Private-sector payroll jobs rose by 99,000 in October, with a -80,000 revision to the September jobs estimate. Meanwhile, a decline in the average workweek more than offset the October job gain, so that total hours worked declined by -0.3% in October. Finally, average hourly wages for all workers rose a scant 0.2% in October, marking the third straight month of slight wage gains.

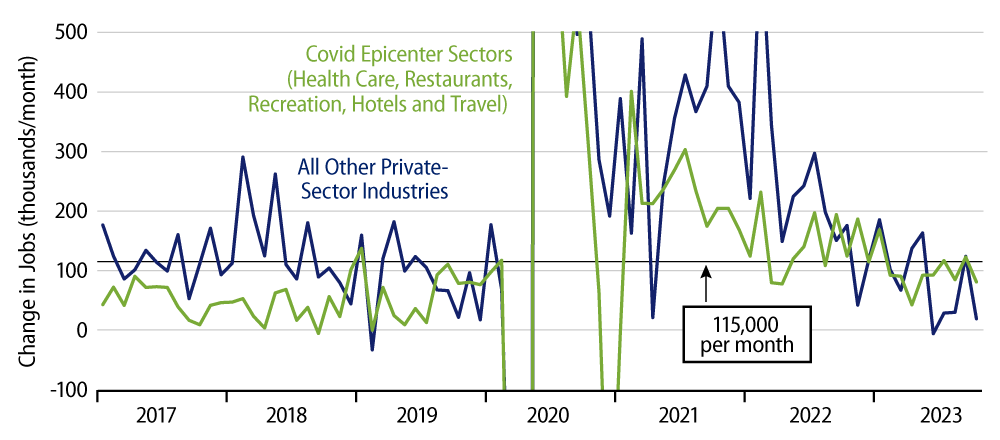

To our minds, the October payroll data were a return to the trends seen over most of 2023, after a bounce to the upside in September. We have pointed out previously that most of the job growth seen in recent months occurred in sectors especially hard hit by the Covid shutdown, what we call Covid epicenter sectors. Indeed, in October, job gains outside those sectors totaled only 19,000, after a spike of 124,000 in September. Even with the September spike, sectors other than Covid epicenter sectors saw average job gains of only 39,000 per month, over the last five months, after those sectors had seen much larger gains through spring 2023 and average gains of 115,000 per month prior to Covid.

What we call Covid epicenter sectors entail health care, restaurants, amusements and recreation, accommodations, and passenger travel. Of these, only health care has shown meaningful net growth in employment since February 2020, just before the Covid shutdown, and even in this sector, job levels are well below pre-Covid growth trends. Restaurant jobs are still 14,000 below pre-Covid levels, while accommodations jobs are 223,000 below pre-Covid levels, and passenger travel 18,000 below. Amusements and recreation have seen a net gain of 13,000 jobs since February 2020, or 0.5%, clearly a below-trend performance for a sector that had gained 100,000 jobs in the same amount of time prior to the Covid shutdown.

In other words, we think it is clear that these epicenter sectors are merely struggling to return to normal staffing levels, after suffering from nearly three years of Covid restraints. The job gains seen there recently are indeed a sign that the economy in general is returning to normal after its Covid sojourn, but they are hardly signs of excessive growth.

Another indication of a return to normal in the economy at large is the decline in workweeks and slowing growth in total hours worked that have accompanied the job growth numbers over the last year. When industries were coping with understaffing due to Covid, existing staff had to work longer hours than otherwise, so that average workweeks for existing workers were elevated. As staffing has returned to normal levels for most industries and as it approaches normal levels in Covid epicenter sectors, workweeks have understandably indeed declined. On net, for the whole economy, total hours worked have grown by only 0.7% over the last year, well below the average growth seen prior to Covid.

In other words, the monthly job gains widely touted quite overstate the strength of the US labor market. This is especially so given that for every month of 2023, the initially announced job gains have been revised sharply lower, by an average of -48,000 per month. In line with this, again, growth in hourly wages has recently slowed to rates consistent with Fed targets. (Average hourly wages for all workers have grown at a 3.2% average annualized rate over the last three months.)

To repeat, these October stats are merely consistent with what we have seen over the course of 2023, following an upside outlier report last month. We believe today’s report will strengthen the case for the Fed halting its rate hikes in FOMC meetings to come.