June payroll data released today by the U.S. Bureau of Labor Statistics (BLS) showed a 149,000 gain in private-sector jobs. On top of this below-expectations tally, there was a sharp downward revision to previous months’ job counts, with the May estimate for private-sector payroll jobs revised downward by -98,000.

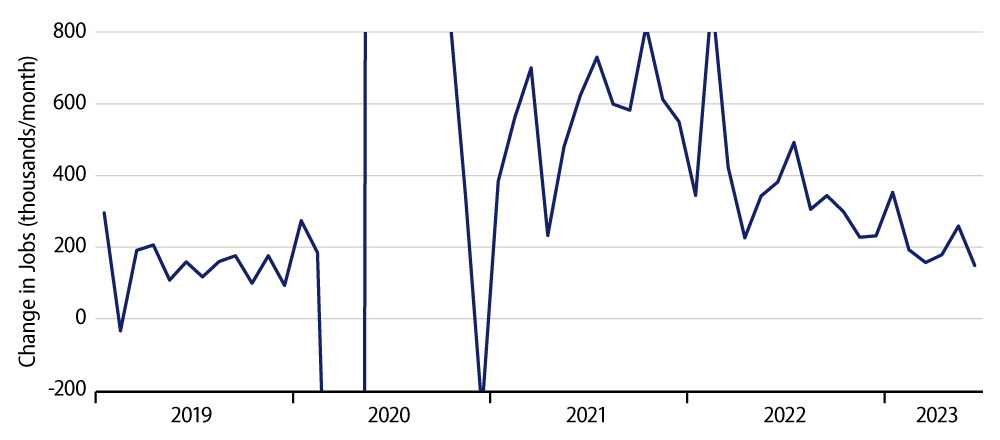

No, labor markets aren’t cratering, but there is clearly a slowing trend in the data, as evidenced by Exhibit 1. Much of this slowing trend would have occurred anyway, as various industries wind down hiring as pre-Covid staffing levels are re-attained. However, some of the slowing could also be attributed to the Fed’s hiking regimen of the last 18 months.

How much of the slowing is “organic” and how much is due to the Fed is impossible to determine. We have never been through a pandemic-related shutdown of the economy before, so it is impossible to gauge the economy’s progress on that count relative to past history. Suffice it to say that however the “credit” is apportioned to competing causal factors, growth is clearly slowing. The question is whether it is slowing quickly enough to appease the Fed.

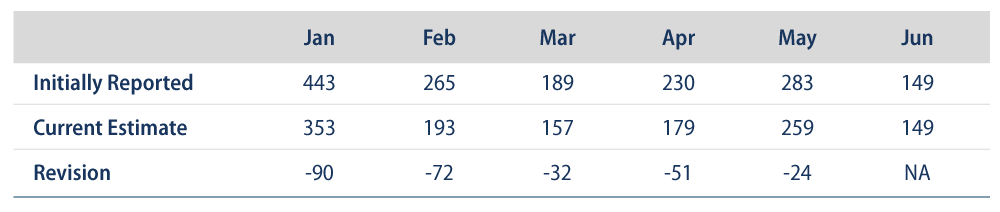

Another interesting aspect of the data is that 2023 has seen an unusually large and frequent spate of downward revisions to previous months’ growth rates in jobs. This is detailed in Exhibit 2.

We now have “final” jobs data through April. Based on these tallies, each of the first four months of the years saw sharp downward revisions, averaging -61,000 per month. So, if the slowing trend in the chart is news to you, perhaps it is because you have been focusing on the initial job counts and have missed the sharp revisions to previous months’ data.

Income data released by the Commerce Department in late May showed income growth in 2022 to be substantially slower than initially reported, suggesting last year’s job growth was actually as much as -2 million jobs lower than is reflected by current payroll data. The initial 2023 jobs data are suggesting a similar pattern.

As is our wont here, we focus on private-sector jobs, so our counts are a bit different from the all-economy totals you’ll see elsewhere. One reason to focus on private-sector jobs is that they are more indicative of the effects of market forces. Another is that government job data show a lot of seasonality, reflecting changes in the length of the school year.

Thus, in June, 44,000 of the 60,000 reported increase in government jobs came in public schools. This likely reflected later-than-usual June closings of public schools, as before seasonal adjustment, public school jobs declined by -564,000.

Elsewhere within the payrolls report, hourly wages also look to be gradually decelerating. Measures of average hourly earnings for all workers and for production workers rose at 4.0% and 4.4% annualized rates, respectively, in the first half of 2023, compared to 4.7% and 5.0% respective rates in the last half of 2022. For these measures as well, plots of monthly data show a steadily declining growth trend.