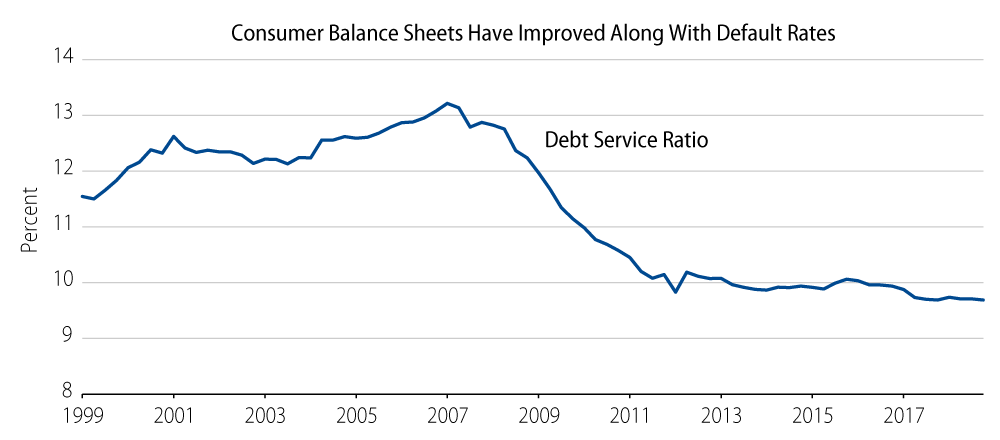

Aggregate US consumer fundamentals remain strong and stable for the time being, even as the effects and risks of COVID-19 continue to grow rapidly. The ratio of consumer financial obligations relative to disposable income has declined meaningfully, and currently stands at 20-year lows. While the overall level of mortgage and consumer debt has grown since the great financial crisis (GFC), the debt burden to the consumer continues to decline, specifically due to falling interest rates and the rise in disposable income, both of which have supported the deleveraging process (Exhibit 1).

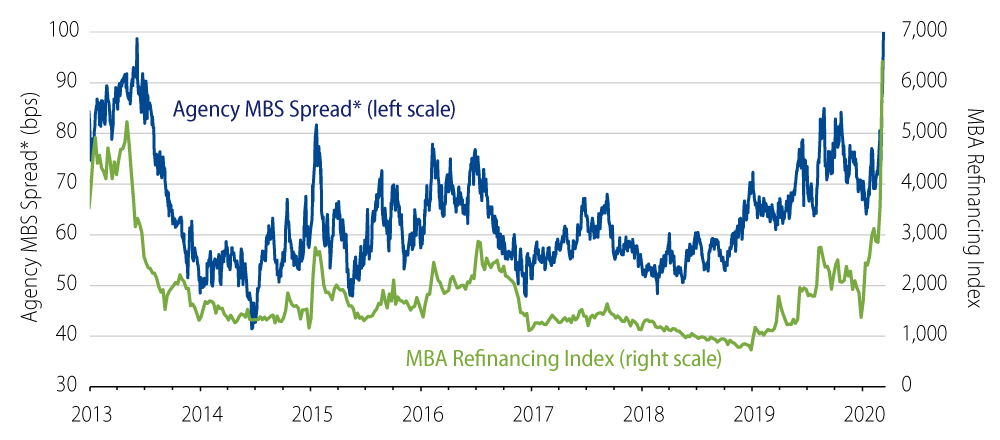

From a consumer stimulus perspective, with mortgage rates continuing to decline, most US homeowners have an incentive to refinance. Given the rapid moves in Treasury rates, mortgage rates have lagged in adjusting as originators’ capacity for processing refinance and purchase applications has been constrained. Lenders are aggressively staffing to address the growing demand from mortgage borrowers; however, lockdowns and social distancing associated with the response to the virus complicate business decisions. As capacity constraints improve and rates remain low, more borrowers will take advantage of historically low mortgage rates, which will manifest in higher prepayments and supply for agency mortgage-backed securities (MBS) investors, while at the same time improving consumer credit fundamentals.

We are constructive on agency MBS given our view that monetary policy will be accommodative for an extended period. On Sunday March 15, 2020, the Fed eased monetary policy by an additional 100 bps and authorized $700 billion in Fed purchases across US Treasury and agency MBS markets ($500 billion in US Treasury and $200 billion in agency MBS). These additional measures are designed to smooth functioning of markets for Treasury securities and agency MBS that are central to the flow of credit to households and businesses. We believe conventional MBS offer better relative value and a liquidity advantage over Ginnie Mae issued MBS, focusing on coupons and collateral stories with more predicable prepayment profiles. Exhibit 2 highlights that agency MBS spreads have largely discounted the surge in refinancing applications.

The housing market has notably lower leverage today based on low loan-to-value ratios and high quality underwriting. Additionally, we have observed low levels of new construction, limited inventory of existing homes and increasing demand from low mortgage rates. We expect home prices to remain steady with limited downside risk, given the lack of supply and leverage in the system. Against this backdrop, fundamentals for securities that are backed by residential credit are favorable. Additionally, the structural features embedded in securitization markets today are far superior to ones we saw pre-GFC, and are built to withstand significant stress. To the extent individuals face quarantines related to COVID-19, we expect servicers to act sympathetically and provide forbearance on loans in affected areas. Similar to what occurs in areas of natural disasters, Fannie and Freddie guidance allow servicers to provide forbearance up to a cumulative term of 12 months with additional forbearance possible if approved by the government-sponsored enterprises (GSEs). We have seen these programs work effectively recently in times of natural disasters such as wild fires and hurricanes. Troubled loans are typically kept in pools for a lengthy period with principal and interest advancement for investors, which is followed by buyout programs.

Commercial real estate has also benefited from a lack of construction and improved demand. However, we are mindful of areas in the commercial MBS (CMBS) market that will be more exposed to COVID-19 risks, most notably hotels and retail properties. These deals are also more soundly structured today, and our focus is on Class A properties with well-capitalized sponsors capable of withstanding short-term disruptions. We would express significant caution on lower quality Class B/C properties and more levered properties that you typically see in CRE-CLOs and Conduit CMBS. We would be cautious in these subsectors.

Asset-backed securities (ABS) markets also vary in exposure from high quality to lower quality borrowers, and asset classes that are more exposed to travel and US recession risks. The areas of primary concern are lower quality consumer ABS such as subprime auto loans and unsecured consumer credit. These borrowers are more susceptible to near-term income disruption. Travel- and trade-related assets such as aircraft ABS, timeshare ABS and container shipping are also under significant pressure. We would be cautious in these sectors as well.

In our view, as volatility in financial markets increases, US fixed-income investments backed by high quality mortgage and consumer loans are expected to provide better risk-adjusted return outcomes. Agency MBS offer a liquidity advantage and an explicit/implicit government guarantee of underlying cash flows for investors, while non-agency structured credit has strong fundamentals.

During the month of February as volatility picked up, performance in our strategies supports our conviction. With that said, a severe and prolonged global economic slowdown will certainly impact most spread sectors negatively and we may see increased levels of delinquencies and write-downs that will start negatively affecting the bottom tranches of different transactions. However, this is not our base case scenario at Western Asset. The Fed’s proactive reduction of its target rate by 150 bps will have little effect to correct a supply shock due to COVID-19 but it will certainly be a positive development for the demand side of the equation. Furthermore, from the consumer point of view, lower prices at gas stations combined with money saved from refinanced mortgages and potential payroll tax cuts will free up some cash, improve balance sheets further and make the fundamental macro picture more attractive.