Headline retail sales were unchanged in July, though that is from a June sales estimate that was revised upward by 0.3%. The headline number was held down by declining gas prices and consequent declines in service station sales. Excluding vehicle dealers, service stations, building material stores and restaurants, the so-called “control” retail sales measure turned in a more robust 0.8% July gain on top of a +1.0% revision to the June estimate.

With inflation slowing in July but nice job growth continuing, we saw the first meaningful gain in real incomes since summer 2021. One might have thought that the bounce in real incomes could drive some rebound in retail spending, thus accounting for the July control sales bounce. The reality is more complex.

Essentially all the gains and upward revisions to control sales came from one merchant type, “nonstore sales,” which includes online retailers. And yes, a certain online vendor named after a river in Brazil celebrated its Prime Day last month. The related furor seems to account for all the apparent strength in July control sales.

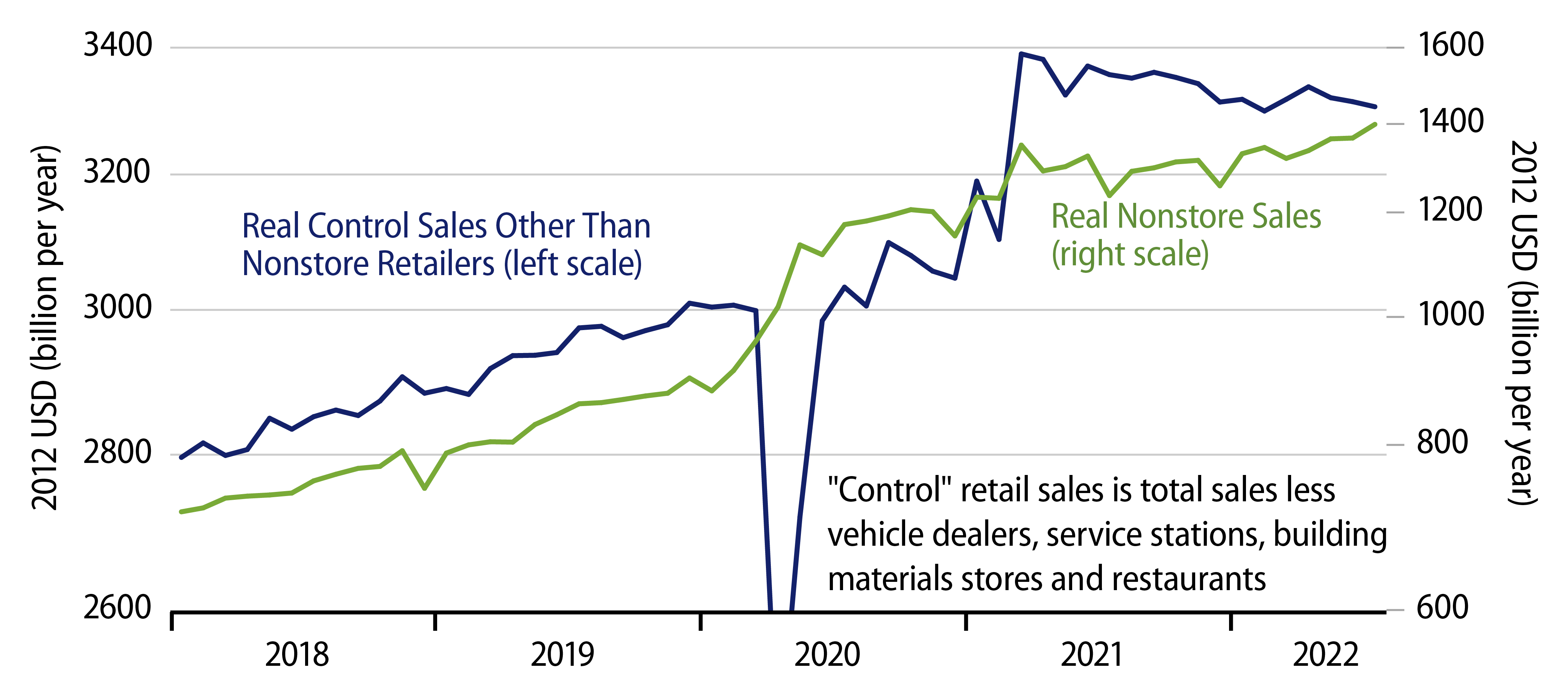

The chart splits out control sales between nonstore merchants (online vendors) and all other store types (brick-and-mortar). The chart also adjusts for inflation, using retail price indices reported by the Bureau of Economic Analysis through June, with Consumer Price Index (CPI) rates of change appended for July.

As you can see in the chart, real sales at traditional (brick-and-mortar) stores appear to have declined again in real terms in July, continuing their downtrend of the last 16 months. Real sales do appear to have risen in July for online vendors. However, sales gains there had been much more modest over the preceding 15 months, so the July gains are likely just a one-time bounce, a response to special discounts, rather than a new trend.

Now, it should be noted that consumers had enough purchasing power to indeed respond forcefully to special discounts in July. Still, there is little reason to think that the trends in place since March 2021 have suddenly been reversed, not when sales continued to go down uniformly at traditional stores and when the online gains were so sudden.

So, today’s news should rightly work to reduce fears that recession is brewing. However, we will likely see a return to more plodding sales data in August, now that the “prime” month is behind us.