Data releases today covered October data for personal income, consumer spending and the Personal Consumption Expenditures (PCE) price index that comprise the Fed’s announced inflation target. Income growth was soft and PCE inflation was softer, but consumer spending grew decently. Overall, the news is probably net constructive for bond markets, as the inflation data help cement the idea that the Fed is done tightening, while the income data cast more doubt on the strength of consumer spending going forward.

Having said that, though, October data show the consumer continuing to spend anyway. Meanwhile, as of this writing, bond prices have moved a bit lower today, but after the sharp gains of the month to date, this likely reflects profit-taking, rather than any disappointment in the data.

Total personal income rose 0.2% in October, with the September estimate revised up by 0.1%. That gain accrued mainly from proprietors’ income and capital income, as private-sector wage and salary incomes rose only 0.1%, and that was fully offset by a -0.1% revision to the estimated September level. This latter softness is a reflection of the nondescript October jobs data released earlier this month.

As soft as the income growth was, it still allowed some gains in real income, thanks to very low October PCE inflation. The headline PCE index registered an increase of less than 0.05%, which annualizes to a pace of 0.6% per year. As you likely know, the Fed actually targets the core PCE, that is, PCE inflation excluding food and energy. That measure showed a 2.0% annualized rate of increase in October, right at the Fed’s target. Indeed, this measure has averaged only 2.5% annualized inflation over the last six months.

Keep in mind too that stated core PCE inflation includes shelter prices, which are still being reported as rising at a 6% annualized rate. Fed Chair Powell himself has acknowledged that shelter prices are currently overstating on-the-ground realities, thanks to technical lags in the government’s reporting practices. To remedy that, Mr. Powell has suggested looking at core inflation excluding shelter. That measure showed only a 1.3% annualized rate of inflation in October and has averaged 1.8% over the last six months.

One month does not make a trend, but it could be argued that six months do. Upon acknowledging the technical flaws in the data which Mr. Powell himself has mentioned, PCE inflation has been compatible with Fed targets—even below them—for half a year. That should be enough to get the Fed’s attention.

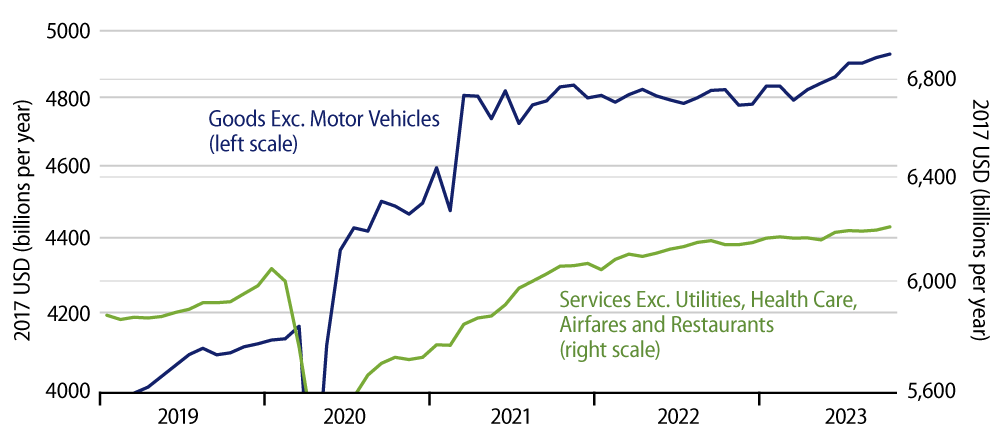

Finally, the consumer spending data showed 0.2% non-annualized gains in real spending on both core goods and core services. Goods spending saw a slight 0.1% upward revision to September levels, but services spending showed a substantial, -0.4% revision to September. Even with that revision, services spending still continues to grow decently, as you can see in the chart. Goods spending has slowed slightly from its robust pace around mid-year, but it too is still growing at a decent pace.

As we have recounted previously, consumer spending is growing faster than is consistent with reported growth in personal incomes. We have been expecting consumption to move more in line with income, but as of October data, we are still waiting.