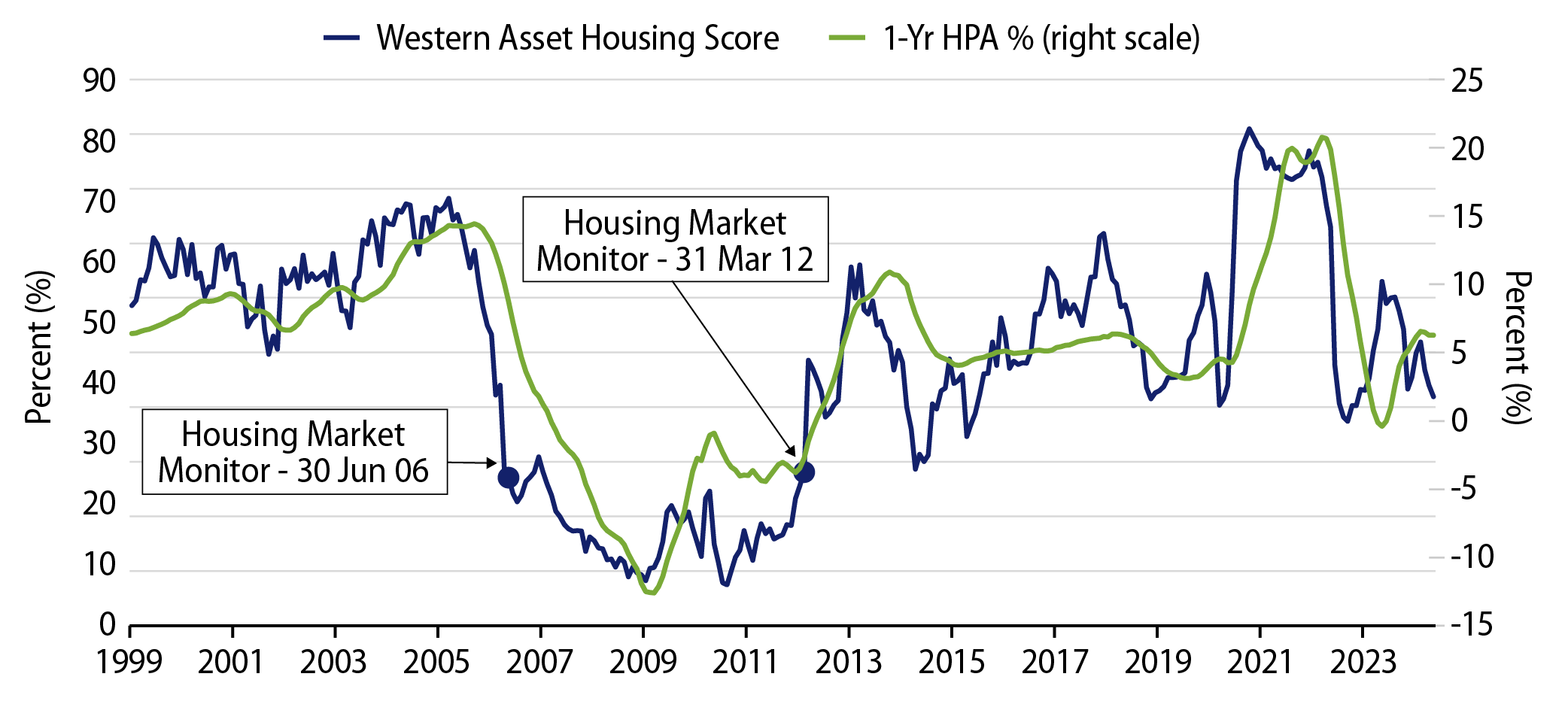

After rebounding nicely in the second half of 2023, the US residential housing market began to weaken under the effects of persistently higher mortgage rates. Our Housing Market Monitor score of 42 as of the end of the secondar quarter represents those weaknesses. As a point of reference, our score of 50 at the end of January was the lowest reading since December 2022. Increases in the supply of both existing and new homes for sale were the driving force behind the score drop. Buyer demand also remained subdued. Affordability continues to be a struggle with average home prices rising and mortgage rates staying elevated. While Exhibit 1 illustrates that a Housing Market Monitor score of 42 is below the historical average trend of 50, it still corresponds to a roughly +3.5% year-over-year (YoY) price appreciation for residential housing. This is in the lower range of our estimates at the start of the year, but still not indicating an imminent national collapse of prices.

Supply

- Existing-home sales months of supply is currently at 3.7 months, up from 3.5 months in April and slightly higher than the peak of 3.6 months in October 2023. From a historical perspective, the last time the existing months of supply went above 3.7 was in June 2020, which was only three months into the Covid pandemic.

- New-home sales decreased 11.3% to 619,000, which is the slowest rate since November of 2023.

- Housing starts fell 5.5% MoM in May to 1.2 million units, on a seasonally adjusted, annualized rate (SAAR) basis. This follows a downwardly revised 4.1% increase in April to 1.35 million units (SAAR), leaving starts at the slowest pace since June 2020.

Demand

- The 30-year mortgage rate ended 2Q23 at 7.05%, which is only a few basis points (bps) away from the 6.95% low of the quarter reached just a few weeks prior. Mortgage rates thankfully ended the quarter 50 bps lower than April’s peak of 7.52%. Mortgage rates have been range-bound between 6.6% and 7.5% through the first half of the year.

- The Mortgage Bankers Association (MBA) Purchase Index remains at historical lows, closing out the quarter at 147. While slightly elevated from last month’s 132, it is still lower than January’s 154 reading.

- The NAHB Traffic of Prospective Buyers Index hit a quarterly low of 28, down from 30 in March. While the June results are a year-to-date low, they are still higher than the reading of 21 in November 2023, the lowest reading since May 2020.

Momentum

- The latest YoY price gain of 6.26% on the S&P CoreLogic Case-Shiller National Home Price Index shows that home prices remain stable on a national level.

While the housing market finds itself waiting for lower mortgage rates, our view remains that the fundamentals supporting securitized mortgage credit continue to be strong. New mortgage production has surprised to the upside, leading to higher-than-expected issuance of mortgage credit bonds. We continue to find attractive yield opportunities across credit risk transfer, non-qualified mortgage and residential transition loan new-issue deals. Seasoned bond profiles also present excellent return opportunities with increased credit enhancement owing to the equity appreciation caused by years of strong housing performance.

We expect the second half of 2024 to continue with the trend of a slowing housing market. National price appreciation is forecasted to be in about the +3.5% range, while mortgage rates remain range-bound between 6% and 7%. The tug of war between supply and demand is currently being pulled down by increased supply and weak demand. At this point in the cycle, we would likely need to see lower mortgage rates improve the demand side. As higher-for-longer mortgage rates appear to weigh down the market, rates are likely to remain at about 7% and carry higher risk for home prices to cool further. Conversely, a more dovish Federal Reserve or weaker economic growth would likely be an upside risk to our forecast, with demand bouncing back as it did in 2023 when the mortgage rate fell below 7%. Given the cooling of economic data, we feel that upside risk is more likely than downside risk, but we will continue to closely monitor the tug of war.