Private-sector payroll jobs rose by 172,000 in July, with the June jobs estimate revised lower by -25,000. Total nonfarm jobs rose by 187,000, with a -49,000 revision to the June estimate.

The gains sound decent, and various financial market analysts will describe them as such. Keep in mind, however, that there are some less favorable elements to the data lurking underneath. First, there has been a pattern this year of substantial downward revisions to the job growth data. We now have “final” jobs data through May, and every one of the first five months of 2023 so far saw downward revisions to private-sector job growth of at least -28,000, with the five-month average at -55,000. And though not yet final, the June job growth estimate has already been revised lower as well.

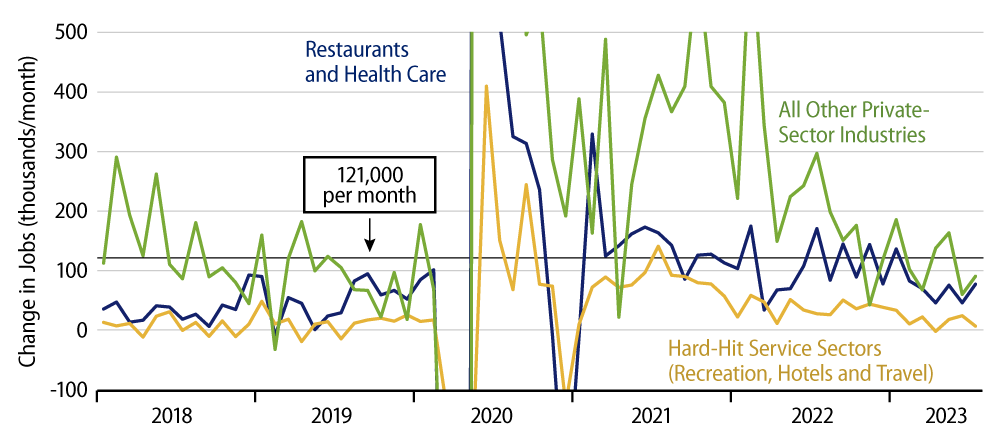

Second, as seen in the chart, job growth continues to trend lower within each of the various major private-sector components. In leisure-oriented sectors hit hard by Covid (gold line), job growth has essentially ground to a halt, even though none of these industries has regained pre-Covid staffing levels, let alone pre-Covid growth trends. Health care jobs do continue to grow nicely, but even there, current job levels remain well below pre-Covid growth trends. For other sectors (green line), job growth continues to follow a sawtooth pattern of slower growth. Recent growth rates there have been below the pre-Covid average of +121,000 per month, even though both the adult population and the labor force are growing faster now than they were pre-Covid.

Third, workweeks continue to decline, and employment services employment is declining as well. These are indications that the understaffing that bedeviled most sectors after the Covid shutdown is easing. Most sectors (other than leisure) have essentially recovered staffing back to pre-Covid norms. So, they don’t need to work their existing employees as hard as previously, and they also don’t need to rely on temp services as much to supplement staffing. Even so, they are growing slower than they were four to five years ago.

No, the labor market is not contracting the way the Fed seems to want. However, once one acknowledges the “hole” that the Covid shutdown shoved most employers into and the lingering effects of that disruption, recent job gains look less impressive, and there are indications that the Fed’s hiking efforts are having effect.